5 Risk Management Trading Techniques for Day Traders

Many traders learn how to trade the financial markets, but forget one key aspect of trading - risk management. Oftentimes, they pay little attention to what can actually make them profitable.

The real secret sauce separating successful day traders from blown-up accounts is ruthless risk management.

Day trading can bring exciting profits, but it also carries the constant threat of steep losses. Risk management in trading is about taming those threats so you live to trade another day.

One day of profit can easily be wiped out by an even bigger loss the next day if you throw caution to the wind. Proper trading risk management ensures that no single bad trade can wipe you out. It’s the defensive play that makes your offensive moves count in the long run.

In this article, we break down what risk management means for traders and reveal five essential techniques every day trader must know. We’ll also show how to implement these strategies in trading bots and how to keep improving your risk management skills.

What is Risk Management in Trading?

Risk management in trading is the art and science of not losing your shirt when the market moves against you.

In practical terms, it’s a set of rules and tools that limit your losses and protect your trading capital. Every time you enter a trade, you face uncertainty: it can go your way or completely sideways. Risk management is about preparing for the latter before it happens. It means determining how much you could lose on a trade (or in a day), setting strict limits on that loss, and planning exactly how you’ll react if things go wrong.

Having a proper risk management strategy lets you take calculated risks (so you can still make money) without taking reckless gambles that could blow up your account.

In essence, risk management is about survival. If you run out of capital, you can’t trade – game over.

A trader with excellent risk management can weather losing streaks and bad market days and still be in a position to profit when conditions improve. Moreover, it's a key aspect that can help traders improve their trading psychology. In contrast, a trader who ignores risk management might ride a lucky streak for a while, but it only takes one or two disastrous trades to lose it all.

Put simply, risk management is the foundation of long-term success.

How to Manage Risk in Day Trading – 5 Risk Management Trading Techniques

How can you manage risk like a pro in your day-to-day trading? Here are five battle-tested techniques that every day trader should implement:

1. Set a Maximum Loss Limit (Daily and Per Trade)

One of the smartest moves is to set a maximum loss limit (both per trade and per day). This is your line in the sand. It's a common technique used by many prop firms to help traders protect their capital and extend their learning curve.

For example, you might decide you won’t risk more than $200 on any single trade and no more than $500 total in a day. This prevents a bad day from turning into a financial disaster and ensures you can afford to sustain losses without a severe financial impact.

Many experienced traders use a percentage of their account for these limits (say 1% on any particular trade and 3% for the day). That way, even a “worst-case” day won’t cripple your account, and one bad trade won’t erase weeks of gains.

Enforcing a max loss limit requires iron discipline. You must actually halt trading when the limit is hit, no excuses or “just one more trade” attempts. It might sting to quit when you’re down, but it’s far better than digging yourself into a deeper hole.

Remember, protecting trading capital is priority #1. Blowing past your limit not only hurts your account but also your confidence. Set a daily loss limit that keeps you in the game for the long haul, and respect it every time.

2. Follow the 1% Rule for Position Sizing

The 1% rule is a classic guideline: never risk more than 1% of your account on a single trade. In practice, that means if you have a $10,000 account, you’d risk at most $100 on any given trade. You achieve this by adjusting your position size and setting a stop-loss so that if your stop is hit, you lose about 1% of your capital (around $100 in this example).

Why 1%? Because keeping each loss that small makes your account tough to kill. Even five losing trades in a row would only draw down roughly 5% of your account – painful but survivable. But if you risked 5% or 10% per trade, a string of losses could wipe out a huge chunk of your account before you have a chance to turn things around.

The 1% rule ensures no single trade loss is devastating. Some traders might use 2%, but the principle remains the same: keep your risk per trade small. It’s a simple discipline that can prevent huge drawdowns in your account.

3. Plan Every Trade and Stick to the Plan

There’s a common mantra: “Plan the trade and trade the plan.” Planning each trade means that before you enter, you decide your entry price, profit target, and stop-loss exit. In other words, you have a clear blueprint for the trade. By doing this upfront trading plan, you remove a lot of emotion once you’re in the position.

Without a plan, it’s easy to act on impulse when things start moving. You might hold a loser too long, hoping it bounces back, or snatch a small profit too early out of fear, both of which wreck your risk/reward balance.

Of course, a plan only works if you stick to it. This is where discipline comes in. The best traders follow their plan relentlessly, whereas amateurs abandon it at the first wobble.

One trick is to write down your trade plan or set alerts for your exit levels to help prevent emotional deviations. Treat your plan as law and execute it without hesitation. For that purpose, you can also use tools such as the lot size calculator, a profit calculator, and the value-at-risk calculator.

A solid plan gives you a good risk-reward ratio (for example, risking $1 to make $2), and it pre-defines the exact point where you’ll cut your loss if the trade goes wrong.

4. Always Use Stop-Loss Orders

If there’s one tool that every day trader must use to mitigate market risk, it’s the stop-loss order. A stop-loss is an order that automatically closes your position at a preset price if the trade moves against you. It’s your safety net that caps the damage. Additionally, it is highly recommended to use a trailing stop loss, which is a stop loss order that automatically follows the market movements.

Every trade you make should have a stop-loss in place – no exceptions.

With a stop-loss, if a trade goes wrong or the market suddenly nosedives, you’re out with a limited loss instead of a ruined account. Setting stop-loss orders at levels relative to the current price is crucial for managing risk effectively. It can also help in protecting your trades against price slippage.

To use stops effectively, set them at logical levels – for example, just below a key support level or recent swing low (a point that, if reached, means your trade likely isn’t working). You can calculate the optimal stop loss level using indicators like the Average True Range (ATR).

Don’t set your stop arbitrarily tight, or normal market noise might trigger it, but also avoid placing it so wide that you’re risking too much.

Crucially, once you set a stop, never widen it on a losing trade – that’s as bad as not having one at all.

Stop-loss orders take the emotion out of cutting losses. Without one, you might freeze up or hold onto a loser, praying it turns around. With a stop in place, the decision is made in advance and executed for you.

5. Diversify Your Trading Strategies and Instruments

“Don’t put all your eggs in one basket.” In trading, this means don’t rely on only one strategy or one asset for all your gains.

Markets are wild. A strategy that works great today might falter tomorrow under different conditions. Understanding price movements in different markets is crucial, as it helps traders predict and react to changes in the value of financial instruments.

For example, if you only trade one stock, a bad news drop in that stock could blow up your day. But if you trade a mix of stocks or markets, a hit in one can be offset by opportunities in others.

Diversification for a day trader also means not putting all your capital into a single trade. Even if one setup looks like a sure thing, resist the urge to bet the farm on it. Spreading risk across a few smaller, uncorrelated trades can smooth out your results and protect you from one trade blowing up your account.

Diversifying your strategies and the instruments you trade helps you reduce the chance that everything goes wrong at once.

How to Implement Risk Management in a Trading Bot

Many day traders use algorithmic trading bots or Expert Advisors (EAs) tools to execute their strategies. The good news is you can (and should) program risk management into your trading bot just as you would do it manually. In fact, a well-designed trading bot can be your best ally in risk control. You should also note that Switch Markets also offers all of its clients a free AI trading bot that can help automate trading without coding.

Here’s how to enforce strong risk management in a trading bot:

First, build in proper position sizing. Have the bot follow the 1% rule (or your chosen percentage) by coding it to calculate trade size based on your account balance and the stop-loss distance. Every trade the bot takes is then sized so the worst-case loss is limited to that 1% of your account. This removes the human temptation to “go big” on a gut feeling, as the bot will stick to the risk formula every time.

Second, make sure the bot uses stop-loss orders (and take-profit levels) for every trade. Any algorithmic strategy should include an exit plan for both winners and losers.

As soon as a trade is opened, the bot should place a stop-loss at the predetermined level.

Platforms like MetaTrader enable EAs to do this instantly. The key is that just because a bot is trading doesn’t mean you can skip safety nets. You need to code those in. Setting alerts can also help traders manage their positions effectively when the market reaches desired thresholds.

Third, set a max loss threshold in your bot’s code. Just as you might stop trading after a certain amount of losses in a day, program your bot to shut down or stop taking new trades if it hits a daily loss limit. For example, you could have it halt trading for the day if it loses around 3% of the account. This kind of built-in failsafe protects your account from a runaway algorithm or an unexpected market shock that triggers multiple losses.

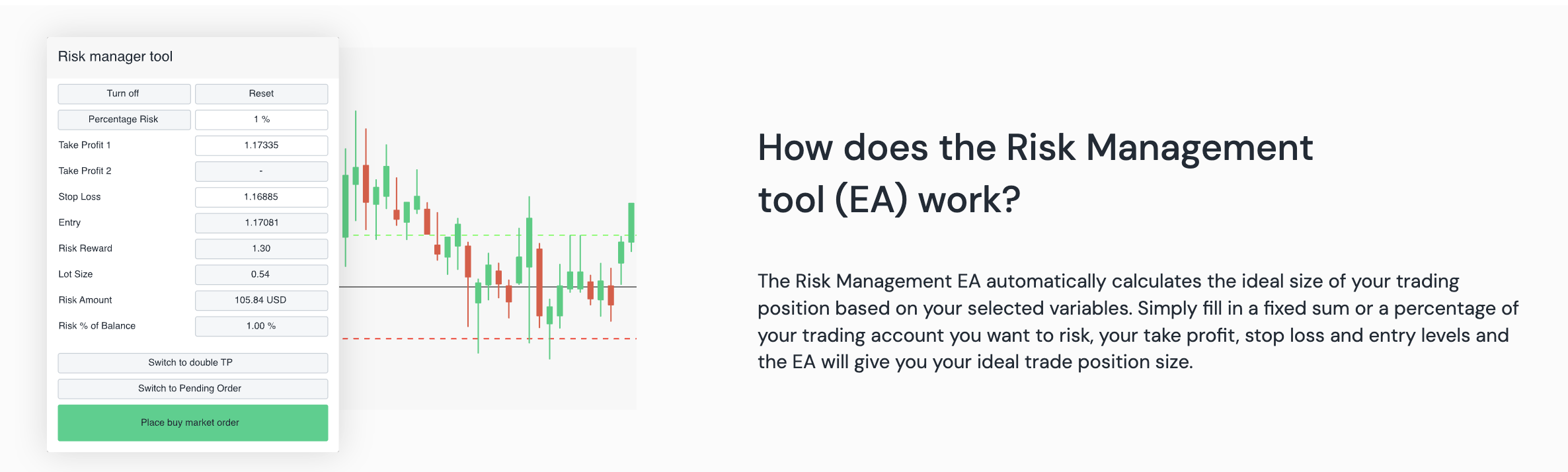

If coding isn’t your forte, don’t worry. Many brokers offer pre-made risk management tools or EAs that you can use. For example, SwitchMarkets offers a Risk Management EA that calculates the optimal lot size for each trade (so you automatically stick to your risk/reward parameters), and a Value-at-Risk (VaR) EA that gauges the risk of your open positions. Tools like these let you enforce risk rules without any coding.

One last thing is to always monitor your bot. Technology can fail, or markets can behave in ways that confuse an automated system. Keep an eye on your bot’s performance and be ready to intervene or adjust settings if something seems off. Luckily for you, Switch Markets provides a built-in trading application, TrackATrader, inside our trading terminal to assist you in tracking and analyzing your trades.

How to Learn Trading Risk Management

Mastering risk management is an ongoing journey. The good news is that there are plenty of ways to learn and improve your risk management skills as a trader. Consider these approaches to become a risk management pro:

1. Self-Education (Articles, Books, Videos): Start by educating yourself through the wealth of trading resources available. Read articles and tutorials that explain risk management techniques, and watch videos from reputable trading educators. Many broker education sections and trading blogs offer free guides on managing trading risks. There are also classic trading books that emphasize risk management and trading psychology.

2. Formal Courses or Workshops: A structured trading course can accelerate your learning. Look for courses or webinars that cover trading strategy and risk management.

A good course will teach you practical methods. For example, how to calculate the exact 1% risk amount for your account, or how to set effective stop-losses and take-profits. It should also reinforce the proper mindset for discipline.

Choose a reputable program (be wary of any “get rich quick” promises). The goal is to pick up solid risk control habits and techniques that professional traders use.

3. Mentorship and Community: Learning from experienced traders can be invaluable. Seasoned traders can provide invaluable feedback on your risk habits. A good mentor or experienced peers in a trading community may quickly spot if you’re taking on too much risk or not protecting yourself. Likewise, being active in trading forums or chat groups keeps you accountable and allows you to learn from others’ experiences in managing risk.

4. Practice on a Demo Account: Nothing beats hands-on practice. Most brokers offer demo trading accounts for trading with virtual money. Use a demo account to practice your risk management rules.

Set your 1% risk per trade, always place stop-loss orders, and see how it feels when they get hit. Once you can consistently manage risk in a demo environment, you’ll be ready to do the same with real money.

In trading and investing, it's not about how much you make but rather how much you don't lose. Bernard Baruch

Final Word

In day trading, risk management is what you have 100% control over. You can have a brilliant trading strategy, but if you fail to control risk, a few bad trades can wipe out all your potential gains.

The techniques outlined above aren’t just friendly advice; they’re non-negotiable rules for anyone serious about trading success.

The difference between a consistently profitable trader and a successful trading career and one who blows up often boils down to discipline and risk management.

Be bold in pursuing profits, but be even bolder in defending your capital. That might mean swallowing your pride and taking a quick loss, or stopping when you’ve hit your loss limit. It may feel bad, but it sets you up for a strong comeback when conditions improve. No single trade or day should ever make or break you – stick to these rules and you’ll ensure it doesn’t.

Now it’s up to you. Knowledge is power, but only if you apply it. Take a look at your trading routine and ask yourself: Am I truly managing my risk on every trade? If not, it’s time to change that. Write down your rules, use the tools at your disposal, and stick to the plan. Your future self will thank you.

FAQs

Now that we've covered these powerful risk management techniques, you might still have a few questions on how to implement them effectively. Here are some common questions traders have about risk management:

Why is risk management important in trading?

Risk management is crucial because it protects you from catastrophic losses and ensures you can keep trading. It also keeps your emotions in check: knowing you have safeguards in place makes you less likely to panic or make reckless decisions during a rough patch. Risk management is the foundation of long-term success.

What is the 1% rule in risk management?

The 1% rule in trading is a guideline that says you should risk no more than 1% of your total account value on any single trade. The idea behind the 1% rule is to ensure no single trade can hurt you too much.

Some traders might use 2%, but the principle remains the same: keep your risk per trade small. It’s a simple discipline that can prevent huge drawdowns in your account.

What is the best risk management trading book?

One of the best books on trading risk management is “The New Trading for a Living” by Dr. Alexander Elder. It offers practical, proven strategies on controlling risk, position sizing, trading psychology, and staying disciplined in the markets. Another highly recommended classic is “Trading in the Zone” by Mark Douglas, which dives deep into the psychological aspects of risk management and consistently makes disciplined trading decisions.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.