Free Trading

Journal Template

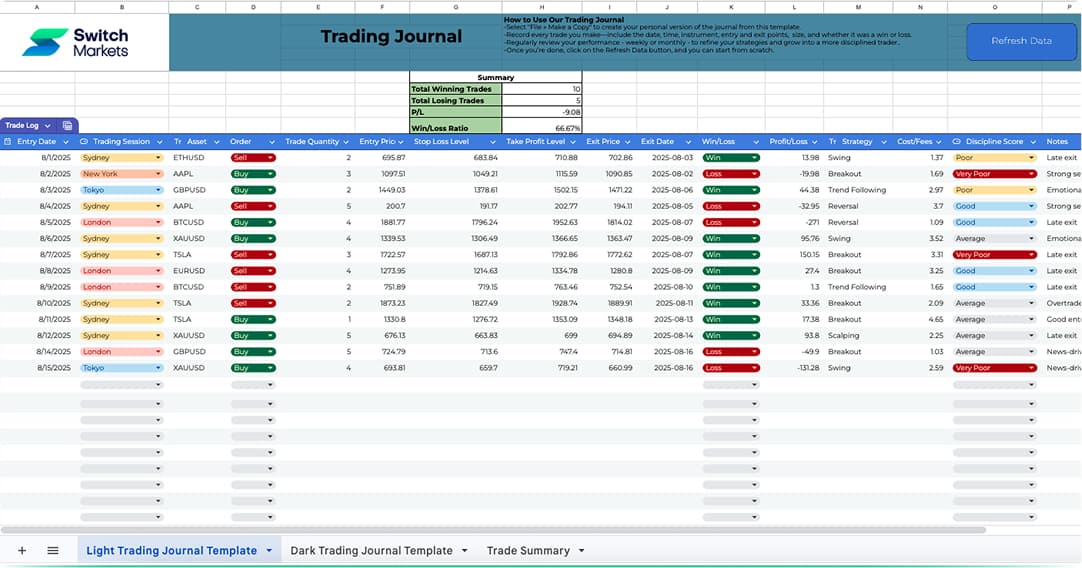

A trading journal template isn't just a spreadsheet; it's your personal playbook for mastering the markets. It's where every trade gets recorded, reviewed, and transformed into insights you can act on.

Inside, You'll Typically Log

Date & Time

So you know exactly when the action happened.

Trade Direction

Whether it's EUR/USD, S&P 500, or your favourite stock.

Position Size

The muscle behind your move.

Entry & Exit Prices

Your battlefield markers for entry and exit points.

Stop Loss & Take Profit Levels

Your safety net and victory line.

Trading Session

To learn in which session you perform best.

Reason for Entry

The strategy or signal that got you in the game.

Cost/Fees

The total trading costs for a chosen period.

Outcome

Profit, loss, and by how much

Win-Loss Ratio

To measure your performance and improve your trade discipline.

Discipline Score

To monitor your discipline performance and enhance trading rules.

Notes

Your observations, emotions, and lessons learned along the way.

Additionally, our trading journal also includes a trade summary that can help you track your month-by-month performance.

Done right, a trading journal becomes more than a record; it's your performance coach, helping you spot trading patterns, analyze key metrics, fine-tune trading edge, and level up your trading game.

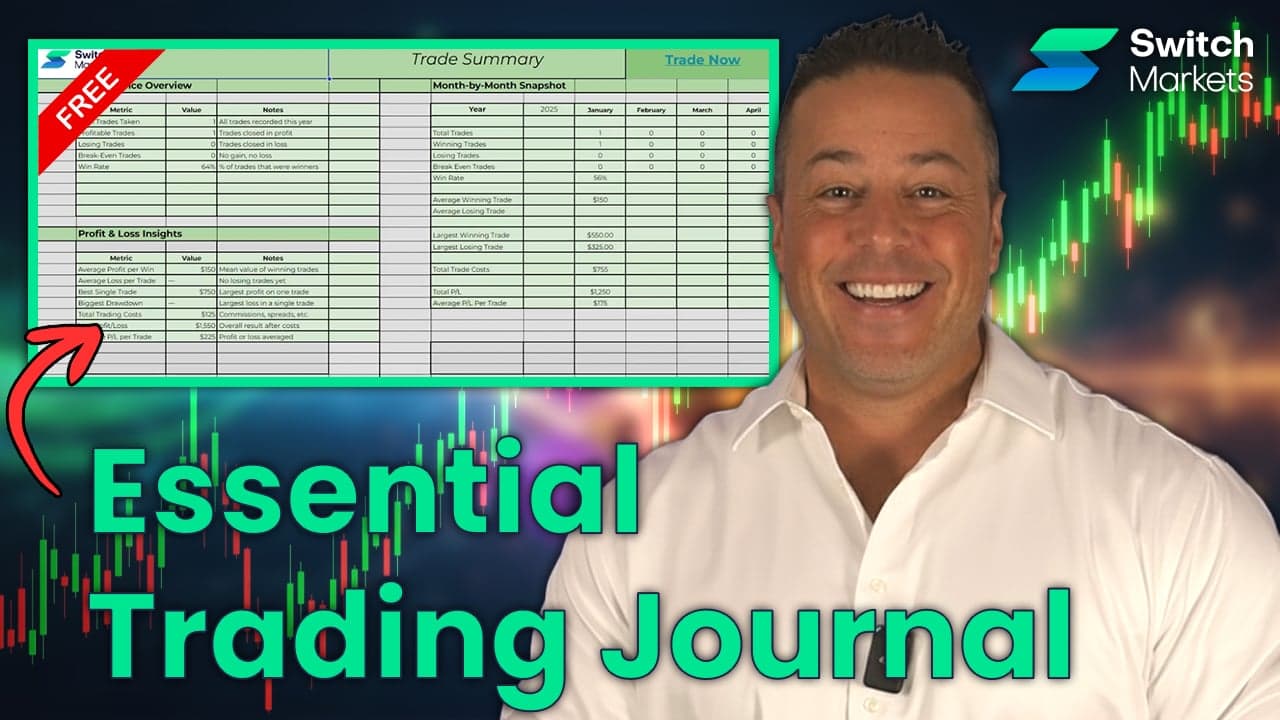

Our Free Trading Journal Templates

Here's a free downloadable and easy-to-use trading journal template in MS Excel format. Simply make a copy, add as many rows as your trading style requires, and export it anytime as your own customized Microsoft Excel trading journal.

Why Is A

Trading Journal Essential?

A trading journal isn't just a log of your trades; it's your personal roadmap to becoming a smarter, more disciplined trader.

By recording every trade, you gain clarity on what's working, what's costing you money, and how your emotions impact your decisions. Over time, you'll spot patterns, refine your strategy, and cut out costly mistakes.

Think of it as your trading "black box", the more trade data you feed it, the better insights you'll get, and the faster you'll grow as a trader.

How To Use Our Trading Journal Templates

Getting started couldn't be simpler:

1. Grab your copy

Click the link to our free trade journal template. Then head to 'File' → 'Make a copy' to save your editable version to your Drive. Prefer to keep it local? Choose 'File' → 'Download' and grab it as Excel or OpenDocument.

2. Know your tools

Use the tabs to navigate. Tab 1 is your 'Light Trading Journal Template'. Tab 2 is your 'Dark Trading Journal Template'. Tab 3 is your Trade Summary, where you can monitor your trade performance and get a month-by-month snapshot.

3. Log like a pro

Every time you open a trade, jump to the 'Trade Log' tab. Record the basics - date, symbol, long/short/open - plus entry trade details like price, time, size, and stop loss. During the trade, jot down notes in our trading journal columns: strategies, market vibes, or your mindset that day.

4. Wrap it up

When the trade closes, fill in the exit details and commission. Your P/L, Win/Loss, and R-Multiple will auto-calculate. Finally, use column O to lock in the discipline score - this is where growth happens. It's not just a journal, it's your trading blueprint. The more you use it, the sharper you get.

It's not just a journal, it's your trading blueprint. The more you use it, the sharper you get.

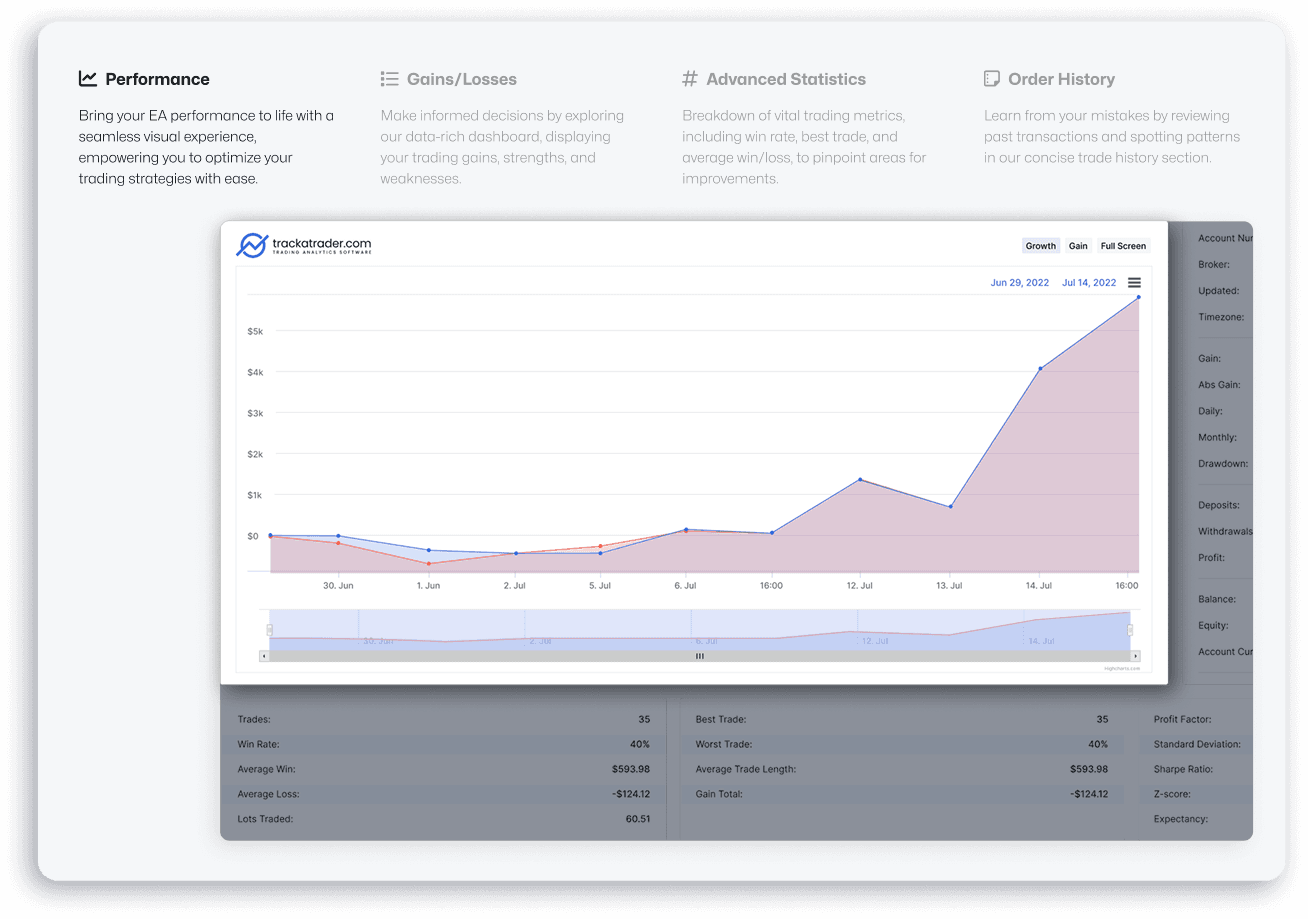

Get Access to Our Built-In Trading Analytics Software

Switch Markets clients get free access to our built-in tracking application, Trackatrader.

Trackatrader makes optimizing your trading performance seamless and intuitive. Simply link your MT4 or MT5 account in minutes, and you'll gain access to beautiful, real-time charts and powerful analytics that bring your results to life. With growth trackers, snapshot insights, and detailed trade analysis, you can refine your edge, uncover improvement patterns, and stay accountable to your goals. Plus, you can share verified results with confidence. Trackatrader ensures credibility, transparency, and trust every step of the way.

Frequently Asked Questions

Read our frequently asked questions below. If you still need help, contact us today.