5 Key Practices to Improve Your Trade Execution Speed

If you’ve ever clicked “buy” or “sell” and watched your order lag for a split second before getting filled, you already know how frustrating execution delays can be.

The process from order entry to execution involves placing buy orders and sell orders at specific bid and ask prices.

Execution speed refers to the time it takes for your order to reach the market, where the bid represents the highest price a buyer is willing to pay at a given moment. Simple enough? But the truth is, a lot can slow it down: your broker, your internet, even your trading platform.

The good news is that you don’t need institutional-level infrastructure to fix it. With the right setup, you can cut out most of the lag and execute trades exactly where you want.

Understanding the importance of how order entry and bid/ask dynamics affect execution speed can help you optimize your trading results.

In this guide, we’ll walk through five practical steps you can take to sharpen your execution speed. These are tweaks you can apply right now to trade faster and smarter.

Why Speed Matters in Trading

Trading is a game of milliseconds. Click buy or sell at market orders on MetaTrader or any other trading platform, and you expect your order to hit the market right away. But here's something worth thinking about: if it takes even a fraction longer, the price might shift. That’s price slippage. And slippage quietly eats into your profits, altering your risk management strategy completely.

Think about scalping. You’re chasing small moves, maybe 2–5 pips at a time. If execution lags and you lose 1–2 pips on entry, your edge is gone. Even swing traders aren’t safe because when the price breaks a key level, a slow order could mean you miss the clean entry and get stuck chasing. During certain periods, such as the market open or times of high market volatility, execution speed is typically even more critical due to rapid price changes.

It’s not just about money. Speed builds confidence. Fast execution means fewer re-quotes, fewer missed trades, and no second-guessing your broker. You trade your plan knowing the tech won’t hold you back.

5 Key Practices to Improve Your Trade Execution Speed

Increasing your trade execution speed by even a tiny fraction of time might look insignificant, but the result can be outstanding. Key factors that influence execution speed include technology, broker infrastructure, and prevailing market conditions.

So, how do you actually improve your execution quality in the financial markets? Well, all you need are the right practices. Let’s break them down.

1. Use a VPS (Virtual Private Server)

If you’ve ever hit “buy” and felt a lag before your order filled, you know why speed matters. Your order has to travel from your device, through your internet, across several hops, before it even reaches your broker’s server. That journey might take 50–200ms at home. On a Virtual Private Server (VPS) located near your broker’s servers? It can be just 1–3ms. That’s the difference between getting filled at your price or chasing the next tick. And that is why a VPS is such an important tool for traders.

Why it matters

- Stability: A VPS keeps your MT4/MT5 running 24/7, even if your laptop crashes or the power goes out.

- Lower latency: Orders reach the broker faster, reducing slippage and requotes.

- Automation support: Perfect for Expert Advisors that must run continuously without interruption.

- Peace of mind: You don’t have to worry about your Wi-Fi failing at the worst moment.

What to look for

- Server location: Choose a VPS in the same region as your broker’s servers.

- Low ping: Under 10ms is excellent, under 5ms is ideal.

- Resources: At least 2GB RAM and a decent CPU for multiple charts/EAs.

- Uptime: Look for 99.9% or better.

- Broker perks: Some brokers offer free or discounted VPS if you meet a trading volume threshold.

Cost vs Benefit

Most VPS plans cost $10–30/month. For scalpers and algo traders, the savings from reduced slippage can outweigh the cost many times over. For swing traders, it’s not essential, but it still adds reliability.

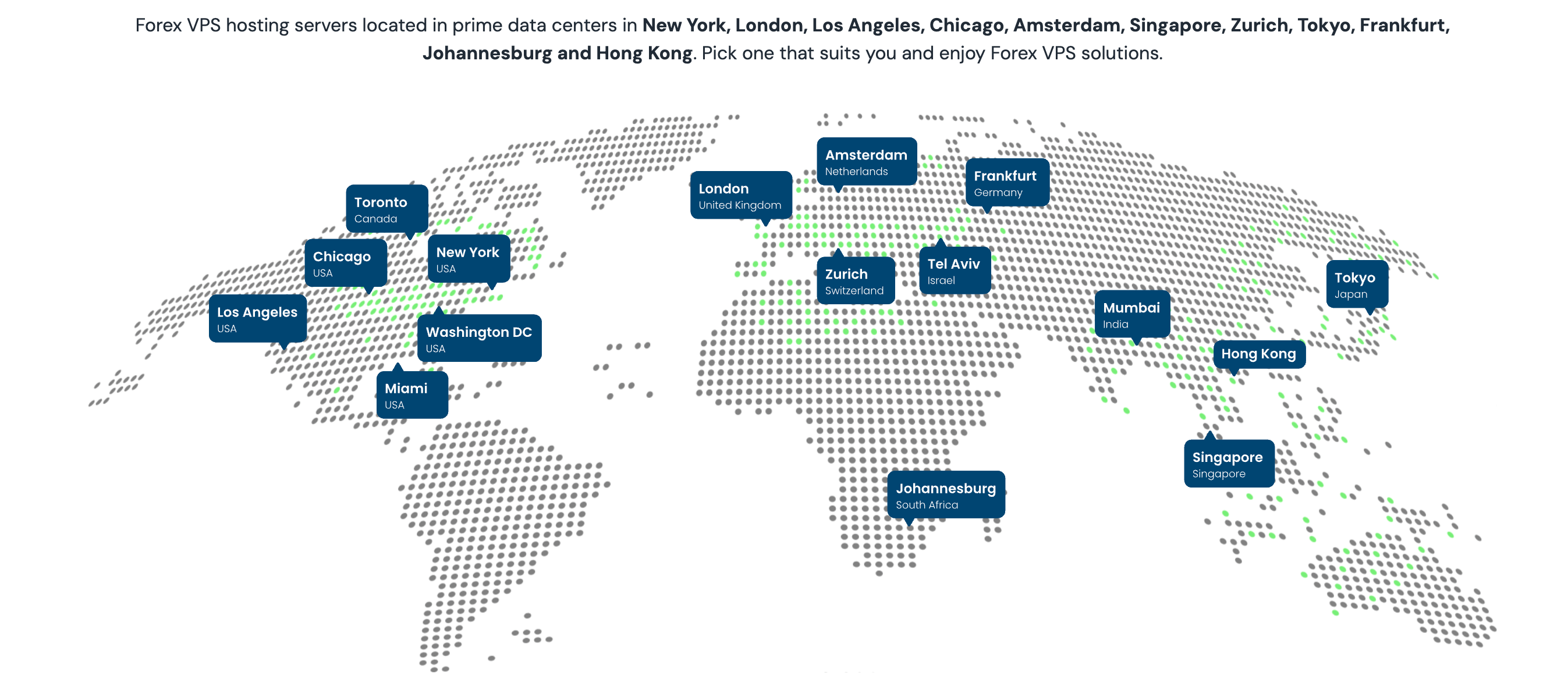

A VPS is like moving your trading desk into your broker’s server room. It’s faster, more reliable, and shields you from local internet issues. If every millisecond counts in your trading strategy, a VPS is a major part of your competitive edge. For instance, Switch Markets has VPS servers in major data centers, enabling traders to achieve fast market execution due to their proximity to the broker's servers.

What's more? While they are worth every dime you pay for them, you actually don’t need to hand out $20/month for some VPS.

With Switch Markets, you can even get FREE access to our world-class ForexVPS services. All you have to do is open an account, make a deposit, and get trading.

2. Choose an ECN Broker

You can have the fastest internet connection, a powerful laptop, even a VPS, but if your broker drags its feet, your execution will still suffer. This is why your broker’s execution model matters just as much as your setup.

Here’s the simple truth: market makers and ECN brokers don’t play the same game in terms of order routing practices. Market makers process orders internally. That means your trade doesn’t hit the real market or any exchange right away. Sometimes it gets delayed, sometimes you get a requote, and sometimes you just don’t get the fill at the execution price you expected. And because a market maker is literally taking the other side of your trade, the relationship is never fully aligned. They can profit when you lose. This is why choosing an ECN broker can be the right choice for those looking for high-speed execution.

Why it matters

- Direct access: Orders go straight to liquidity providers, not held by a dealing desk.

- Faster execution: No internal delays from a market maker.

- Less slippage: Deep market liquidity pools improve fills in volatile conditions.

- Alignment: The broker isn’t taking the opposite side of your trades.

- Transparency: Raw spreads plus commission usually work out cheaper than hidden markups.

What to look for

- Broker type: True ECN/STP, not a disguised market maker.

- Commissions vs spreads: Raw spreads plus commission usually cost less than wide “free” spreads.

- Liquidity depth: More providers = better fills during volatility.

- Minimum deposit: Check if it suits your budget.

- Regulation: A properly licensed broker gives you trust and protection.

Now, ECN accounts usually come with a catch. You’ll often need a higher deposit, and instead of “free” trading, you pay a commission per lot. But the good thing is that Switch Markets requires the same deposit requirement for traders who wish to trade on an ECN account. To learn more, you can read our guide on ECN vs. Standard accounts.

Market makers make up for zero commissions by marking up the spread. With ECN, you get raw spreads plus a small commission. In practice, that usually costs you less, and more importantly, it gives you speed and consistency.

If milliseconds matter to your strategy, don’t let your broker be the bottleneck. Choose ECN, and give your trades the chance to hit the market as fast as you do.

3. Refinements to Code Architecture

If you trade with Expert Advisors, here’s something you might not realize: your code can be the bottleneck. You might blame your broker or your internet, but sometimes the delay is right inside your EA.

A script that’s too heavy, too cluttered, or poorly optimized can waste milliseconds, and in trading, that’s all it takes to miss a move.

Another common drag is repeating calculations you don’t need to repeat. For example, if your EA calls the same moving average twenty times in the same cycle, you’re wasting time. Cache the value once and reuse it. The same goes for formulas or conditions that don’t change between ticks. Store them in a variable and let your EA breathe.

Similarly, you may want to pay attention also to logging. While it’s useful when debugging, too many Print statements or file writes will grind your EA down. Logging every tick might look harmless, but it eats up CPU cycles. Keep logs light, or better yet, turn them off once your strategy is stable. If needed, you can use our AI trading bot to automatically code your trading strategies without having to know any programming languages.

Why it matters

- Efficiency: Heavy EAs waste milliseconds on every tick.

- Faster reactions: Lean code fires orders instantly.

- Reliability: Clean logic reduces missed opportunities.

- Scalability: Optimized EAs handle more markets with less lag.

- Edge: The sharper the code, the sharper your strategy’s performance.

What to look for

- Tick efficiency: Keep OnTick() light—shift heavy tasks elsewhere.

- Caching: Store values like indicators instead of recalculating every tick.

- Loops: Break early, simplify structures.

- Logging: Minimal logs once stable.

- Optimization: Use built-in libraries for speed.

At the end of the day, the principle is simple: keep your code lean. A slim EA reacts instantly, spots conditions faster, and fires orders without hesitation. A bloated one hesitates, and by the time it sends the order, the price may have already moved. The cleaner your logic, the sharper your edge.

4. Optimize RAM

MetaTrader is a workhorse, but let’s be honest, it’s not the lightest piece of software out there. Load it up with too many charts, custom indicators, and EAs, and it starts dragging its feet. A sluggish platform means delayed orders, frozen charts, and execution that just can’t keep up.

One thing to bear in mind is that MetaTrader (or any other platform) also builds up clutter the longer you leave it running. Cached data, log files, and tiny memory leaks all stack up over time. That’s why a regular restart works wonders.

Why it matters

- Faster execution: A lean platform means no lag between clicks and orders.

- Reliability: Avoid frozen charts and delayed entries.

- Clean performance: Restarting clears cached junk and memory leaks.

- Stability: Updated MetaTrader versions include performance patches.

- Power: MT5’s 64-bit design handles heavier loads better than MT4.

What to look for

- Charts: Only open what you actually trade.

- Market Watch: Hide unused symbols to cut streaming data.

- Restart routine: Clear cached data regularly.

- Updates: Always run the latest version for speed patches.

- Platform choice: MT5’s 64-bit, multi-threaded design outperforms MT4.

In sum, optimizing RAM is important for faster trade execution because your trading platform, charts, indicators, and automated strategies all rely on memory to process data in real time. If your system runs low on available RAM, it can slow down order processing, cause platform lag, or even lead to missed trade opportunities. By ensuring you have enough optimized memory, your platform can handle live market data streams smoothly, execute orders faster, and reduce the risk of slippage in high-volatility conditions.

5. Increase Network Bandwidth

Your trades are only as fast as your internet connection. You could have a great broker, a VPS, even a perfectly optimized MetaTrader setup, but if your internet lags, your execution speed will too. This is why you need to consider increasing your network bandwidth. If the extra cost is not too high, then it should be a smart investment.

Why it matters

- Latency: A fast, stable connection lowers order delays.

- Reliability: Wired beats Wi-Fi for clean signals.

- Consistency: No interference or sudden drops.

- Accuracy: Low ping ensures orders hit at intended prices.

- Confidence: Smooth execution builds trust in your setup.

What to look for

- Connection type: Ethernet > Wi-Fi.

- Ping: Under 50ms is solid, under 20ms is excellent.

- Background usage: No Netflix, gaming, or updates while trading.

- Hardware: Use modern routers/modems.

- Provider quality: Stable low-latency ISP over raw speed numbers.

Keep in mind that it’s quite important to see your internet connection as a trading infrastructure. Treat it that way. A fast, stable, and clean network ensures that when you hit buy or sell, your order isn’t fighting through traffic to reach your broker. It’s a straight shot, and that’s exactly what you need.

Tips to Speed Up Your Trade Execution

Here’s a quick checklist to keep handy for faster execution speeds:

Simple tweaks, big difference.

Final Word - How to Choose a Fast Execution Broker

At the end of the day, your broker is the biggest factor in how fast your trades hit the market. The speed at which a broker processes an order received can directly impact whether you get filled at the quoted spread, which is crucial for optimal execution. You can fine-tune your platform, run a VPS, even upgrade your internet, but if your broker is slow, everything else is just a patch.

The right broker gives you an edge before you even place a trade. Look for brokers with a no-dealing-desk model, and always test limit order execution speeds, which are often preferred over market orders. Remember, ECN and STP brokers route your orders straight to liquidity providers without pausing to process them in-house. These top brokers are committed to providing high-quality execution across a wide range of securities, ensuring transparency and putting clients' interests first. And this is where Switch Markets comes in. A broker that takes pride in offering a fast and reliable order execution.

If a broker offers an ECN account, lowers the minimum deposit barrier to just $50, and on top of that gives you free access to state-of-the-art VPS service and also a free AI-powered playground to build your own EA, that’s the ultimate trade execution upgrade you shouldn’t miss. These accounts are designed to deliver execution at or near the quoted spread for various securities, maximizing your trading efficiency.

So, if you want the fastest execution possible, don’t leave this to chance. Pick a broker like Switch Markets that’s built for speed, and you’ll notice the difference in every single trade.

FAQs

Before we wrap up, let’s address some common questions active traders ask about order execution speed.

What is the fastest trading platform?

MT5 is generally faster than MT4 because of its 64-bit, multi-threaded design. Outside of MetaTrader, platforms like cTrader and NinjaTrader are also known for speed. But in reality, your broker’s infrastructure matters more than the platform itself. Generally, there's no need to look for an alternative trading system, as long as you make all the above tips work for you.

What affects execution speed the most?

Three things typically affect the average execution speed: broker model (ECN vs. market maker), server proximity, and your own connection/platform performance.

Does upgrading my PC help?

It won’t lower latency to your broker, but it makes MetaTrader itself more responsive. If your platform lags, upgrading RAM or CPU will make order placement smoother.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.