How to Become a PAMM Account Manager

If you are an experienced trader with a solid track record, becoming a PAMM account manager can be an excellent career choice. As a PAMM account manager on Switch Markets, you get the opportunity to manage a pooled account with funds from multiple investors and receive a fee based on performance.

Here, at Switch Markets, we’ll show you the way to get started and assist you in providing all the necessary tools to become a successful PAMM manager.

First, What is a PAMM Account?

A Percentage Allocation Management Module, also known as PAMM, is a type of trading account where investors entrust their funds to a professional fund manager for investment and management.

When investors open a PAMM account and deposit funds, their contributions are pooled together with those of other investors. The combined capital serves as trading funds for the manager, allowing investors to benefit from the expertise of a professional trader without directly engaging in trading activities themselves.

Each investor's share in the pooled account is proportional to their individual contribution, and profits or losses are distributed accordingly. The structure of a PAMM account is designed to ensure transparency in all financial transactions, with fund money managers operating under strict regulations to safeguard investors' assets and interests.

For their services, fund managers charge a fee, which is deducted from the profits they generate from applying the PAMM fund strategy. This arrangement aligns the manager’s incentives with those of the investors, promoting strategies and decisions aimed at mutual success.

The Role of a PAMM Account Manager

As a PAMM account manager, you are responsible for building a successful network for your investors. Here’s a breakdown of how it works and the role of a PAMM account manager:

First, a PAMM account manager must set conditions for investors. This includes, among many other factors, the percentage of profit distribution, the traded assets, the investment period, the entry fee, and the minimum amount of investment for potential clients.

The second step involves making trading decisions on behalf of investors. Once investors' funds have been funded in the manager account, the PAMM manager can start investing investors’ pooled capital with the goal of generating profits. At the end of the trading period set by the account manager, profits or losses are distributed among investors based on the proportion invested by each investor.

Lastly, if the PAMM account manager succeeds in delivering returns at the end of the chosen period, the manager can promote his or her performance and further grow the investor base. For that, you’ll be able to use a variety of tools provided by Switch Markets, including our custom widget embeds to promote your account performance on external websites, automated financial reports, and our intuitive PAMM dashboard panel.

Key Reasons to Become a PAMM Account Manager on Switch Markets

PAMM accounts present a valuable opportunity for both novice and experienced investors to access the financial markets while capitalizing on the knowledge and skills of professional fund managers. Here are the key features and benefits of becoming a PAMM account manager on Switch Markets:

A Low Initial Deposit Requirement - Start Managing with Just $100

To activate a PAMM account on Switch Markets, the PAMM Manager only needs a minimum deposit of $100. That’s significantly lower than other PAMM account manager programs.

Demo PAMM Account

PAMM Account managers on Switch Markets have access to a demo trading account where they can test their strategies before risking investors’ funds in live markets.

Comprehensive PAMM Dashboard Panel

The PAMM Manager on Switch Markets gains access to an intuitive dashboard panel where they can view full statistics of all managed retail investor accounts, investments, and performance metrics. This feature can assist PAMM managers to improve their performance as well as promoting their PAMM to their audience.

In the panel, PAMM money managers can view all the data they need to manage their PAMM account, including a list of their clients and their open and closed positions.

Flexible Account Currencies

PAMM accounts are available in multiple currencies to suit global investors, including USD, EUR, AUD, GBP, CAD, NZD, CHF, and PHP.

Performance-Based Rewards

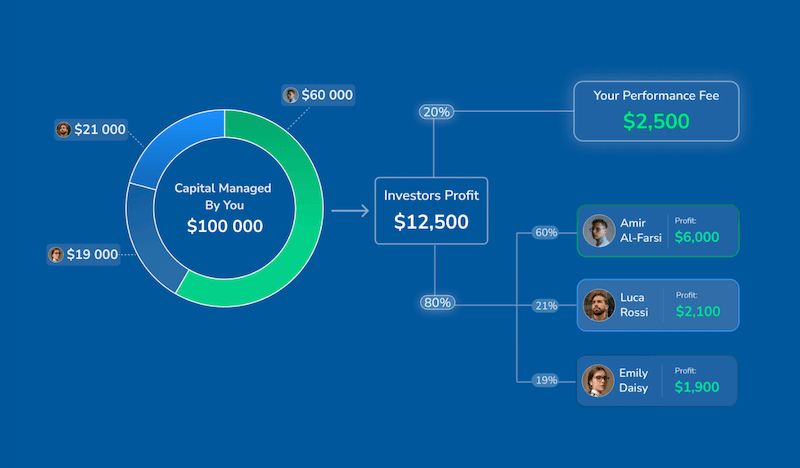

Managers earn performance fees based on the agreed percentage of the profits generated for their investors. On Switch Markets, the PAMM can set the performance fee for the profits generated for clients. For example, here's what a PAMM account's profit distribution might look like:

Customizable Offers

Switch Markets PAMM Managers can create multiple offers to attract a diverse range of investors. For example, set different performance fees based on investment thresholds ($1,000 or $2,000) or other criteria to tailor the experience for your audience.

Key Tools and Resources

PAMM managers at Switch Markets get a variety of tools and resources to help them achieve success. These include an AI trading bot, a free VPS, and a free tracking application to help them track and analyze their trading performance.

Transparency and Control

On Switch Markets, both the manager and investors can monitor performance in real-time, ensuring trust and confidence in the process.

Seamless Agent Chain Integration

Share a portion of your performance fees with agents who refer investors to your PAMM. This feature allows you to create a dynamic network of collaborators and gradually increase your account management business.

No Trading Limitations and Restrictions

PAMM account managers can benefit from flexibility regarding the techniques being used to generate profits. On our platform, all trading strategies are permitted without restrictions, including the possibility of applying EAs. Furthermore, PAMM managers on Switch Markets have the ability to choose the market and instruments they wish to focus on, from trading Foreign exchange pairs in the forex market to trading shares, cryptocurrencies, ETFs, indices, commodities, and trading CFDs, complex instruments.

Becoming a PAMM Account Manager at Switch Markets - How to Get Started

If you are keen to get started with building your PAMM account on Switch Markets, here are the steps you need to follow:

1. Create Your PAMM Account

Register for a PAMM Manager account and make your initial deposit.

2. Customize Your Offers

Use the PAMM dashboard to create and manage tailored offers for your investors.

3. Grow Your Network

Leverage Switch Markets' tools to attract more investors and maximize your earning potential. Our in-house partnership manager will assist you in building a successful account management system and growing your investor base.

With Switch Markets’ PAMM solution, managing funds has never been easier or more efficient. If you feel this is the right path for you, take your trading expertise to the next level and build your investor portfolio today!

For more details about our PAMM service, visit this page.

FAQs

Here are some key questions for those who are interested in becoming a PAMM account manager:

How do I become a PAMM account manager on Switch Markets?

To become a PAMM account manager on Switch Markets, you can book a call with our in-house partnership manager. On the call, you’ll discuss all the details regarding your investment objectives, setting up your account, and building your network.

What is the minimum deposit requirement for activating a PAMM account on Switch Market?

Here, at Switch Markets, you can captivate a PAMM account with a minimum deposit of $100. Additionally, we also offer a demo account for PAMM account managers, which allows you to test various strategies before applying those with investors’ capital on a live account.

What are the tools provided by Switch Markets for PAMM managers?

PAMM managers on Switch Markets gain access to several tools that can enhance their trading performance. This includes, among other tools, a free VPS, an AI trading bot, a comprehensive PAMM dashboard panel, custom widget embeds to promote the manager’s performance on external websites, and around-the-clock support.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.