The Carry Trade Strategy: What Is It and How Should You Use It

The Carry Trade Strategy - Listen to the Full Article Here

Every beginner forex trader needs to get familiar with one strategy and concept - that is, the carry trade trading strategy. This strategy, which primarily relies on interest rate differentials between two currencies, is one of the most popular trading strategies in the FX currency market and one of the key factors that impact the direction of one currency versus the other.

So, how can you use the currency carry trade strategy in forex trading? And why is the carry trade such a significant concept in financial and foreign exchange markets?

First, What is a Carry Trade?

So, here’s the thing - money can move from one place to another. Consider this: assuming there are two “financially safe countries” and a 1% interest rate gap exists between them, where will the money go? Clearly, capital will move to the country with the highest interest rate.

That is the core idea of carry trade. At its most basic, a currency carry trade transaction is a trading strategy that involves borrowing a currency with a low interest rate and buying a currency with a higher interest rate. The goal of a trader using this strategy is to profit from the interest rate differential, while also benefiting (or incurring losses) from any fluctuations in the exchange rate between the two currencies.

A Carry Trade Example

Let's take a look at a carry trade example - in 2010, shortly after the 2008 economic crisis, the USD/JPY was trading around 85. Back then, the interest rate differential between Japan and the United States was insignificant. The Japanese central bank kept rates very low due to Japan’s ongoing recession (and without any future forecast of rate hikes). At the same time, the FED was maintaining a near-zero interest rate environment but with high anticipation of rate hikes in the near future. Furthermore, the Japanese government had a strong incentive to weaken the value of its currency in order to increase the competitiveness of its exports and thereby raise its GDP. Meanwhile, the US central bank was largely indifferent to the USD/JPY rate.

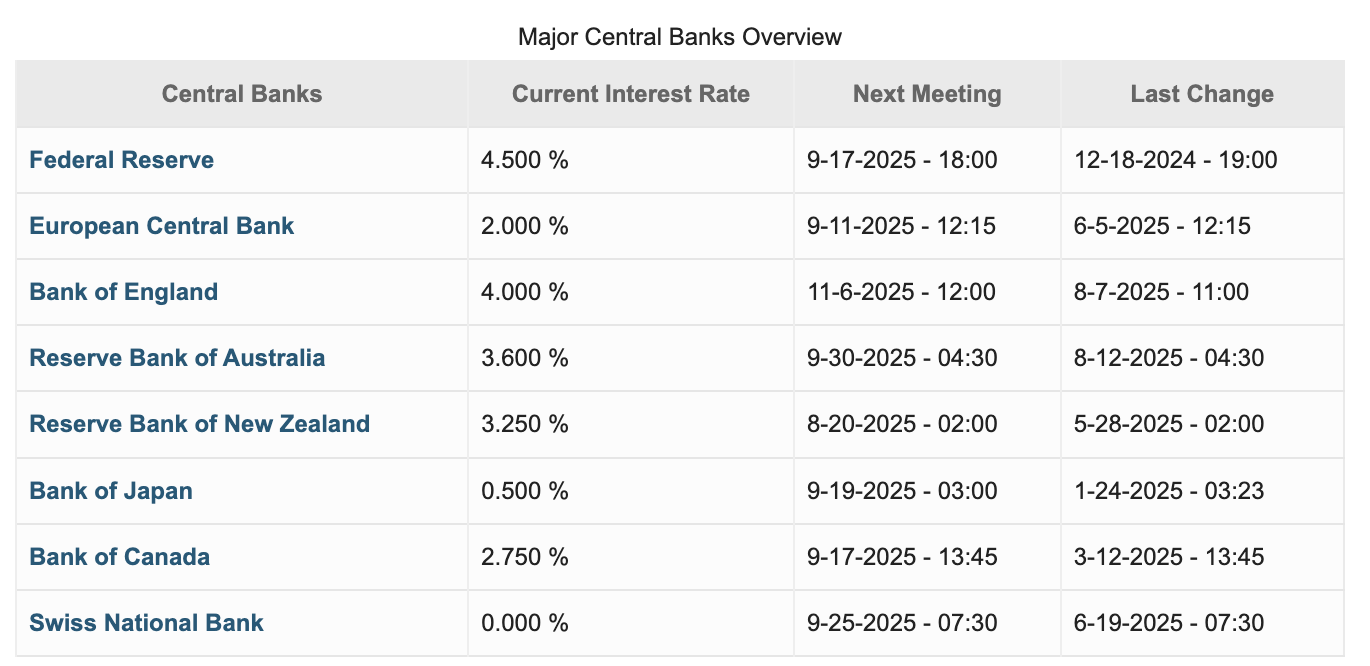

And, so, since 2012, the Fed slowly raised US rates to its currency rate of 4.5% while the BOJ (Bank of Japan) has kept a low interest rate near zero before raising it (after nearly three decades) to its currency rate of 0.5%. What happened during this period? The USD/JPY exchange rate increased from around 85 to around 150, while touching a 50-year high of 161.

Obviously, during this time, there were many ups and downs for the pair, largely due to the fact that the JPY is being used as a safe-haven currency. This means that in times of uncertainty, investors will shift their capital to Japan. Yet, the Japanese Yen is the classic example of a carry trade strategy. The interest rate differential between the US and Japan, or Australia and Japan, or, to be honest, almost any country around the world, has made the Yen the currency of the carry trade.

The History of Carry Trade

Currency carry trades are not a new phenomenon. In fact, it is more than likely that carry trades have been conducted in various forms throughout history, often using currencies or commodities. After all, the use of interest rates in financial transactions can be traced back to 2400 BC.

However, the first modern use of carry trades was introduced when financial markets opened up in the early 1980s. Due to the low-interest rates in Japan, for example, many investors exchanged the Yen for the US dollar, making it the first real speculative carry trade in history.

By the early 90s, the vast majority of central banks had decreased their interest rates due to the recession in the US and worldwide. Consequently, the high-interest rates of the late 70s and 80s from the US government and other developed countries were no longer available for investors. This caused a situation where investors and hedge funds were looking for speculative carry trades by taking funds out of developed countries and investing in undeveloped countries with high-interest rates, such as Mexico, Turkey, Brazil, and China.

During the first decade of the current century (taking aside the dot.com bubble), carry trades were back in fashion as investors, once again, renewed their interest in low-risk positions by borrowing low-yielding currencies such as the Japanese yen and buying high-yielding currencies such as the US dollar, the Euro, and the British Pound. That was, obviously, a result of the high economic growth in the US and other leading countries from the mid-90s up until the financial crisis in 2008.

Following the 2008 crisis, the use of carry trades by large financial institutions and retail investors has significantly decreased. This can partly be attributed to the near-zero interest rates applied by central banks, which makes almost all currencies less attractive. In that scenario, stocks (and... cryptocurrencies) became the main drivers of return.

But once the global economy was back on track, the carry trade became, again, a global strategy. As of writing, the carry trade strategy is widely used by large financial institutions and retail investors. As long as there’s a rate differential between two economies, investors are likely to exploit this opportunity.

How Carry Trades Impact the Global Economy

The carry trade might look simple - borrow cheaply in a low-interest currency and park that money where yields are higher. But in reality? It’s a financial tidal wave. When billions pour into this strategy, it doesn’t just pad traders’ pockets; it reshapes global capital flows, rattles exchange rates, and at times, shakes entire economies. Let's explore how carry trades impact the global economy.

1. Currency Tug-of-War

Carry trades push high-yield currencies up and drag low-yield ones down. Think of traders borrowing yen at rock-bottom rates and snapping up Aussie dollars. The result? A stronger Australian Dollar (tougher for Aussie exporters) and a weaker yen (great news for Japanese exporters). These moves ripple through trade balances and growth trajectories worldwide.

2. Floodgates Into Emerging Markets

Emerging markets are magnets for carry trade money when their rates shine brighter. Cash floods in, currencies strengthen, and asset prices soar. But here’s the catch—it’s hot money. The moment risk sentiment sours, the tide can turn overnight.

Example: In the early 2000s, investors borrowed yen and chased sky-high returns in Brazil, Turkey, and South Africa. The inflows fueled booms—but when risk appetite evaporated, bubbles burst, leaving economies scrambling.

3. Unwind = Shockwaves

The real danger? Unwinding. When crises hit or interest rates flip, traders stampede out of carry trades. The funding currency (like the yen) spikes, while target currencies nosedive.

Example: During the 2008 crash, the yen surged as investors dumped risky positions. Japanese exporters took a hit, and emerging markets saw currencies collapse under the weight of capital flight.

4. Central Banks in the Crossfire

Carry trades don’t just move markets—they mess with central banks. Too much inflow? Currencies overheat. Outflows? Panic sets in. That’s why central banks often step in with interest tweaks, interventions, or even emergency liquidity just to keep the balance.

Example: The Reserve Bank of Australia has long battled the AUD’s reputation as a “carry darling,” its value often dictated less by Aussie fundamentals and more by global appetite for yield.

5. From Boom to Bust

On a macro scale, carry trades turbocharge cycles. They fuel growth and asset booms in good times. But when sentiment flips, the unwind can spread panic across borders, feeding financial contagion and exposing just how fragile global markets really are.

In short: The carry trade isn’t just a trader’s tool—it’s a global force. It builds momentum fast, but when it unwinds, the fallout can be brutal.

How to Use Carry Trade in Forex Trading

For the average Joe trader, there are several factors to keep in mind in order to use the carry trade strategy effectively.

First, many brokerage firms enable investors to receive the interest difference when they buy a currency with a high-interest rate and sell a currency with a lower rate. In forex trading, this is also known as a positive swap. For example, you can check swap rates of FX currency pairs and commodities to evaluate the annual rate you are expected to make if investing in a certain financial instrument.

To view the current interest rates of central banks worldwide, you can visit this page.

So, how does it work? You simply receive the interest from your brokerage firm on the currency you hold with the higher interest rate (this includes short positions). Simple as that. This gives you a fixed income that you can consider when entering a position.

For example, assuming that the interest rate differentials between two currencies stand at around 2%, this means investors will be able to make an annual return of 2% by holding a position for one year. A good strategy would be to set the stop loss at the price where you meet the interest rate difference (for the example above, 2%) and take a long-term position buying the high-yielding currency and selling the low-yielding currency.

Another approach to use the carry trade strategy is to follow the inflationary rates of each country and the anticipation of rate hikes, which is a result of the economic activity of countries. For that, you need to constantly follow economic events and data published on a reliable economic calendar, and be alert to any major central bank meetings that may indicate the possibility of a future rate hike. Further, it is a good idea to follow government bond prices to predict future rate decisions and currency exchange rates.

Based on this data, an investor can make an investment decision whether to invest in a certain currency versus another. For example, right now, as of 2025, some of the most popular carry trades include the Japanese Yen and major currencies such as the USD, GBP, AUD, and NZD. This is largely due to the low interest rates adopted by the Bank of Japan, and as a result, the high rate differential between the above currencies.

In sum, here are the key points to keep in mind when using the carry trade strategy:

The Risk in Carry Trades

Although the carry trade strategy is considered a low-risk investment strategy, there are factors to keep in mind when using it. Much like other trading strategies, in carry trades, the lower the risk, the less you should receive. This means that the currency pairs with the highest interest rate differentials also tend to be the most volatile, and the trade risks are therefore higher.

For example, the interest rate differential between the USD and the Turkish Lira is one of the widest in the Forex market. Clearly, this might be attempting to buy the Turkish Lira currency, which has a high interest rate, and sell the US dollar, which is a low-interest-rate currency; however, it is certainly a risky long position to take.

Therefore, like any other investment you plan to make in the currency markets, it is crucial to use fundamental analysis and proper risk management tools, including a risk-reward ratio, trailing stop loss, and limit orders.

In short, here are the key risks of the carry trade strategy:

Final Thoughts

To sum up, there are many benefits of using the carry trading strategy. It is a great method to get passive income in the FX market and identify long-term trends. In the long run, if the exchange rate of the asset currency pair you invest in stays the same or moves in your direction, you make a profit. In addition, when using this strategy correctly, the steady fixed income you are expected to get from a positive carry trade provides a cushion for your trading activity.

However, you should keep in mind that the carry trade strategy is far more suitable for long-term positions as well as for swing traders. For day traders, there’s no real use for a carry trade. Still, many forex traders, and especially carry traders, confirm that carry trades work well over the long term, particularly during times when central banks increase interest rates or have plans of rate hikes.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.