How to Use a Position Size Calculator

Not every trader blows their accounts because they can’t analyze charts. Some actually blow up because they don’t know how much to risk. Ever stared at a trade setup and wondered, “How many lots should I use?” You’re not alone.

That question is the make-or-break difference between disciplined risk management and emotional gambling. While everyone is obsessed with artificial intelligence and complex trading tools, a simple tool like a position size calculator may be all you need to step up your trading game. It’s the underrated tool that takes the guesswork out of your trading and replaces it with precision.

In this guide, you’ll learn not just what a position size calculator does, but exactly how to use it to protect your account, stay consistent, and focus on what really matters: executing your strategy like a pro.

What Is a Position Size Calculator?

If you’ve had to calculate how much you’re risking per trade, or carefully change your lot size until you arrive at the proper lot size for the amount you want to risk for a certain trade, then what you have done is manually calculate your position size. While it is not a bad method, there's a tool that can help you achieve this goal - a position size calculator.

A position size calculator (often called a lot size calculator in forex trading ) is an online tool that calculates the ideal size of a trading position for a given trade. It simply makes calculating your position size easier and faster.

With just a few inputs, a position size calculator will “find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.” Yet, in order to use it correctly, you must know what a lot size is in trading and how to calculate your desired lot across different markets. To learn more, we suggest visiting our comprehensive guide on lot size in trading.

Why (and When) Should You Use a Position Size Calculator?

Here are several key reasons why you should use a position size calculator, and when it makes the most sense to do so:

Protect Your Account from Big Losses

Sizing your trades correctly is critical to preserving your capital. Many experienced traders follow the “2% rule.” That is, they risk no more than about 2% of their account on any single trade. This way, even 10 losing trades in a row would only draw down roughly 20% of the account, which is survivable. Not surprisingly, the 1%-2% rule is considered one of the best risk management trading techniques for day traders.

Without a sizing tool, traders often end up either too aggressive or too conservative. A position size calculator enforces that risk limit every time, so you don’t accidentally over-leverage on a trade.

Consistent Risk Management & Discipline

Using a calculator for every trade instills discipline and consistency. It ensures you are systematically applying your risk tolerance rather than making seat-of-the-pants guesses. This consistency helps take emotion out of trading decisions, and we all know that trading psychology plays a huge role in trading success.

The goal of proper position sizing is to strike a balance between risk and reward, so that even during a losing streak, your capital stays protected and your mindset remains stable.

Eliminate Guesswork and Human Error

Calculating position size by hand can be tedious and prone to error, especially in markets like forex, where you must factor in different currency pairs and pip values.

Manual calculation can often result in mistakes, which is why many brokers and trading websites provide position size calculators to help traders manage risk.

Even if you know the formula, it’s easy to make a slip with decimals or pip values under pressure. The calculator’s precision gives you confidence that your risk is exactly what you intended; no more, no less.

Save Time and Focus on Strategy

Using a position size calculator is quick and hassle-free. Even experienced traders prefer using a calculator to save time on bigger trades .

It streamlines your pre-trade routine so you can spend more energy on analyzing the market and refining your strategy, rather than crunching numbers.

How to Use a Position Size Calculator (Step-by-Step)

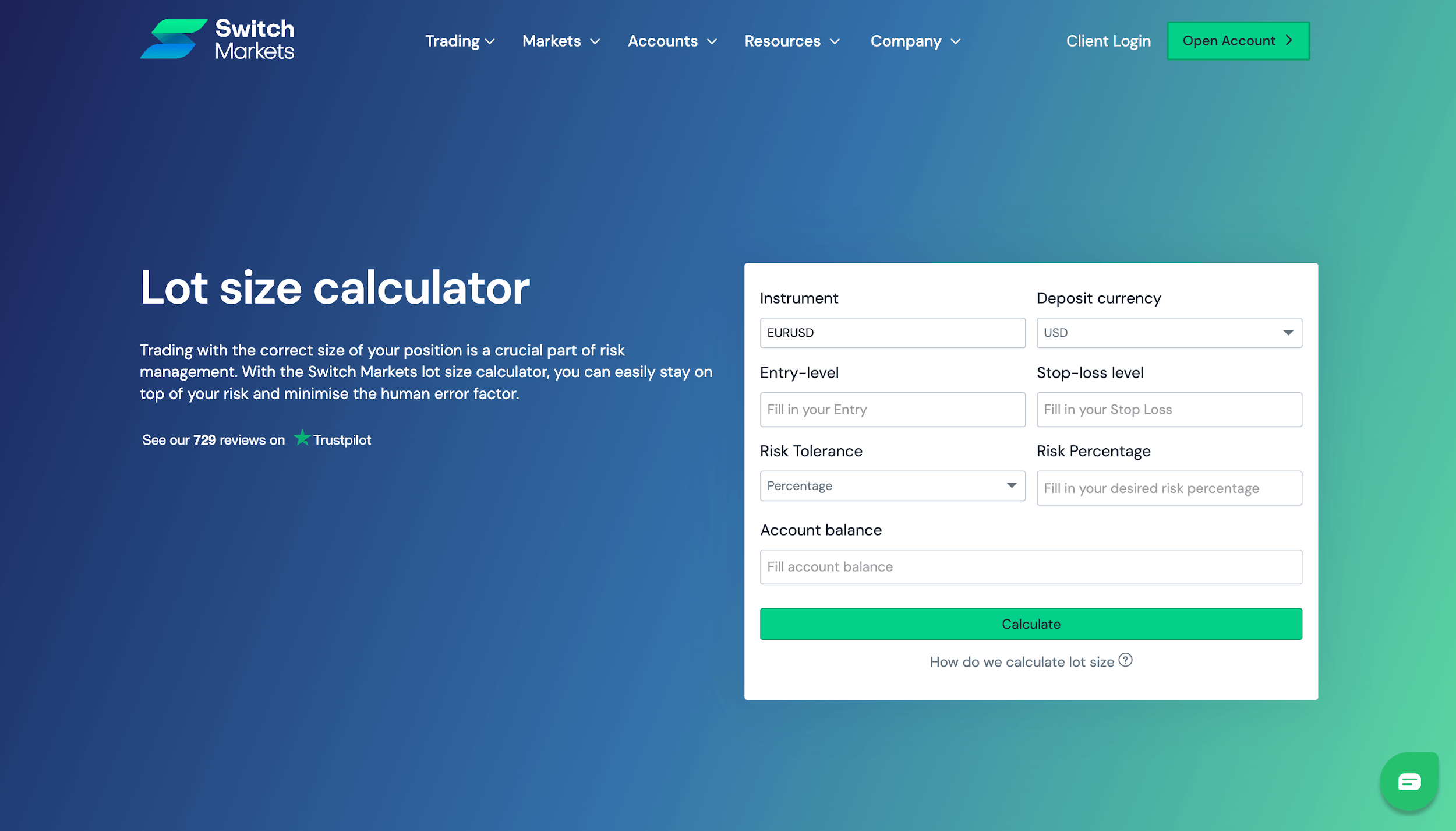

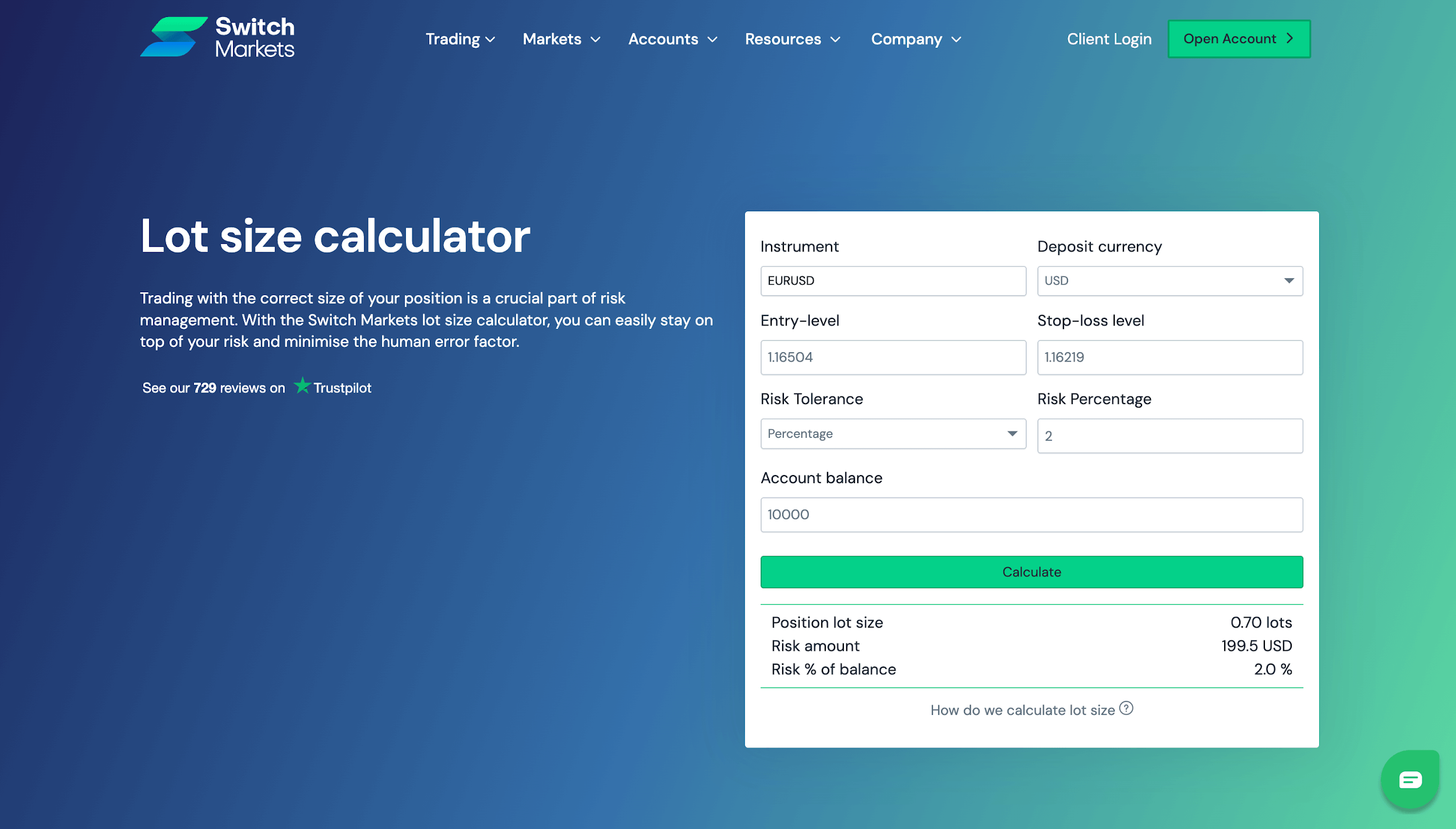

Using a position size calculator is straightforward and usually takes only a minute. In just a few simple steps, you can figure out the correct trade size for your desired risk using Switch Markets' lot size calculator. Below is a step-by-step guide on how to use a typical forex position size calculator (the process is similar for other markets like stocks or crypto):

Select Your Instrument and Account Currency

Start by choosing the asset you plan to trade and your account’s base currency. For a forex trade, this means picking the currency pair (e.g., EUR/USD, GBP/JPY) and specifying the currency in which your trading account is denominated (USD, EUR, GBP, etc). For example, we chose EURUSD in the image below.

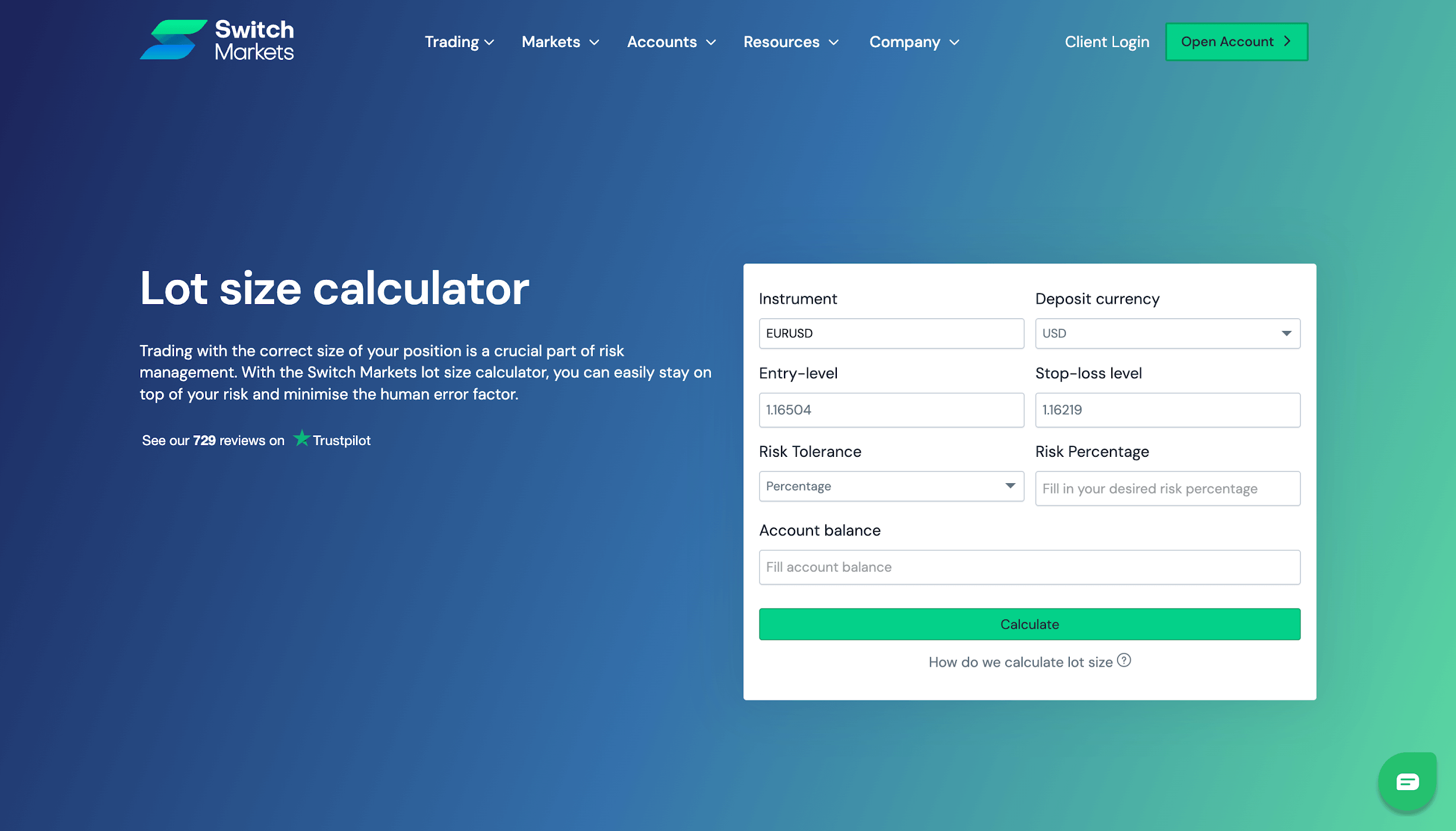

Input Your Entry Price and Stop-Loss Level

Enter the planned entry price for your trade and the price at which you would set your stop loss (the level at which you’ll exit to cut a loss). The difference between these two prices represents your stop-loss distance (the risk per unit of the trade).

For our example, we used 1.16504 and 1.16219 for our entry price and stop loss price, respectively. Here's what the process looks like now:

Note that some calculators may ask you to directly input the stop-loss distance in pips or points; others derive it from the prices you enter. The key is that the tool needs to know how far your stop is from your entry, since a wider stop means a smaller position size for the same risk, and a tighter stop allows a larger position size.

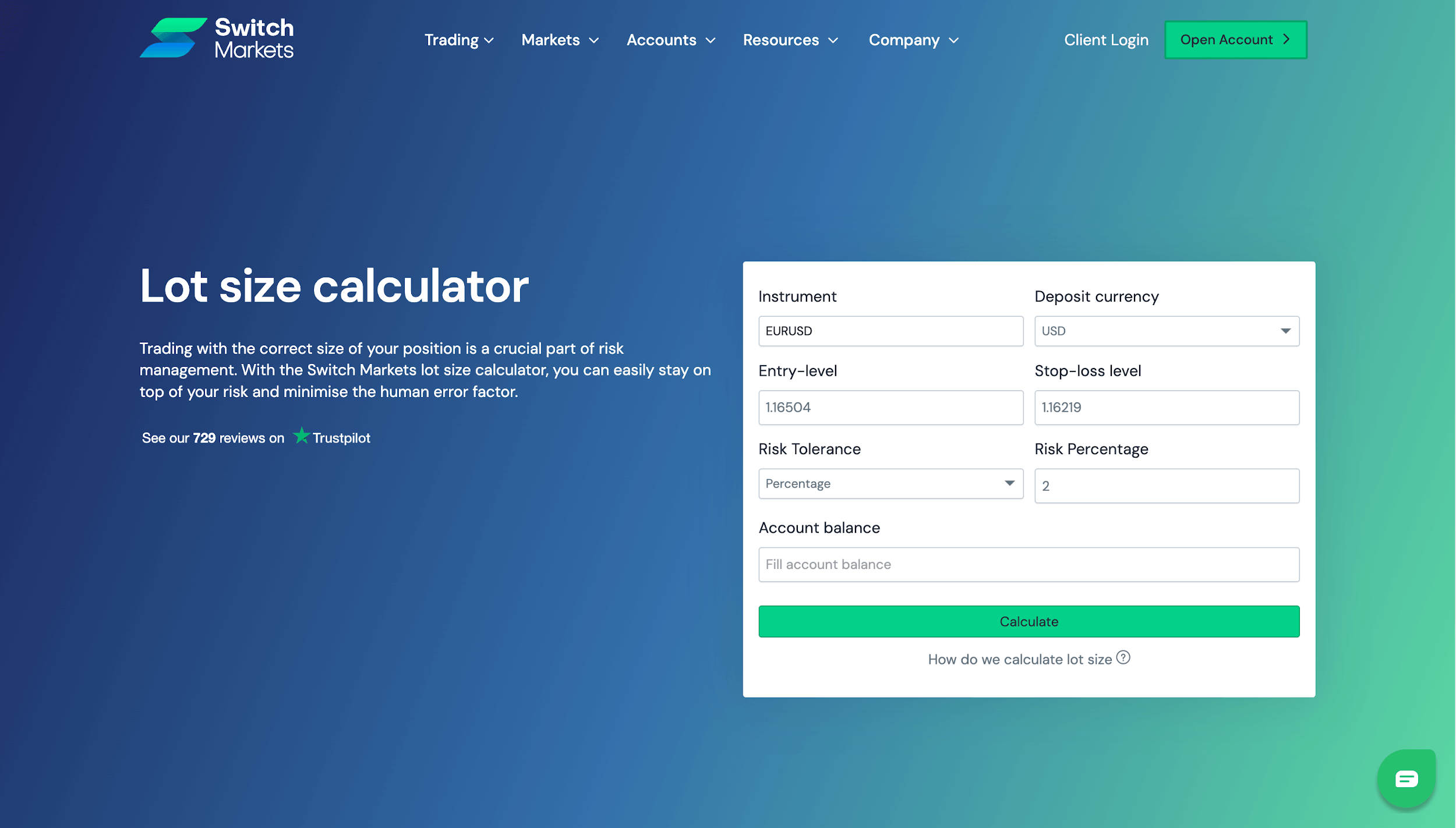

Set Your Risk Tolerance for the Trade

Specify how much you want to risk on this trade. You can either choose between entering a risk percentage (e.g., 1%, 2%) or a fixed currency amount (e.g. $50, $200). For instance, you might decide never to risk more than 1.5% of your account on any single trade, or you might say you’re comfortable risking up to $100 on this particular setup.

Select or input this value. Risk percent is common, as many traders stick to around 1-2% per trade for sound risk management, but if you have a specific dollar cap, the calculator can use that too.

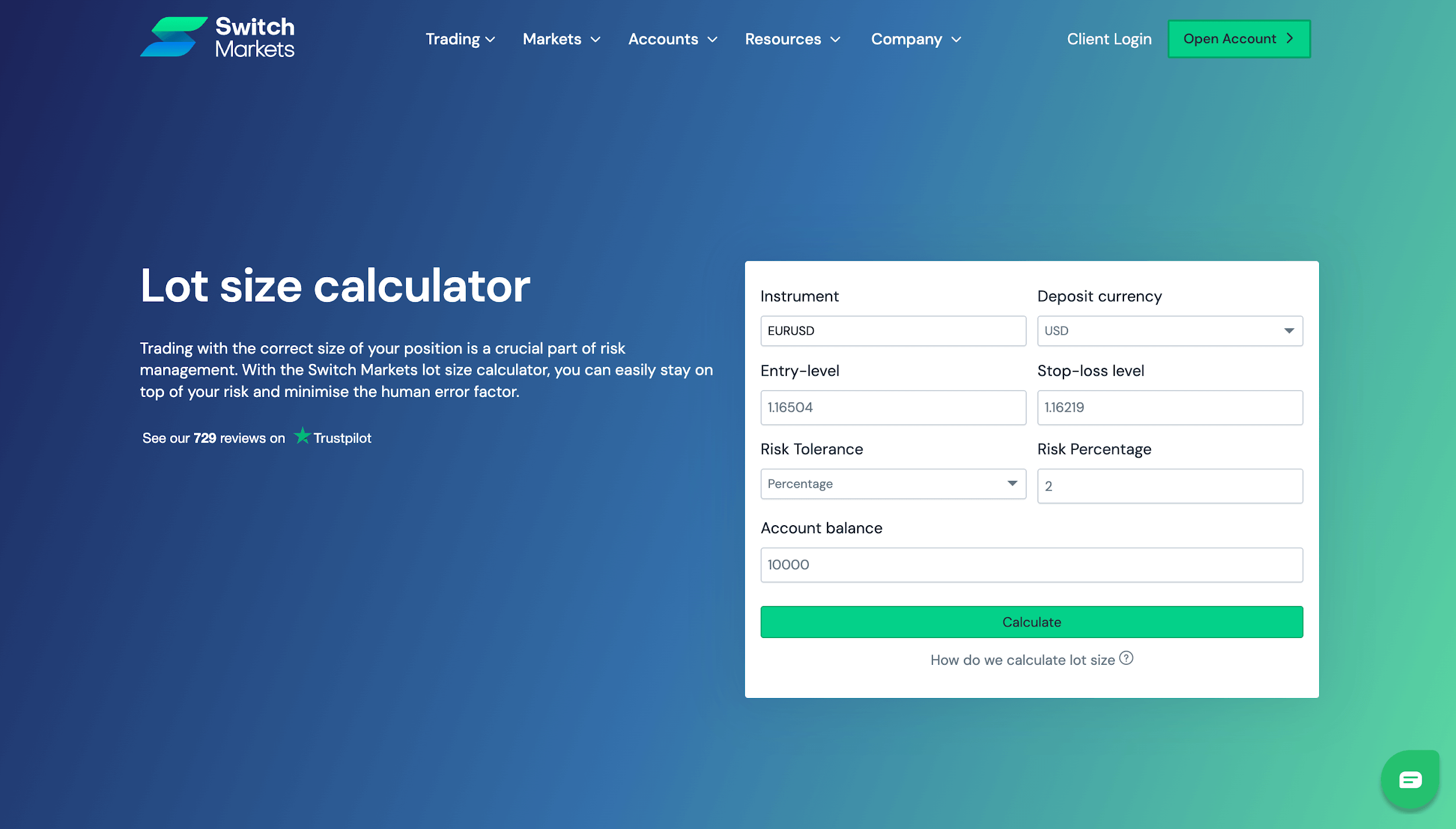

Enter Your Account Size

Provide the current size of your account (your total account balance or trading capital). This figure is used to calculate how much money a certain percentage risk equates to. For instance, 2% risk on a $10,000 account is $200.

What the calculator will do with this information is to use your account size together with the previous step (your risk percentage or amount) to determine the exact cash amount you’re willing to put at risk on the trade.

Click “Calculate” to Get Your Position Size

Now hit the Calculate button. The position size calculator will instantly compute the recommended position size based on the information you provided. Review the results.

As seen above, the output will tell you how many units or lots you should trade. It will also display the equivalent risk amount in your account currency and what percentage of your account that risk represents, as a confirmation.

Use the Suggested Position Size in Your Trading

With the calculator’s output in hand, you now know the maximum position you should take for the trade. When you go to your trading platform to place the trade, use this position size to set the volume/number of shares. This ensures you are adhering to your predefined risk limit.

For example, if the calculator said 0.20 standard lots, you would trade 0.20 lots, not a full lot or any other amount.

Wrapping Up

At the end of the day, consistent profitability in trading doesn’t come from flashy strategies or perfect entries. Rather, it comes from managing your risk like a pro. That’s where a position size calculator proves its worth. While it helps you get your numbers right, it also builds discipline, protects your capital, and allows you to trade with a clear head.

Using a calculator means you no longer have to guess your lot sizes, second-guess your stop loss, or worry about whether you’re risking too much. With just a few quick inputs, you get a precise trade size that aligns with your risk tolerance every single time.

So if you’re serious about trading for the long haul, don’t treat this tool as optional. Make it part of your routine. The market is already unpredictable; your risk doesn’t have to be.

FAQs

Still got a few questions bouncing around? Here are some quick answers to the most common questions traders ask when it comes to using a position size calculator:

Is a position size calculator only for forex trading?

Nope. While it's popular in forex, you can use a position size calculator for stocks, crypto, indices, and pretty much any market where risk management matters. Just make sure you’re using a calculator designed for that specific asset class.

Do I need to use it for every trade?

Ideally, yes. Consistency is key in trading. Using the calculator every time helps enforce discipline and keeps your risk aligned with your strategy. Yet, day traders often find the proper lot size and stick with it for a while, until they increase their position size. Swing and position traders, on the other hand, often change their position size, and as such, they use a position size calculator regularly.

What’s the difference between lot size and position size?

Lot size refers to the number of units you’re trading (e.g., 1.00 lot = 100,000 units in forex). Position size is a broader term; it’s how big your trade is overall, often expressed in lots, shares, or contracts. The calculator figures this out based on your risk inputs.

Can’t I just estimate it in my head?

You could, but that’s how traders accidentally over-leverage. A small mistake in pip value or account balance can throw your risk way off. The calculator makes sure your math is always on point, helping you maintain an effective risk management habit every time.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.