Trailing Stop Loss - A Guide to Using It on MT4/5

As much as trading successfully has a lot to do with entering positions at the right time, it’s also about knowing when to exit and how to protect your profits. This is where a trailing stop loss comes in handy.

Trailing stop loss orders automatically adjust your stop level as the market price moves in your favor, helping lock in gains while limiting risk.

In this quick guide, we’ll explain what a trailing stop loss is, how it works, and how you can use it effectively on MetaTrader 4 and 5.

What is a Trailing Stop Loss?

A trailing stop loss is a type of stop order that “trails” the market price of an open position by a specified distance. Unlike a regular stop loss, which stays at a fixed price, a trailing stop automatically moves (in one direction only) as the price moves favorably.

In simple terms, if the market price goes up for a buy position, the trailing stop will also move up, maintaining the pre-set gap between the current market price and the stop. If the price then starts to fall, the stop stays in place – potentially locking in profit or reducing the loss on the trade.

This dynamic adjustment makes trailing stops especially useful for riding trends while guarding against reversals. Ultimately, it is one of the best risk management trading techniques.

How Does a Trailing Stop Loss Work?

When you set a trailing stop, you decide how far behind the current price the stop loss should remain (often defined in pips, points, or as a percentage).

As long as the trade moves in a profitable direction, the trailing stop will continually recalibrate the stop-loss level to maintain that set distance.

If the market reverses direction by that distance or more, the trailing stop will trigger, closing the position.

Essentially, the trailing stop loss ensures that if your trade keeps winning, the stop moves up (or down for a short trade) with it, but if your trade starts losing, the stop loss is hit and the trade exits.

Trailing Stop Loss Example

To illustrate, let’s say you buy a stock at $100 and set a trailing stop loss 5% below the current price. Initially, your stop is at $95 (5% below $100). If the market rises to $120, the trailing stop will move up to $114 (which is 5% below $120). Now you’ve locked in at least a $14 profit per share should the price fall. If the stock price then drops from $120 to $114 or below, the trailing stop will trigger and sell at around that level, securing your gains.

On the other hand, if the price keeps climbing to $130, the stop loss will trail behind at $123.5 (5% below $130), and so on. This way, the stop-loss “trails” the upward movement, letting profits run while still capping potential losses or locking in profit as it goes.

In the case of Forex trading on MT4/MT5, trailing stops are usually set in points or pips. For example, you might set a trailing stop of 50 pips on a AUD/USD long position. If AUD/USD moves in your favor by 50 pips, the platform will place a stop loss 50 pips above your entry (for a long trade). As the price continues to rise, the stop-loss will keep moving up in 50-pip increments. If the market reverses by 50 pips from its peak, the trailing stop kicks in and closes your trade, hopefully locking in the profit accumulated up to that point.

Why Should You Use a Trailing Stop Loss Order?

Trailing stop losses offer several advantages for active traders and investors. Here are some of them:

- Lock in profits automatically: The biggest benefit is the ability to secure profits without manually adjusting your stop. As the trade becomes more profitable, the trailing stop moves to protect those gains. This removes the need for constant monitoring and can capture more profit if a trend runs far.

- Limit downside risk: Like a regular stop loss, a trailing stop still provides a safety net if the market moves against you. You predefine the maximum loss (or the amount of profit you’re willing to give back) you’re comfortable with. This can prevent a winning trade from turning into a loser.

- Ride big trends: Trailing stops help you stay in winning trades longer. Instead of taking profit too early out of fear, you let the market’s momentum decide when to exit. In a strong uptrend, the trailing stop will keep moving up and only exit after the trend finally reverses by your set amount.

- Emotion-free trading: Because the stop moves automatically, it reduces trading emotional interference. Traders often struggle with deciding when to move a stop loss or take profits. Trailing stops enforce discipline by sticking to a predefined rule, which can be especially useful when you’re not watching the screen or when using automated strategies. (Even an AI trading bot or algorithmic system can employ trailing stops as part of its risk management.)

- Adapt to volatility: You can adjust the trailing distance according to market volatility or your strategy. For volatile assets, you might use a larger trailing gap to avoid getting stopped out by normal noise. For steadier markets or tighter strategies, you can use a smaller gap. This flexibility means the risk management tool can adapt to different trading styles and conditions.

Note: In choppy, range-bound markets, a tight trailing stop might stop you out on a minor swing before the price continues in your favor.

It’s important to choose an appropriate trailing distance based on the asset’s volatility. We’ll discuss tips for that in the FAQs (see “What is a good trailing stop percentage?”).

The biggest benefit of a trailing stop loss order is the ability to secure profits without manually adjusting your stop. As the trade becomes more profitable, the trailing stop moves to protect those gains. This removes the need for constant monitoring and can capture more profit if a trend runs far.

How to Set a Trailing Stop Loss on MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms, and setting up a trailing stop on MT4 is straightforward.

Keep in mind that MT4’s trailing stop feature only works on the desktop client (not on the web platform or mobile app), and it requires your trading platform to be running to function.

Here’s how to configure a trailing stop loss on MT4:

On MT4 Desktop

Here are the steps you need to take in order to set a trailing stop loss order on MT4 desktop:

- Right-click on your open trade: In the MT4 desktop platform, go to the Trade tab of the Terminal window (bottom panel). Find the open position you want to protect and right-click on that line. This will open a context menu.

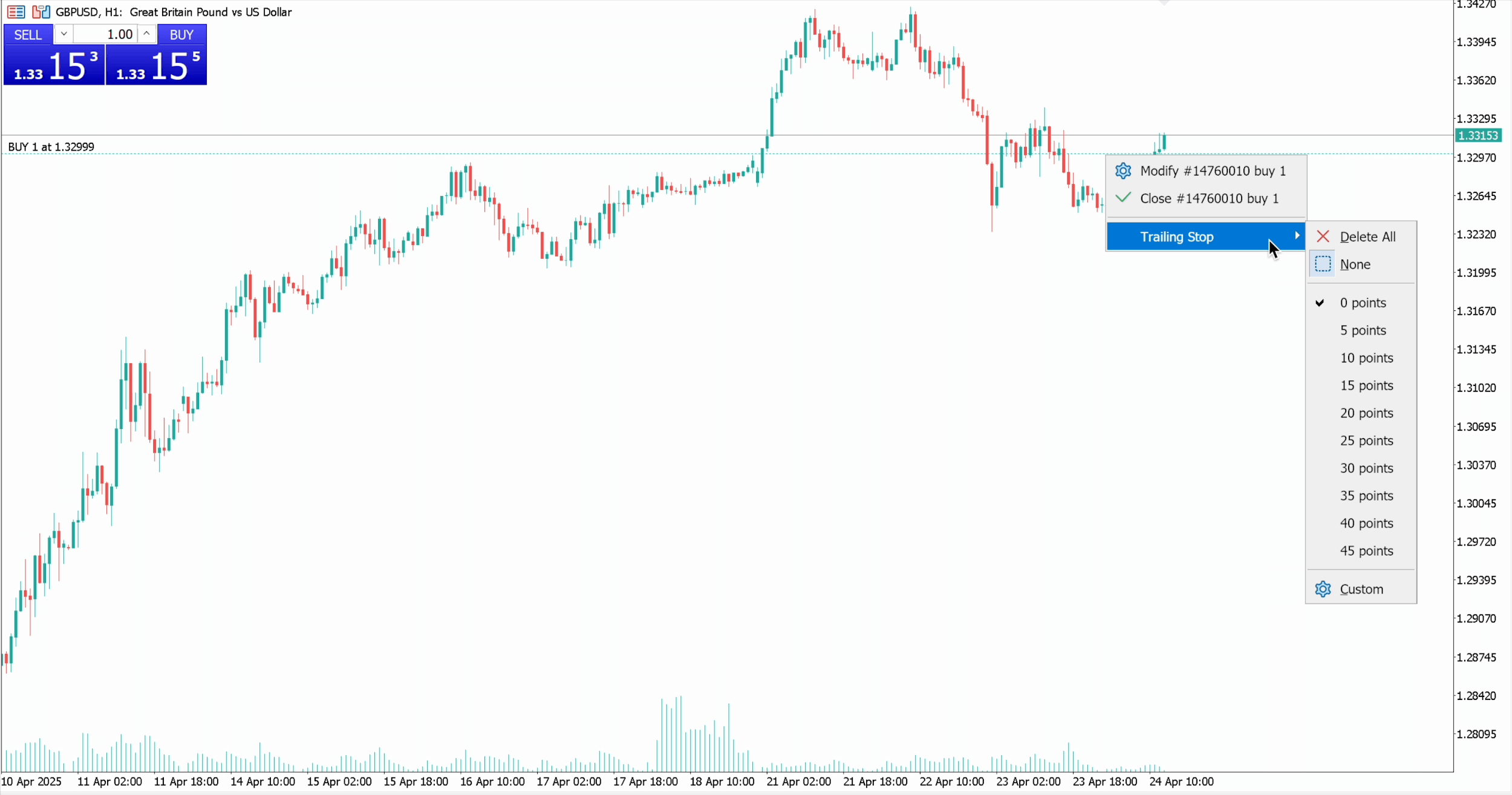

- Select “Trailing Stop” and set the value: In the context menu, hover over Trailing Stop. You’ll see a list of preset trailing distances (in points) and an option to choose Custom to enter a specific number. Select the desired trailing distance. For example, choosing “50 points” sets a 5-pip trailing stop (for brokers using 5-digit pricing, since 10 points = 1 pip).

- Activate and monitor: Once you select a value, the trailing stop is applied to that position. It stays dormant until the position is in profit by at least that many points. Then the platform will automatically place a stop loss that “trails” the price. As the trade moves further in your favor, the stop loss will adjust itself accordingly. You can see the stop-loss level update in real-time on your chart or in the Trade tab.

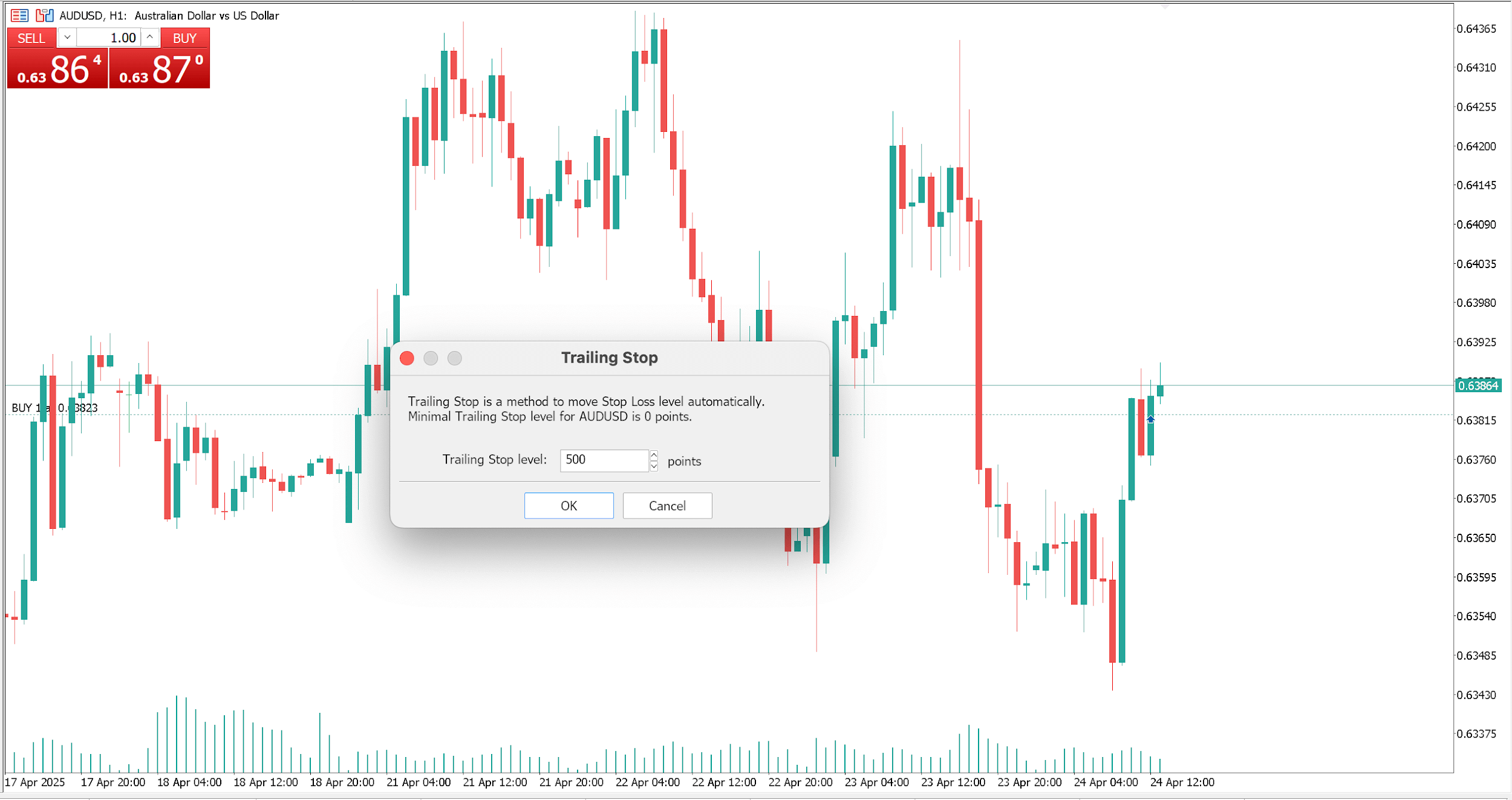

The Trailing Stop menu in MT4’s context menu offers preset point options or a custom value for the trailing distance.

The screenshot above shows the list of available trailing stop levels (in points) when you right-click on an open position. You can choose one of these values or set a custom number to define how far behind the price the stop will trail.

Important: MT4 must stay open for the trailing stop to work. If you close the platform or lose connection, the trailing stop will stop adjusting (the last stop-loss set will remain, but it won’t move further). For that matter, it is highly recommended to use a VPS, which is a must-have tool for traders.

On MT4 Mobile

The MT4 mobile app (Android/iOS) does not have trailing stop-loss functionality. There is no option to set a trailing stop in the mobile version.

If you are trading from your phone and want to trail a stop, you would have to do it manually: that is, periodically move your stop-loss order to a higher level as the trade moves in your favor. You can also set price alerts on your mobile to know when to adjust your stop.

For fully automated trailing stops, you’ll need to use the MT4 desktop platform (or run MT4 on a computer/VPS that stays online).

Additionally, the MetaTrader WebTrader (browser platform) also does not support trailing stops, so the desktop app is required for this feature.

How to Set a Trailing Stop Loss on MetaTrader 5 (MT5)

Setting a trailing stop on MetaTrader 5 is virtually the same process as on MT4.

In the MT5 desktop platform, open the Toolbox panel (bottom) and find your trade under the “Trade” tab. Right-click on the open position and choose Trailing Stop. You can then select a preset distance (in points) or click Custom to input a specific number of points for the trailing stop.

Once set, the trailing stop will activate after the position is in profit by at least that distance, then automatically trail the price just as described for MT4.

Make sure to keep MT5 running; trailing stops in MT5 also require the platform to be open to function.

On MT5 Mobile

Just like MT4, the MetaTrader 5 mobile app does not support trailing stops. You cannot set a trailing stop order on the MT5 mobile app.

If you need to use a trailing stop, you must do so on the desktop platform (or adjust your stop loss manually on mobile as the price moves).

Trailing Stop Loss vs Trailing Stop Limit

Both trailing stop loss and trailing stop limit orders automatically trail a price behind your position, but the difference lies in how the order is executed when the stop level is reached:

- Trailing Stop Loss: Triggers a market order when the stop price is hit. This means the position will be closed at the next available price. You are virtually guaranteed to exit the trade, but the exact exit price could slip if the market is moving quickly or gaps.

- Trailing Stop Limit: Triggers a limit order when the stop price is hit. The trade will only close at the specified stop price (or better). This can prevent selling below your desired price, but if the market falls past your stop price faster than it can be filled, the order might not execute. In that case, you remain in the position and could lose more if the price continues to move against you.

In general, trailing stop loss orders (market orders) are preferred by most traders for their certainty of execution – your trade will close once the stop is reached. Trailing stop limits are used by some traders to control price slippage, but they carry the risk of no execution in a fast market.

MetaTrader 4 and 5 support only the standard trailing stop loss (market) order, so in practice you will be using that on MT4/MT5.

Final Words

Trailing stop orders are a handy tool to maximize profits and limit losses in an active trade. By automatically moving your stop-loss level up (for longs) or down (for shorts) as the market moves in your favor, a trailing stop lets you lock in gains without needing to constantly monitor the position.

On MetaTrader 4 and 5, this feature is available on the desktop platform and can make trade management more automatic and stress-free once set.

As with any trading strategy and the different types of trading orders, you should use trailing stops thoughtfully. If a trailing stop is set too tight, normal market fluctuations might stop you out of a good trade prematurely. If it’s set too wide, you might end up giving back a large portion of your profits before the stop hits. It often takes some experimentation to find the optimal trailing distance for each market and strategy.

Now that you understand what a trailing stop loss is and how to use it on MT4/MT5, you can practice incorporating it into your trading plan. With the right settings, trailing stops can help you let winners run while still protecting you when the market reverses.

FAQs

Here are some popular questions we often get about trailing stop loss:

How does a trailing stop loss order work?

A trailing stop loss works by automatically moving your stop-loss price in tandem with favorable moves in the market. You set a specific distance (in points, pips, or percentage) for the stop to trail the current price.

As long as the price moves in a profitable direction, the trailing stop “chases” the price, staying that set distance away. If the price reverses by that distance, the trailing stop order triggers, closing the trade.

What is a good trailing stop percentage?

There is no single “best” trailing stop percentage for every trade; it depends on the asset’s volatility and your trading style. However, a common guideline for stocks is to use a trailing stop between about 5% to 20%.

For instance, a swing trader might use roughly a 10% trailing stop on a stock position to give it room to fluctuate, whereas a day trader might use a tighter 2–5% trailing stop. In forex trading, percentages are less often used; traders might think in terms of pips or use indicators like the Average True Range (ATR) to set a trailing stop.

A good practice is to match the trailing stop to the market’s volatility: if an asset typically moves 1-2% in a day, setting a 0.5% trailing stop would likely be too tight (you’d get stopped out on normal swings). On the other hand, a 10% stop on something that barely moves 1% a day would be too wide to meaningfully protect profits.

Can I set a trailing stop on the MetaTrader mobile app?

No. Neither MT4 nor MT5 mobile apps have the option to set a trailing stop loss. The mobile apps only support basic stop-loss and take-profit orders at fixed levels.

Do I need to keep MetaTrader running for a trailing stop to work?

Yes. In MT4/MT5, trailing stop orders are managed by the client terminal (your computer), not by the broker’s server. This means your MetaTrader platform must be open and connected to the internet for the trailing stop to actively adjust.

If you close the platform or shut down your PC, the trailing stop will stop moving because the server isn’t updating it. The last stop-loss level that was set will remain in place on the broker’s server, but it won’t move further without your client running. It is, therefore, advisable to use a VPS, which is given for free by Switch Markets to all clients who open a trading account.

What’s the difference between a trailing stop loss and a regular stop loss?

A regular stop loss is a fixed price at which you’ll exit a trade to cap your loss (or protect a certain amount of profit). It doesn’t change once you set it (unless you move it manually).

A trailing stop loss, on the other hand, is dynamic. If the market reverses by more than that distance, the trailing stop triggers and closes the trade.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.