A Trader's Guide to Fibonacci Trading Strategies

One of the first strategies you are most likely to come across as a trader is the Fibonacci trading strategy. This strategy has long been a favorite of traders for pinpointing hidden support and resistance levels in any market.

While trading the Fibonacci strategy is simple and straightforward, most traders don't just know how to use it the right way. So, we’ll try to demystify Fibonacci retracements and show you how to draw them correctly in this article. You’ll also discover 3 potent Fibonacci trading strategies that you can start using right away.

Lastly, we’ll also explore how you can autopilot your trading with the power of AI. Enough said, let’s get started.

What is the Fibonacci Trading Strategy?

The Fibonacci trading strategy is a method of using specific mathematical ratios to predict potential support and resistance levels in the market.

It's common knowledge that price action trading is mostly about pattern recognition. As such, it is only natural for traders to be drawn to the concept of using the Fibonacci sequence even in trading. After all, the pattern has been seen in different areas of life, from music to art, plants, and so on.

So, when traders use Fibonacci retracement levels on a price chart, they usually stick to the key Fibonacci levels such as the 23.6%, 38.2%, 50%, 61.8% (and sometimes 78.6%), and for some reason, they seem to work really well. So, as more and more traders adopt this strategy, you can expect these levels to reflect critical support and resistance zones in the market.

Now, let’s take a closer look at trading with Fibonacci. If you have spent some time observing a price chart, you'll notice that in a bullish trend, the price doesn’t continue to go up forever. At some point, price will “give back” some of that gain before continuing upward.

Fibonacci levels tell us roughly how far that pullback might go. That way, we know precisely where to wait for the price in order to join the next bullish run. The reverse is also true for a bearish market.

Sometimes, this level can be the 50% or 61.8% or others. However, most traders focus on the 61.8% level.

Why 61.8%? This is the golden ratio (approximately 0.618), which appears in art, nature, and yes, financial markets. In fact, 61.8% retracement is so influential that the area between 50% and 61.8% is nicknamed the “golden pocket” or golden zone. We’ll discuss a strategy around that soon.

Other levels have their roles too: 38.2% retracement is a shallow pullback in a strong trend (a “buy-the-dip” spot), and 23.6% is even shallower (often hit during very strong momentum moves). However, you may want to stay away from trading these Fibonacci ratios when you're just starting out.

It’s important to note that the Fibonacci strategy works best in trending markets. Now that we have an overview of what the Fibonacci trading strategy is about, let’s quickly learn how to draw it correctly.

How to Correctly Draw Fibonacci Retracements on a Trading Chart

If you’ll only learn just one thing from this article, it should be how to draw Fibonacci retracement levels correctly. This is where most traders fail; to draw Fibonacci retracement levels so they become valuable and accurate to your charts. Place them wrong, and you’ll end up with bad trades at prices that don’t make sense. Place them right, and you’ll have a powerful map of the market’s potential turning points.

Remember that one key reason Fibonacci retracement levels are such an effective tool is that many professional retail traders use the same levels. This often makes these levels more valuable and helps traders find key levels.

Here’s the only guide you’ll need to draw Fibonacci retracement the right way every time:

Identify the Market Trend

The first thing you want to do is to determine whether you’re dealing with an uptrend or a downtrend. If you’re not sure or the trend is not clear, just move to another asset.

To recognize the trend, simply look back and observe what the price has been doing. If price has been creating a series of higher highs and higher lows, you’re in an uptrend. However, if price is creating a series of lower highs and lower lows (like the chart above), you’re in a downtrend.

Pick the Significant Swing High and Low

Once you know the market trend, the next thing is to look at the recent price action and find the major swing points that encapsulate the move you want to analyze.

For an uptrend, this means the notable low (swing low) where the rally began, and the subsequent high (swing high) where the rally peaked.

For a downtrend, identify the swing high where the sell-off started and the swing low where it bottomed. Be sure these are meaningful extremes (daily or hourly swings, for example, if you’re trading those timeframes). Beginners often overcomplicate this. You don’t need to fib every tiny wiggle.

Focus on the most relevant leg of the move that the current price is reacting to.

Draw from Low to High (Uptrend) or High to Low (Downtrend)

Grab the Fibonacci Retracement tool on your charting platform. For example, in the above chart, we are in a downtrend. What that means is that you are going to drag the Fibonacci retracement tool from the swing high to the swing low.

For an uptrend, click at the swing low (the beginning of the move) and drag the tool up to the swing high. This will automatically generate horizontal Fib lines at the key percentage levels between those two points.

There you go! If you follow these steps, you should be able to draw Fibonacci retracements accurately on your charts.

Now, go ahead and practice on historical charts: identify a prominent swing, draw the Fib, and see how future price action respected (or didn’t) those levels. You’ll likely notice that markets do often react around these fib lines.

That said, let’s now translate this tool into concrete strategies you can start trading right away.

Top Fibonacci Retracement Trading Strategies

Proper technical analysis doesn't stop at merely knowing how to draw Fib levels; you also need to learn how to use them within a solid trading strategy. So, we're going to cover 3 major Fibonacci-based strategies that you can start testing out right away.

1. Fibonacci “Golden Zone” Strategy (50%–61.8% Retracement)

Remember we mentioned the “golden zone” and “golden pocket” earlier? Well, this refers to the area between the 50% and 61.8% Fibonacci retracement levels. The Golden Zone strategy zeroes in on this sweet spot. Instead of using all Fib levels, you primarily wait for price to enter the 50–61.8% corridor, and look for your trade opportunity there.

How To Trade The Golden Zone Strategy

When you spot a significant swing, draw your fib and mark the region between the 0.5 and 0.618 lines. Allow price to retrace into this zone before pulling the trigger.

The Golden Zone strategy assumes a normal healthy correction will reach deeper into 50–61.8%. Focusing mainly on these zones helps you filter out some false signals and potentially get a better entry price.

If you notice from the example above, while our entry was at the 50% level, our stop loss was placed at the 78.6% rather than the 61.8%. The reason for this is quite simple: usually, prices often come to the 61.8% before taking off. So, moving the stop loss level to 78.6% significantly increases our win rate.

When trading this strategy, you can always use the opposing swing points as your profit targets. In this case, we will take profit at the swing low.

Overall, the Golden Zone strategy is about stacking probabilities in your favor. You know that zone is watched by many and has a natural significance; by acting there with confirmation, you’re trading in a high-probability area with definable risk.

2. Fibonacci Confluence Strategy

This strategy takes Fibonacci analysis to the next level by looking for a confirmation of a Fibonacci retracement area of interest on the lower timeframe. What does that mean? Let's take a look at the chart below:

You'll notice that the price is currently reacting to the 78.6% Fibonacci retracement level on the 4-hour timeframe. Usually, a typical trader will open the trade immediately. However, we will approach it a little differently. We will scale down to the lower timeframe and look for another confirmation.

Going down to the lower timeframe does two things. First, it allows us to avoid bad trades since we won't be entering any trades without a confirmation. Second, it significantly increases the risk-to-reward ratio.

After scaling down to the 15-minute timeframe, the next thing we want to do is to wait for the price to give us another structure on the lower timeframe and then plot our new Fibonacci retracement tool for that timeframe.

Now, when the price comes into that zone (as seen in the chart above), you are especially interested in a trade. Because there’s higher conviction it will hold, you might even choose to increase your position size slightly or be more aggressive in entering (with tight stops). The logic is that a confluence level is more likely to produce at least a tradable bounce.

3. Fibonacci with Confirmation Signals (RSI Divergence, Candlesticks, etc.)

Our final strategy is more of a trading best practice: always pair your Fibonacci levels with a confirmation signal for entry. While this isn’t a standalone “pattern” like the others, it’s so crucial that it deserves to be treated as a strategy in itself. Essentially, you’re adding an extra filter: Only trade a Fibonacci level if you also get a clear indication from price action or technical indicators that the level is indeed holding. This approach can drastically improve the quality of your trades by filtering out false signals.

Candlestick Patterns at Fib Levels

This is one of the simplest and most effective confirmations. If the price dips to Fibonacci support, look for bullish candlestick reversals right at that level.

For example, in the chart above, we have a bullish engulfing candlestick pattern as price was touching the 61.8% line. This is a strong sign buyers are defending that Fib support. One thing you should always do is to wait for the candle to close to ensure the pattern is confirmed. Candlestick signals are fast and visual, making them a favorite confirmation tool.

Momentum Indicators (RSI, Stochastics)

Indicators are also important technical analysis tools that can quantitatively signal when a Fib level might hold. A popular confirmation indicator is RSI divergence. Imagine price makes a new low, dipping slightly under a 61.8% Fib support, but the RSI indicator makes a higher low (showing bullish divergence). This is often a giveaway that the down move is weakening and a reversal is imminent, whereas confirming the buy at the Fib support is even better. If RSI is also coming out of oversold territory by then, even better.

Conversely, in an up retracement to a Fib resistance, if RSI is overbought or shows bearish divergence (price made a higher high relative to an earlier swing but RSI made a lower high), that Fib resistance is likely to hold as a top.

Using the Fibonacci Trading Strategy on an AI Trading Bot

By now, you might be imagining scanning charts across many assets to find Fibonacci setups and the amount of stress that can bring, right? What if you could delegate some (or all) of that work to a trading algorithm? Good news: with today’s technology, you can. In fact, you don’t even need programming skills to do it.

Modern platforms like Switch Markets’ Algo Builder allow you to turn a strategy into an AI trading bot in just a few clicks without any coding skills. This means the bot will watch the market 24/7 for your setup and execute trades automatically, following your rules to the letter.

Why Use an AI Trading Bot for Fibonacci Strategies?

Here are a few compelling reasons:

- No Emotions, No Hesitation: An AI trading bot isn’t scared to buy when everyone else is panicking, nor will it get greedy and ignore your exit rules. It will execute your Fibonacci strategy systematically – say, it will short every time a price hits the 61.8% retracement and RSI flashes overbought, without second-guessing. This mechanical precision can be great for strategies that require strict discipline (which Fibonacci often does). As we traders know, sticking to the plan is half the battle, and bots are great at that.

- Around-the-Clock Market Scanning: We all know that it's usually impossible to trade every valid trading opportunity. A bot, on the other hand, can monitor multiple currency pairs simultaneously and instantly act when, for example, a Golden Zone entry appears. You’ll never miss that 3 A.M. reversal on EUR/USD because your bot will be on it. However, for that purpose, you will need to use a VPS, which enables you to run your trading platform without any interruptions.

- Backtesting and Optimization: With an AI or algorithmic approach, you can backtest your Fibonacci strategy on historical data easily. Switch Markets’ Algo Builder, for instance, lets you generate a trading bot from your strategy rules and then run it on past market data from 2021 to today with a click. This means you can see how a “fib 50% pullback + engulfing candle” strategy might have performed over the last 5 years on the S&P 500, for example. You can tweak parameters (maybe 61.8% vs 50%, or add a moving average filter) and quickly rerun the test to compare results. This kind of optimization is much faster than manual trial-and-error, and it gives you data-driven confidence when going live.

How to Implement Your Fibonacci Strategy on Switch Markets’ AI trading bot

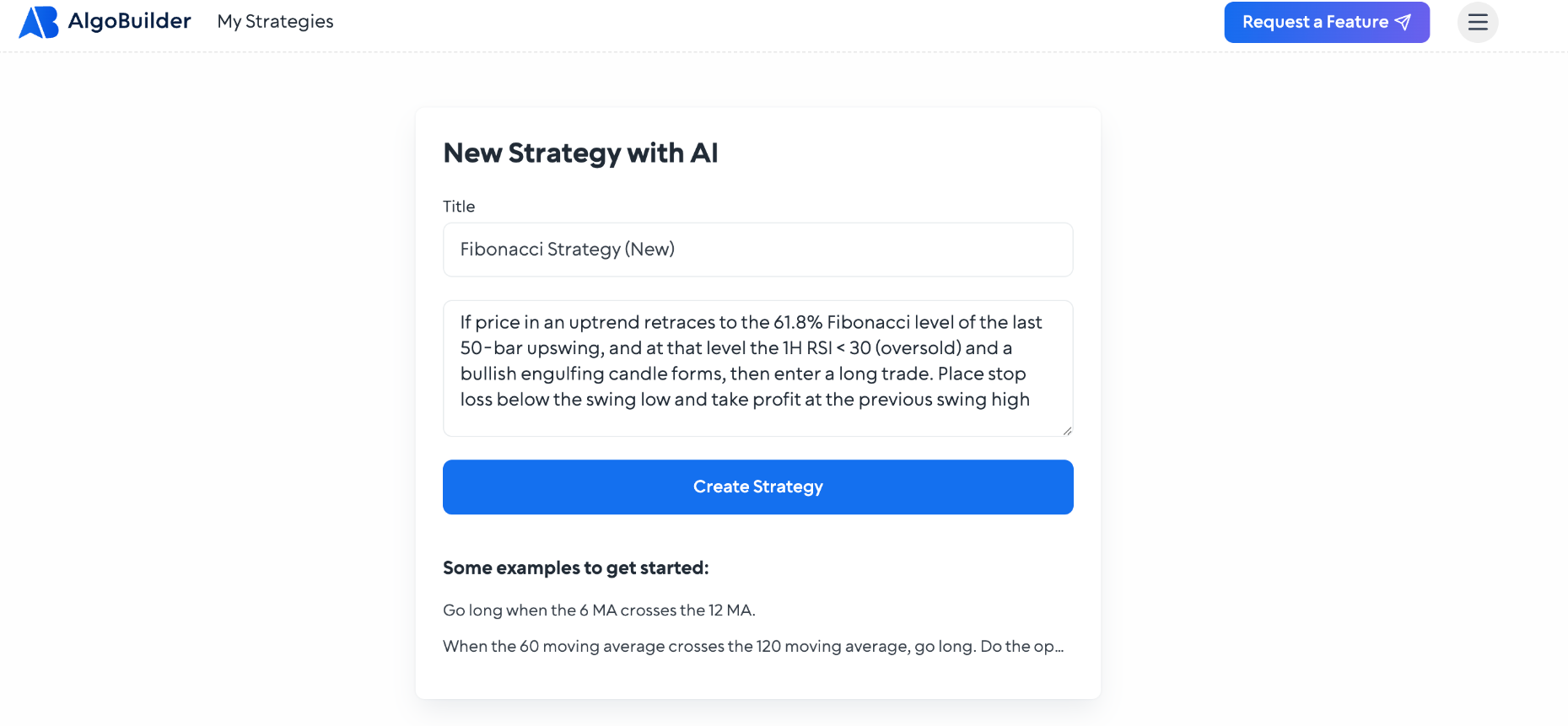

So, how can you implement your Fibonacci strategy on an AI trading bot? Our platform, in particular, is user-friendly because it doesn’t require coding – it uses AI to translate plain English strategy descriptions into bot code. To start, visit this page. Here’s a simplified workflow aligned with how this tool works:

1. Define your strategy logic clearly

You start by writing down your Fibonacci strategy in a few sentences, almost like telling someone the rules. For example: “If price in an uptrend retraces to the 61.8% Fibonacci level of the last 50-bar upswing, and at that level the 1H RSI < 30 (oversold) and a bullish engulfing candle forms, then enter a long trade. Place stop loss below the swing low and take profit at the previous swing high.” This might sound wordy, but the idea is to be explicit about entry conditions, indicators, and your risk management techniques.

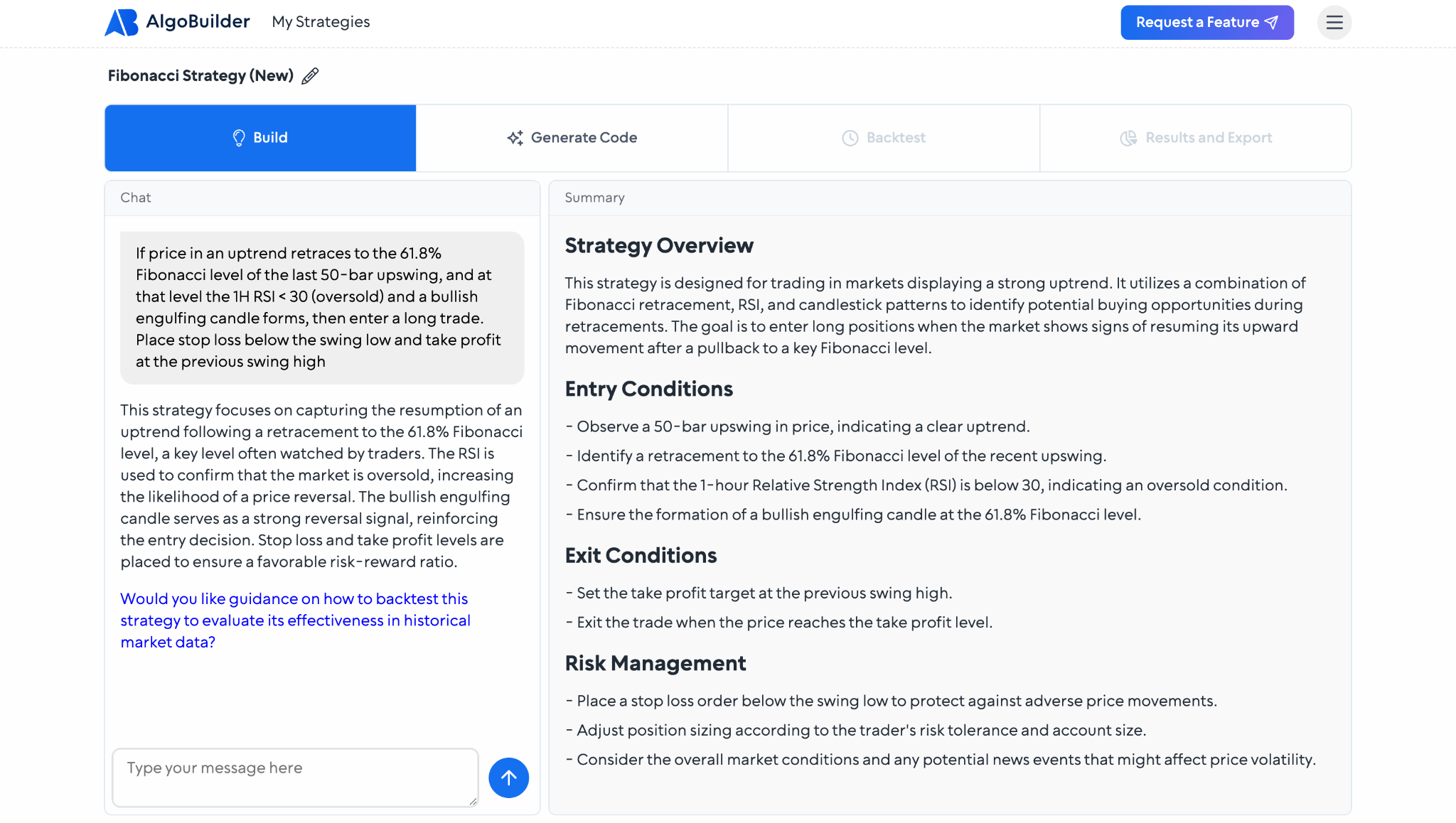

2. Algo Builder parses and confirms rules

The AI in Algo Builder will take that description and translate it into a set of trading rules, essentially programming the logic for you. It then shows you this interpretation to verify it matches your intent.

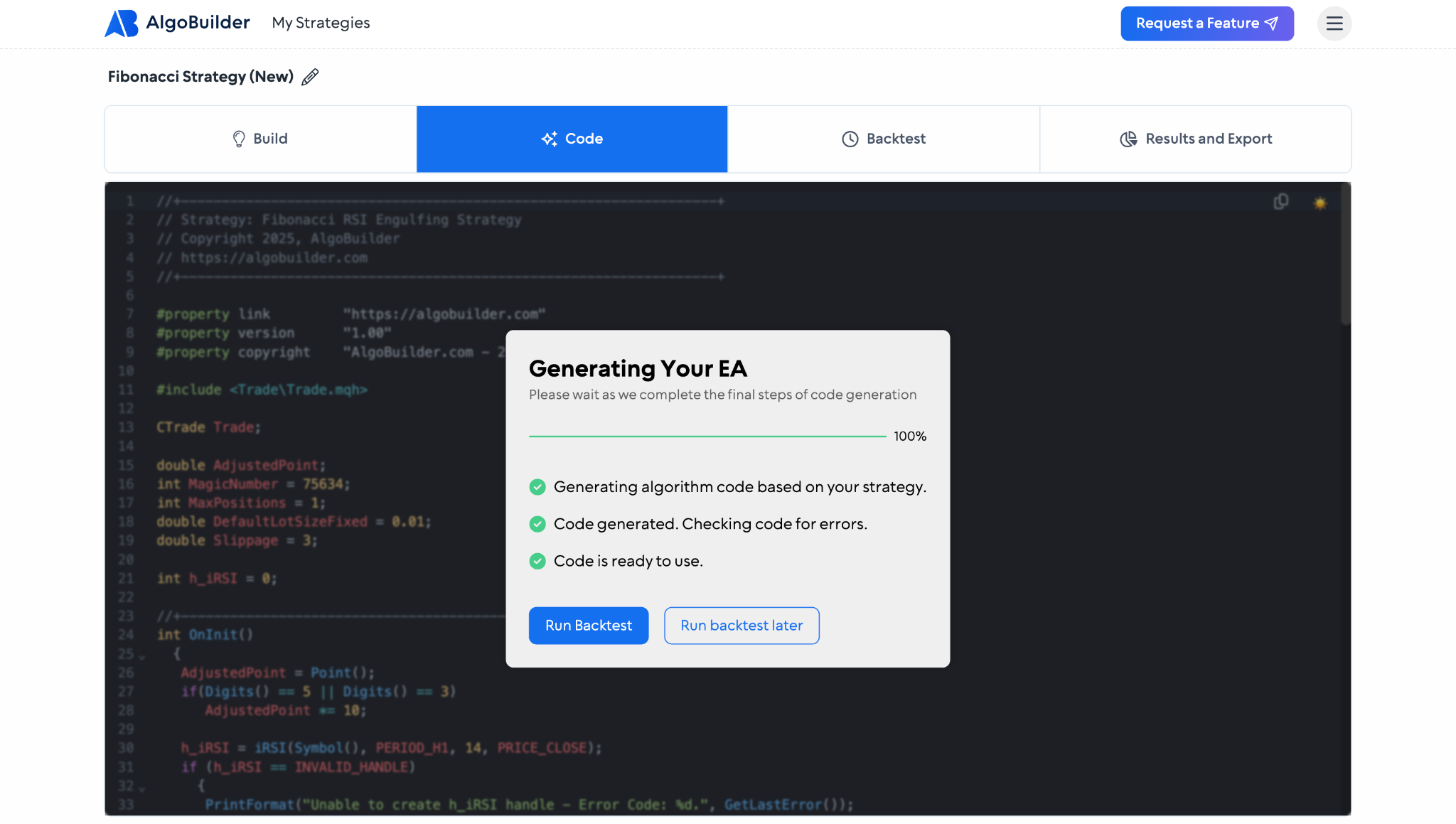

3. Generate the bot code

With a click, the platform will generate the actual trading bot code (behind the scenes, it’s creating an MQL5 script that embodies those rules). You don’t have to see the code unless you want to.

4. Backtest instantly

Before risking real money, you use the built-in backtester. You’d select EUR/USD, 1H timeframe, and a date range (say Jan 2022–Dec 2022) and hit Run. In a few seconds, you get a full performance report: win/loss ratio, equity curve, drawdown, etc.. Maybe you discovered the strategy as defined was a bit too strict and only took 5 trades all year. So you might go back and adjust the conditions (e.g., allow 50% or 61.8%, not just exactly 61.8, or remove the engulfing requirement to see the difference).

5. Deploy the bot live

Satisfied with the backtest? Time to deploy. With Switch Markets, once your bot is ready, you can directly download it as an MQL5 file for MetaTrader 5. That means you can load it into your MT5 platform and run it on a demo or live account. The platform essentially gave you a ready-made trading robot. Switch Markets makes this available to clients (it’s free with a small $50 deposit in a trading account, as they’ve positioned it to help traders get into algorithmic trading easily). So with minimal cost, you have an institutional-grade capability at your fingertips.

Key Takeaways

Here are the key takeaways to keep in mind regarding using Fibonacci trading strategies:

FAQs

So, before you head off to apply what you’ve learned, here are some quick answers to the most common questions traders ask about Fibonacci strategies.

What is the Python Fibonacci trading strategy?

“Python Fibonacci trading strategy” isn’t a unique strategy per se – it generally refers to implementing a Fibonacci-based trading strategy using Python code (for example, in an algorithmic trading script or bot). In essence, it’s the same concepts of trading off Fibonacci retracement levels and extensions, but automated through programming.

Many algo traders use Python to backtest and execute strategies that buy or sell when the price hits certain Fibonacci levels. For instance, one might code a Python script to scan many stocks and automatically place trades when a 50% retracement aligns with other bullish signals. The advantage of doing it in Python is that you can systematically test the strategy on historical data and deploy it live with speed.

What is the strongest Fibonacci retracement level?

The 61.8% retracement (the golden ratio) is widely regarded as the strongest and most significant Fibonacci level. Traders and analysts pay special attention to it because the price often has dramatic reactions there. A 61.8% retracement represents a deep correction of a move, and if the original trend is to continue, this is a common spot for the reversal to happen.

What are the disadvantages of the Fibonacci trading strategy?

While Fibonacci tools are widely used, they’re not without limitations. One major drawback is subjectivity. For instance, different traders may choose different swing highs and lows, leading to inconsistent levels and results. Fib levels also aren't guaranteed to hold; in real-time, price can easily cut through them, especially in news-driven or choppy markets. That’s why relying solely on Fibonacci without additional confirmation can be risky, particularly for beginners who treat them as magic levels.

Moreover, Fibonacci strategies are purely technical with no fundamental backing, and crowded Fib zones can even attract stop-hunting by smart algorithms. Despite these drawbacks, Fibonacci tools remain effective when used as part of a broader strategy with proper risk management and flexibility. The key is to treat them as helpful guides and combine them with experience and other trading tools for better reliability.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.