How to Start Trading CFDs: A Beginner's Guide

- What is CFD Trading?

- What Are the Key Reasons to Trade CFDs?

- CFD Trading Examples

- How to Start Trading CFDs

- 1. Sign Up for an Account and Complete Identity Verification

- 2. Pick Either a Live or a Demo Account

- 3. Download Your Trading Platform

- 4. Get Familiar with the Platform’s Tools and Features

- 5. Deposit Funds

- 6. Choose an Asset and Place a Trade

- 7. Apply Risk Management Strategies

- 8. Track and Manage Your Open Positions

- 9. Enhance Your Knowledge with Educational Resources

- Managing Trading Costs - What You Need to Consider When Trading CFDs?

- Final Word - Why Trade CFDs with Switch Markets?

- Frequently Asked Questions

Wondering how to start trading CFDs? This guide covers the essential steps: setting up your trading account, choosing a broker, and making your first trade. You’ll learn what you need to begin trading CFDs with confidence. Let’s get started.

Key Takeaways

What is CFD Trading?

CFD trading, or trading Contracts for Difference, is a method of speculating on the price movements of an asset without actually owning it. Essentially, a CFD is a financial instrument that is a contract between two parties who agree to exchange the difference in the value of the asset from the time the contract is opened until it is closed. However, unlike the equity or futures markets, where participants physically exchange the asset (whether the asset is a commodity or shares in the form of papers), in CFD trading, traders simply speculate on the price of the asset without owning or exchanging the asset.

Because CFDs are essentially a derivative market that enables traders to solely speculate on prices, there are many benefits to trading CFDs.

For example, traders can go long (buy) if they believe the market price will rise or go short (sell) if they expect the market price to fall, providing opportunities to profit in both rising and falling markets. Yes, this is possible in the share or the futures market as well; however, with CFDs, there are no margin requirements for short-selling an asset.

Another primary advantage of CFD trading is leverage, which allows CFD traders to control a larger position with a smaller amount of capital. This can amplify profits but also carries the risk of greater losses. For instance, CFD traders can trade with a leverage ratio of up to 1:1000 for some markets.

This flexibility makes CFD trading a popular choice among traders seeking to maximize their asset ownership and returns in the financial markets.

In simple terms, CFD trading (Contracts for Difference) is a way to trade on the price movements of assets like stocks, forex, or commodities without actually owning them. You just predict whether the price will go up or down. If you’re right, you make a profit, and if you’re wrong, you take a loss. It also allows you to use leverage, meaning you can trade with a smaller amount of money, but this makes both potential profits and losses bigger.

What Are the Key Reasons to Trade CFDs?

There are several reasons why many traders choose to trade CFDs over other forms of trading. Those include:

1. Leverage and Capital Efficiency

CFDs allow you to control a larger market position with a smaller initial margin. This leverage means you can amplify potential returns on relatively small capital. However, it also magnifies risks, so risk management is crucial. You should also be aware that Switch Markets offers clients dynamic leverage, which is a risk management tool that enables traders to adapt their stop losses based on their position price movement.

2. Access to a Wide Range of Markets

With a single CFD trading account, you can access multiple asset classes, including forex, indices, commodities, stocks, ETFs, and cryptocurrencies. All without needing to own the underlying asset.

3. Ability to Go Long or Short

Unlike traditional investing, CFDs allow traders to profit in both rising and falling markets. You can buy (go long) if you expect prices to rise, or sell (go short) if you expect prices to fall. Unlike traditional trading via the exchange, this can be done without any margin requirement.

4. No Ownership of the Underlying Asset

Because CFDs are derivatives, you don’t own the underlying asset (like shares, oil barrels, or gold bars). This removes the costs and restrictions of ownership, such as storage, delivery, or transfer fees.

5. Lower Costs and Accessibility

CFD brokers often provide lower entry costs than traditional exchanges, with competitive spreads, no stamp duty in certain jurisdictions, and efficient online platforms.

For example, traditional stock trading or futures requires an initial minimum investment of at least $2000-$3000, in order for a trader to be able to access the markets and make realistic profits. For comparison, the recommended minimum deposit for CFD trading is somewhere between $500 to $1,000, which is significantly lower due to the leverage provided and the efficiency of the CFD market.

CFD Trading Examples

To illustrate how CFD trading works, let’s delve into some practical examples. These examples will help you understand the mechanics of CFD trading and the potential outcomes of different trading strategies.

Example 1: Trading Currency CFDs

Let’s say you decide to open a long position by buying 0.50 lots of EUR/USD at a trading price around 1.1800. Let’s break down what might happen:

- First of all, 1 standard lot = 100,000 units of the base currency (EUR in this case).

- So, 0.50 lots = 50,000 units of EUR/USD.

- At this size, each pip (0.0001) is worth $5.

The sequence of events is as follows:

- EUR/USD appreciates by 50 pips, rising from 1.1800 to 1.1850.

- This creates a new price of 1.1850 for your open position.

- You decide to close the trade at this level.

Profit Calculation:

- 50 pip move × $5 per pip = $250 profit, excluding spreads, commissions, or swap fees.

This example shows how even a relatively small market move can result in a significant return when trading with leverage. However, the opposite scenario is true as well. If the market had moved against you by 50 pips, you would have incurred a $250 loss.

Example 2: Trading Stock CFDs (Tesla)

Let’s assume that you expect Tesla’s share price to decline, so you decide to open a short position by selling 10 shares of Tesla via CFDs at $428 each.

- In stock CFDs, 1 CFD = 1 share, making it easy to track your exposure.

- Your total position size here is $4,280 (10 shares × $428).

Sequence of events:

- Tesla’s share price drops to $412, just as you anticipated.

- You close your short position by buying back the 10 shares at the lower price.

Profit calculation:

- Profit per share = $428 − $412 = $16

- Total profit = $16 × 10 shares = $160, excluding spreads or commissions.

This example shows how you can profit when stock prices fall, even without owning the shares. Best of all, some brokers like Switch Markets enable traders to receive dividends on CFD positions, which makes this type of investment almost similar to physically holding shares via the exchange.

Example 3: Trading Crypto CFDs (Bitcoin)

You believe Bitcoin is about to rise, so you open a long position for 0.50 BTC via CFDs at $117,600 per BTC.

- Note that you can trade whole coins or fractions, giving you flexibility to adjust position size.

- Here, your total exposure is $58,800 (0.50 × $117,600).

Sequence of events:

- Bitcoin’s price rallies to $119,100.

- You close the position to lock in your gains.

Profit calculation:

- Price increase = $119,100 − $117,600 = $1,500

- Total profit = $1,500 × 0.50 BTC = $750.

How to Start Trading CFDs

CFD trading is one of the most accessible ways to participate in global financial markets. This flexibility, combined with features such as leverage and the ability to trade both rising and falling markets, makes CFDs a popular choice for beginners and experienced traders alike.

Here are the steps you need to take to get started trading CFDs on Switch Markets:

Sign up for an account and complete identity verification

Pick either a live or a demo account

Download your trading platform

Get familiar with the platform’s tools and features

Deposit funds

Choose an asset and place a trade

Apply risk management strategies

Track and manage your open positions

Enhance your knowledge with educational resources

1. Sign Up for an Account and Complete Identity Verification

The first thing you need to do is to sign up for an account and verify your identity. On Switch Markets, you can click on the Open Account button to sign up for an account. You will then get transferred to our cabinet, where you'll be asked to upload a document and verify your identity.

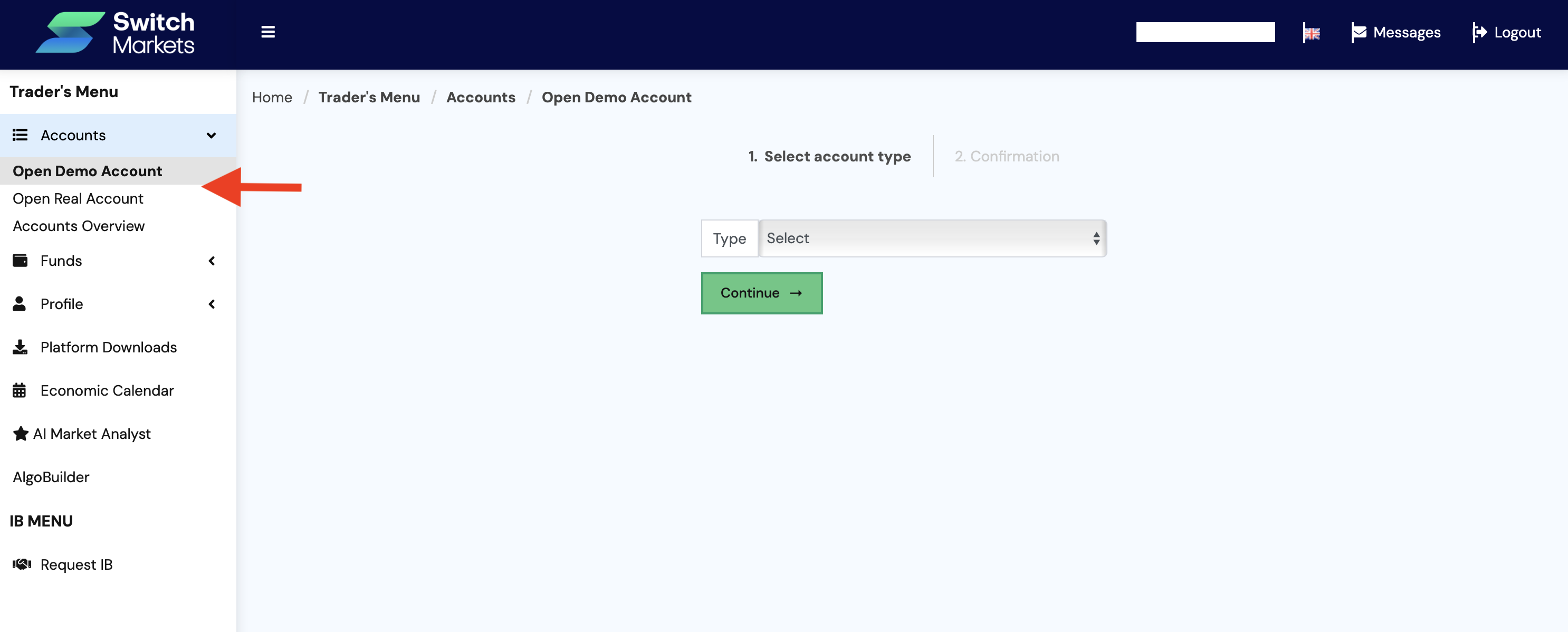

2. Pick Either a Live or a Demo Account

Now that your account is verified, you can pick your account: a demo or a live account. If you are a beginner, then it is highly recommended to start on a demo account, where you can practice with virtual money.

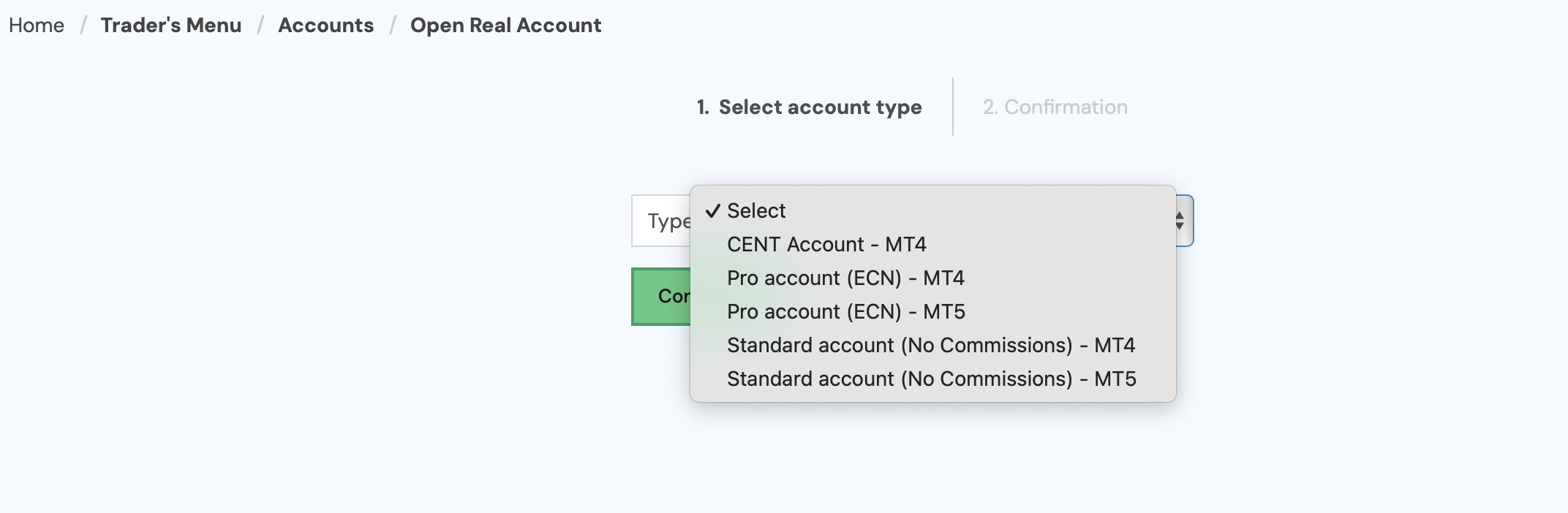

At this point, you'll have to choose the account type - ECN or Standard account. To learn more, you can visit our guide about ECN vs. Standard accounts.

Take note that you'll also have to choose the platform you wish to trade on, that is, MetaTrader 4 or MetaTrader 5. If you are not sure about the right trading platform for you, you can read this guide on the differences between MT4 and MT5.

Once you feel confident enough to move on to the next step, you can open a live account.

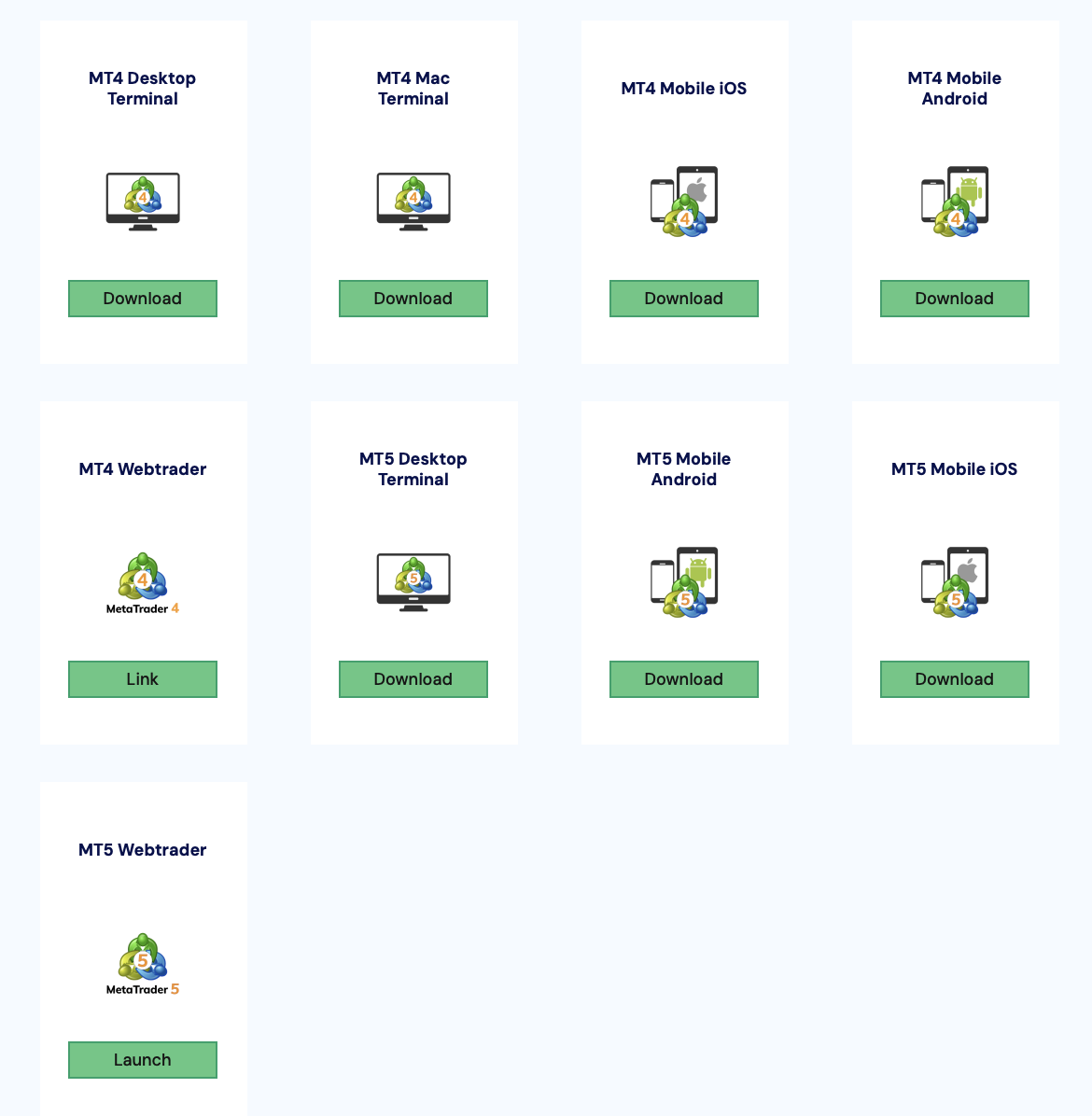

3. Download Your Trading Platform

Click on the Platform Downloads tab and choose the platform you would like to trade on.

4. Get Familiar with the Platform’s Tools and Features

Before you dive into trading, take the time to explore the platform’s tools and features. Remember that every broker has different tools, features, and services. Explore them, and try to make the best out of the broker's tools and features.

For your knowledge, Switch Markets offers the following:

- A free VPS

- Free access to PineConnector

- Free access to AlgoBuilder, an advanced AI trading tool.

- A credit bonus

- EA tools for traders

- Dynamic leverage

- AI market analyst

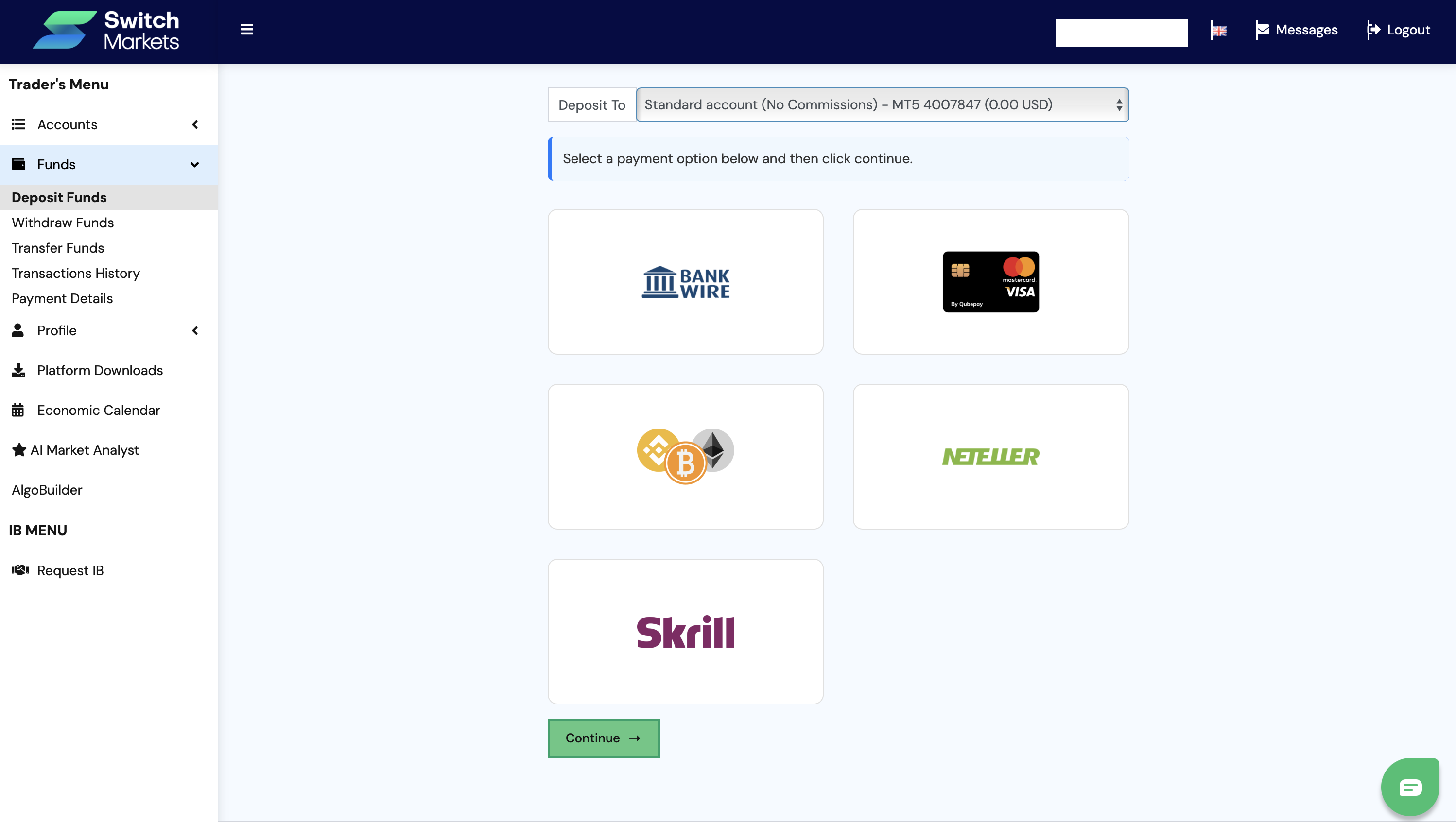

5. Deposit Funds

After your account was verified and you practiced for a while on a demo account, you can make a deposit to start trading with real money.

Simply navigate to the Funds tab on the left-side menu and choose your preferred deposit method. Bear in mind that Switch Markets offers a wide range of deposit methods, including the option to fund your account with Bitcoin and other cryptocurrencies.

6. Choose an Asset and Place a Trade

You are now all set to place your first trade. What you need to do is choose an asset and click on the New Order button. Add the lot size (volume), stop loss, and take profit (optional), and the position direction (buy or sell).

7. Apply Risk Management Strategies

Trading without risk control is like racing downhill with no brakes. You must apply risk management strategies to ensure you limit your loss and you have a well-planned trading strategy. This includes the basic risk management tools like stop and take profit, or a trailing stop loss, which is a type of stop-loss order that automatically adjusts as the market price moves in your favor, helping lock in profits while still protecting you if the market turns against you.

Short-term traders can learn more by reading our day trading risk management techniques guide. Algo traders can also use our EA risk management tools, including our risk manager EA.

8. Track and Manage Your Open Positions

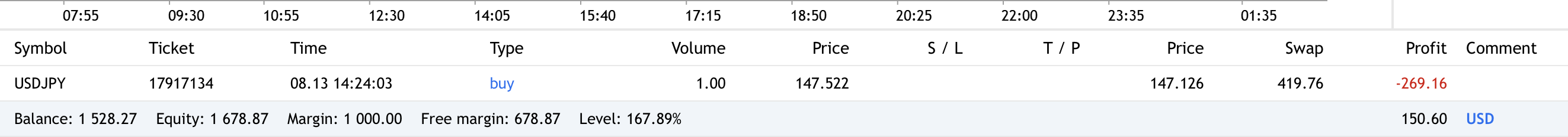

Now that you trade the markets, the next step is to track and manage your performance. For that matter, you need to track the Trade Balance on MetaTrader.

In the Trade Balance, you can track your P&L, swap P&L (refers to swap rates in trading), your balance, equity, margin, and free margin.

Additionally, Switch Markets provides a free built-in tracking application inside the cabinet. With TrackATrader, you can regularly monitor and track your trades in order to analyze and improve your performance. Finally, you can also use a Trading Journal, which is an Excel spreadsheet that helps you track your trades and analyze your performance.

9. Enhance Your Knowledge with Educational Resources

Lastly, knowledge is power. Even if you succeed in making profits in trading, you always need to sharpen your skills and enhance your knowledge. Visit our learn section, join our newsletter, and visit financial websites and forums on a daily basis to stay informed and updated with the latest market events.

Managing Trading Costs - What You Need to Consider When Trading CFDs?

Managing trading costs is crucial for maintaining profitability in CFD trading. Costs associated with CFD trading can include spreads, overnight financing fees, and commissions.

Crucially, commission fees for trading CFDs are determined based on the chosen account. For instance, on Switch Markets, traders can choose an ECN or a Standard account, where the first option enables you to trade without spreads and with a fixed commission. A standard account does not incur any fixed commission, but you'll have to pay a spread when getting in and out of a position.

Overnight funding fees are incurred when positions are held past a specified cutoff time, typically charged daily. These fees can reduce your profit if the CFD position is kept open for more than one day, especially when considering the underlying instrument.

Additionally, borrowing charges can apply when shorting a stock via CFD, influenced by the specific financial asset and the underlying asset, including a small admin fee. It is, therefore, extremely important to understand how CFD rollovers work and their impact on CFD trading. By understanding and managing these costs, you can optimize your trading strategy and improve your net returns with underlying assets.

Final Word - Why Trade CFDs with Switch Markets?

In summary, CFD trading offers a versatile and dynamic approach to engage with financial markets. By understanding what CFD trading is, setting up the right trading account, and selecting the appropriate markets, you can position yourself for success. Making your first trade, employing risk management strategies, and leveraging advanced trading techniques can further enhance your trading performance. Before you start, we also suggest reading our guide on CFD trading tips and 7 top technical analysis strategies to add to your trading toolkit.

Clearly, the first and most important step is selecting a reliable broker to execute your strategy effectively. Switch Markets is a well-recognized CFD trading platform, known for its user-friendly desktop and mobile apps. With access to over 1000 assets, including forex, stocks, indices, ETFs, commodities, and cryptocurrencies, it supports a global community of traders across the globe.

Here's why you should trade with Switch Markets:

Frequently Asked Questions

Here are some of the most frequently asked questions about CFD trading:

What is a CFD?

A CFD, or Contract for Difference, is a financial derivative enabling traders to speculate on price movements of assets without ownership. It offers opportunities for profit based on market fluctuations.

How do I choose a CFD broker?

To choose a CFD broker effectively, prioritize regulatory compliance, evaluate platform features, consider associated fees, and review user feedback. This approach will ensure you make an informed decision that aligns with your trading needs.

Why should I use a demo account?

Using a demo account is essential as it provides a risk-free environment to practice trading with virtual funds, allowing you to build confidence and refine your strategies before entering live markets. This preparation can significantly enhance your performance when you begin trading with real money.

Is CFD trading a good way to start trading the markets?

CFD trading can be an excellent starting point for entering the markets, as it gives access to a wide range of assets, the flexibility to trade rising or falling prices, and the use of leverage to control larger positions with less capital. However, leverage also makes CFDs high-risk, since it can magnify losses as much as profits, and they are designed more for short-term speculation than long-term investing. For beginners, CFDs may be suitable if approached with caution, proper risk management, and practice on a demo account before trading real money.

What is the difference between CFDs and Futures?

CFDs (Contracts for Difference) and Futures are both derivatives that let traders speculate on price movements without owning the underlying asset, but they differ in structure and use. CFDs are more flexible, with no fixed expiry date, allowing traders to open and close positions at any time, usually offered by brokers with access to a wide range of markets. Futures, on the other hand, are standardized contracts traded on exchanges with a set size and expiry date, often used by institutions for hedging as well as speculation. While CFDs are generally more accessible for retail traders, Futures tend to involve larger capital requirements and stricter trading conditions.

Is CFD trading halal?

CFD trading can raise concerns under Islamic finance principles because it often involves interest (swap or rollover fees) and speculation, which may be considered non-compliant with Sharia law. However, some brokers like Switch Markets offer Islamic or swap-free accounts that are specifically designed to align with these principles by removing overnight interest charges while still allowing access to global markets.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.