Lot Size in Trading Explained - A Complete Guide

- What is a Lot Size in Trading?

- Why Lot Size Matters

- Not All Markets Use the Same Lot Size Standards

- How to Manually Calculate an Ideal Lot Size in Trading

- How to Calculate Lot Size in Forex Trading

- How to Calculate Lot Size in Stock CFDs

- Lot Size in Commodity Trading (Crude Oil, Gold, etc.)

- Common Mistakes Traders Make with Lot Sizes

- Final Thoughts

Most traders focus a whole lot on their trading strategy and often forget to pay attention to another important aspect of their trading that can either make or break their trading progress: their lot size.

With the wrong lot size, you can make significantly less profit when the market goes in your favor or easily blow out your entire trading capital when the market moves against you. So, this guide will teach you how to consistently and accurately calculate the appropriate lot sizes for your trades every single time.

But before we go into the whole article, this is an overview of all we are going to cover in this piece:

- What is a Lot Size in Trading?

- How to Manually Calculate Lot Size in Trading

- How to Calculate Lot Size in Forex Trading

- How to Calculate Lot Size in Stock CFDs

- How to Calculate Lot Size in Commodities

- Common Mistakes Traders Make with Lot Sizes

Now that you have an idea of what this article will cover, let's get started.

What is a Lot Size in Trading?

In trading, a lot size refers to a standardized unit of measurement that determines the quantity of a financial instrument being traded. This lot size specifies the predetermined number of units of a financial instrument involved in a single transaction.

So, this standardization is crucial as it directly influences factors such as risk exposure, leverage, margin requirements, and most importantly, your P&L.

For instance, in the forex market, trading is typically conducted in lots, with a standard lot equating to 100,000 units of the base currency. This means that when a trader places an order for one standard lot of EUR/USD, they are buying or selling 100,000 euros. However, you should note that every asset class has a different standard of a lot size, which means you'll need to know the size of your position before you start trading a specific market.

Why Lot Size Matters

Sometimes, the difference between consistently making a profit can be something as easily overlooked as your lot size. Why? Well, lot sizes are essential for effective risk management and strategic planning in trading. If you do not know your position size, then one losing trade can seriously harm your account balance.

Let’s go deeper. Here's how lot size impacts various aspects of trading:

In forex trading, the lot size determines the value per pip movement. For a standard lot, a one-pip movement typically equates to a $10 change. Therefore, larger lot sizes can lead to significant profits or losses with even minor price movements.

In stock trading, especially when dealing with CFDs, the lot size can affect the transaction cost. For example, trading a standard lot of 100 shares of a particular stock will have different cost implications compared to trading a mini lot of 10 shares.

In cryptocurrency trading, the lot size influences the amount of capital required and the level of market exposure. Larger lot sizes necessitate more substantial capital and expose the trader to higher risk, while smaller lot sizes allow for more controlled exposure.

Add it all up: In sum, you must know ahead of entering a position the lot size that suits you. If you are entering a positon with a large lot size, you might panic with value of each pip. Conversely, if you enter a positon with a small lot size, the transaction might not produce a return that satisfies your needs.

Not All Markets Use the Same Lot Size Standards

Different financial markets define and utilize lot sizes uniquely. Understanding these distinctions is vital for traders operating across various asset classes. Let’s take a closer look at that in the table below:

How to Manually Calculate an Ideal Lot Size in Trading

The last thing you ever want to do is to carefully analyze the chart, plan your execution and then go ahead and use an incorrect lot size when it’s time to place your trades.

In order to avoid all of those, let’s quickly go over how to manually calculate lot size in your trading. Getting this right ensures that each trade aligns with your risk tolerance and account balance, helping to protect your capital over the long term.

Key Factors to Consider

Before we go into it properly, here are some key factors that will come in handy when calculating lot sizes:

- Account Balance: This is the total capital available in your trading account.

- Risk Per Trade (%): The percentage of your account balance you're willing to risk on a single trade. A common guideline is to risk no more than 1-2% per trade.

- Stop Loss Distance: The difference between your entry price and the stop loss level, measured in pips (for forex) or price units.

Take note that if this might be a bit confusing for you, then you can also use a demonstration account to find the ideal lot size for your trading account. For that matter, we highly recommend opening a trading demo account with the estimated capital you wish to deposit into your live account. This will help you get accurate results when it comes to the right lot size that matches your account balance and your trading style.

Step-by-Step Lot Size Calculation

Now that we have that out of the way, let’s explore how to calculate the appropriate lot size across different markets:

Forex Trading (EUR/USD Example)

Here’s the Formula:

Lot Size = [Account Balance×Risk Percentage]/ [Stop Loss in Pips×Pip Value]

Example:

- Account Balance: $10,000

- Risk Percentage: 2% (0.02)

- Stop Loss: 50 pips

- Pip Value for EUR/USD: $10 per pip (for a standard lot of 100,000 units)

Lot Size= [10,000×0.02] / [50×10] = 200 / 500= 0.4 lots

This means you should trade 0.4 standard lots, or 40,000 units of EUR/USD, to risk $200, which is 2% of your account balance.

Stock Trading (AAPL CFD Example)

This is the Formula for calculating lot sizes for Stock CFDs:

Number of Shares = [Account Balance×Risk Percentage] / [Stop Loss in Price]

Example:

- Account Balance: $10,000

- Risk Percentage: 2% (0.02)

- Stop Loss: $5

Number of Shares = [10,000×0.02] / 5 = 200 / 5 = 40 shares

You can purchase 40 shares of AAPL, risking $200 if the price moves against you by $5 per share.

Side Note: Since most brokers equate 1 share to 1 lot, you can also use 40 lots.

Cryptocurrency Trading (BTC/USD Example)

Formula:

Position Size = [Account Balance×Risk Percentage] / [Stop Loss in Price]

Example:

- Account Balance: $10,000

- Risk Percentage: 2% (0.02)

- Stop Loss: $1,000

Position Size = [10,000×0.02] / 1,000 = 200 / 1,000 = 0.2 lots

You should trade 0.2 lots, risking $200 if the price moves against you by $1,000.

Using a Lot Size Calculator for Precise Position Sizing

In reality, gone are the days when traders manually calculate lot sizes before opening a position, and the reason is not far-fetched: it’s a lot of work.

To simplify these calculations and ensure accuracy, you can use online lot size calculators. These tools allow you to input your account details, risk tolerance, and trade specifics to determine the optimal position size.

For instance, the Switch Markets Lot Size Calculator is a popular choice among traders. Our lot size calculator is easy to use and can be used in advance by beginner and advanced traders to calculate their position size.

We will be using this online lot size calculator for the rest of this article.

How to Calculate Lot Size in Forex Trading

In forex trading, a lot refers to the standardized quantity of the base currency you're trading. The system is structured to accommodate traders with varying risk appetites and account sizes:

- Standard Lot: Represents 100,000 units of the base currency. For instance, trading one standard lot of EUR/USD involves €100,000.

- Mini Lot: Equivalent to 10,000 units. Trading a mini lot of GBP/USD means you're dealing with £10,000.

- Micro Lot: Consists of 1,000 units. A micro lot in USD/CAD equates to $1,000.

- Nano Lot: Contains 100 units. While rare, some brokers offer nano lots, allowing trades as small as 100 units of the base currency.

How Lot Size Impacts Pip Value

A pip is the smallest price movement in the forex market, typically located at the fourth decimal place for most currency pairs (0.0001) and the second decimal place for pairs involving the Japanese yen (0.01). The lot size you choose directly influences the monetary value of each pip movement:

- Standard Lot: Each pip movement is worth $10.

- Mini Lot: Each pip movement is worth $1.

- Micro Lot: Each pip movement is worth $0.10.

- Nano Lot: Each pip movement is worth $0.01.

Example: If you're trading a standard lot of EUR/USD and the price moves from 1.1000 to 1.1001, that's a 1-pip movement, resulting in a $10 gain or loss.

Leverage & Margin Requirements in Forex

Forex brokers offer leverage, allowing traders to control large positions with a relatively small amount of capital. Leverage is expressed as a ratio, such as 1:1000 or 1:10, and so on. For example, at Switch Markets, traders can trade with a leverage of up to 1:500. Let’s take a closer look at what a leverage ratio means:

- 1:1000 Leverage: With this leverage, you can control a position size 1000 times greater than your capital. For example, with $1,000, you can trade a position worth $1,000,000 (one standard lot).

- 1:10 Leverage: Here, your trading power is tenfold. With the same $1,000, you can control a $10,000 position (one mini lot).

It's essential to understand that while leverage can enhance profits, it also increases the risk of significant losses. In other words, leverage is a double-edged sword. So, it’s recommended to use less leverage when you’re just starting out.

Using a Lot Size Calculator for Forex Trades

Of course, you can manually calculate the desired lot size, and within time, you might even choose a fixed lot size that you always use.

But, in the beginning, you don’t have to do it all by yourself. In fact, even professional forex traders use a lot size calculator to do the heavy lifting for them. So, here’s how you too can use it in your trading:

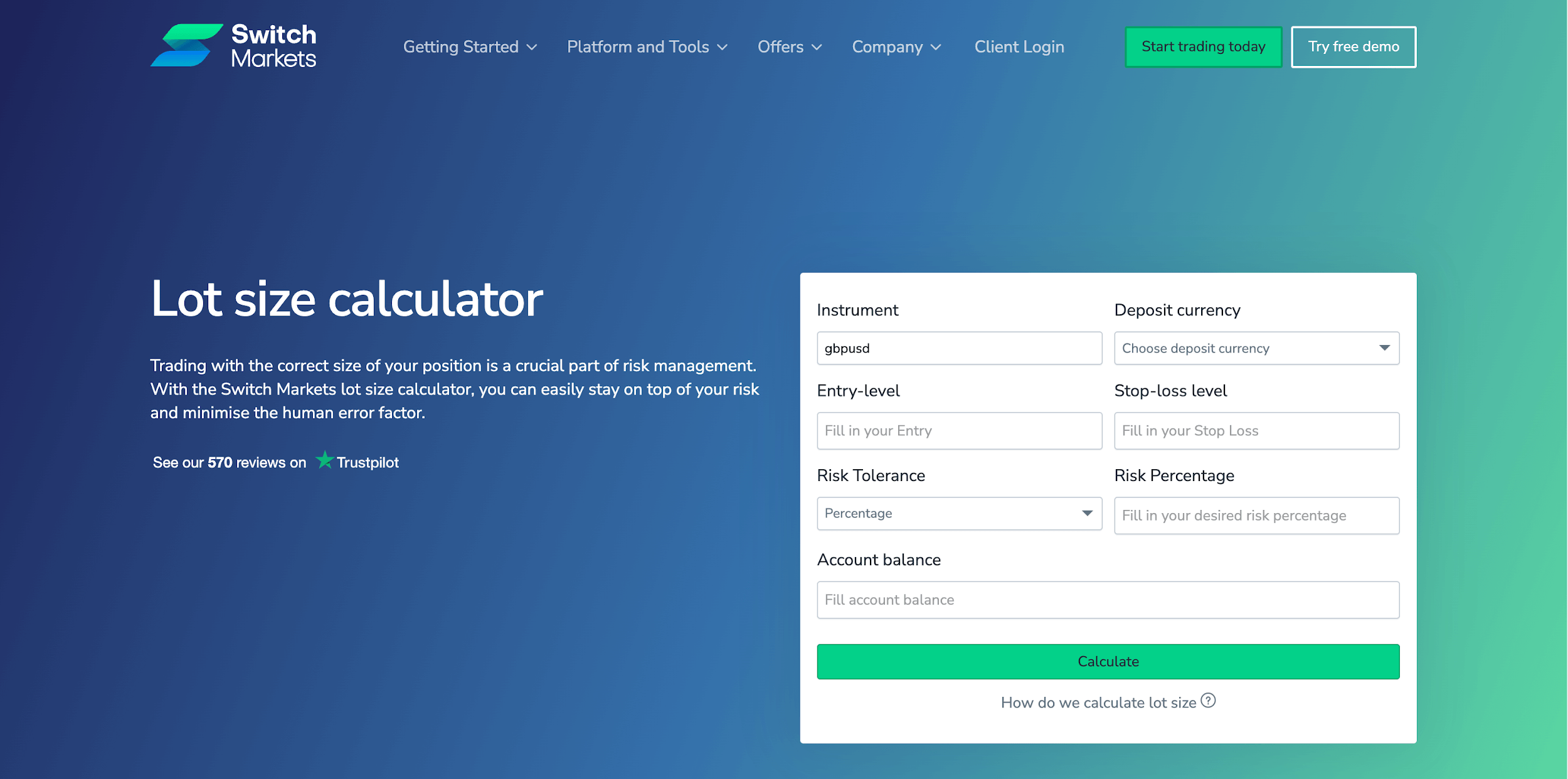

1. The first thing you want to do is to open the Switch Markets lot size calculator and choose the currency pair you want to trade.

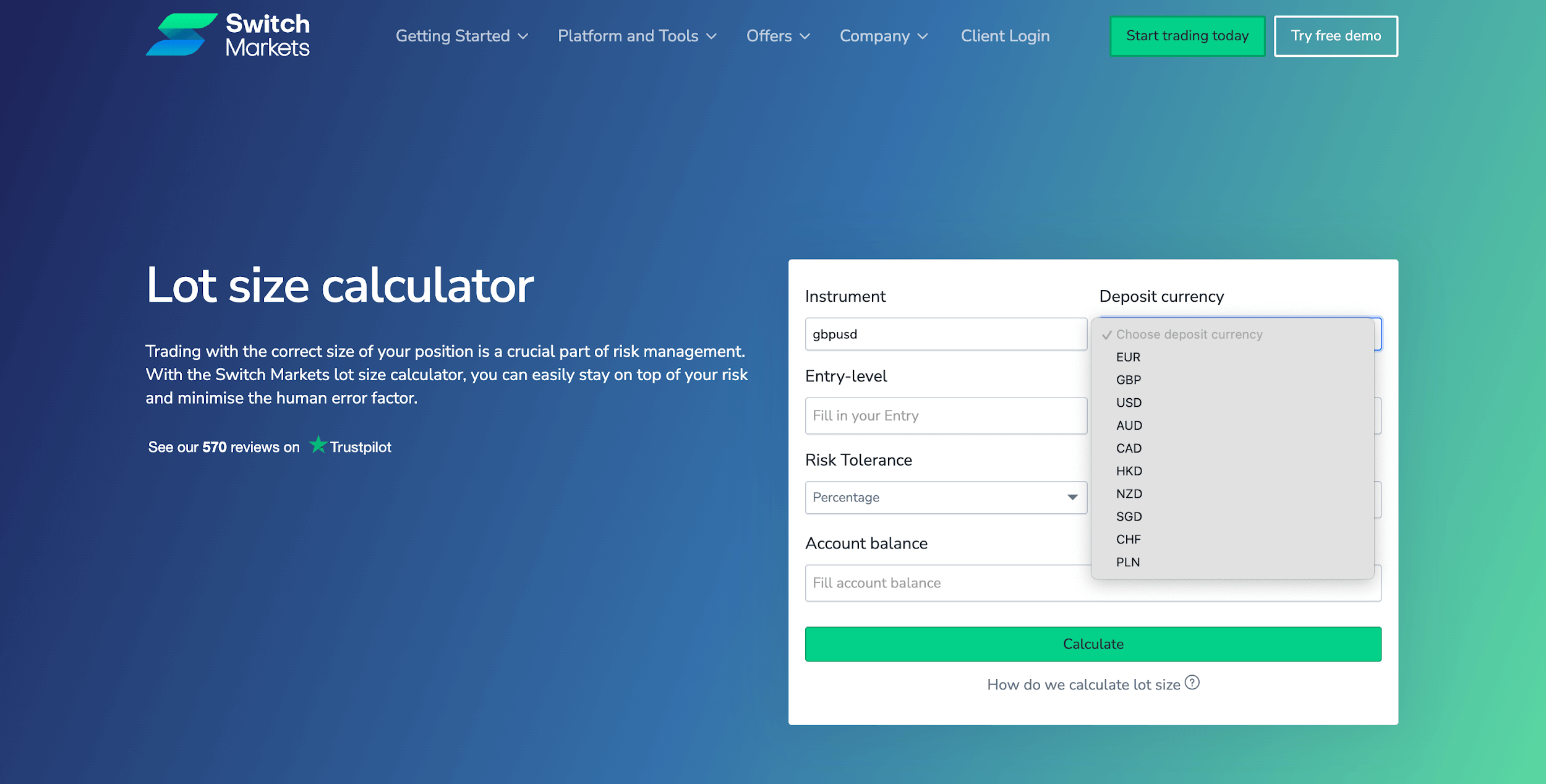

2. After that, you should go ahead and choose the deposit currency on your trading account.

3. Once that is done, you will have to go back to your MT4/5 platform and fetch your entry and stop loss prices as received in the calculator.

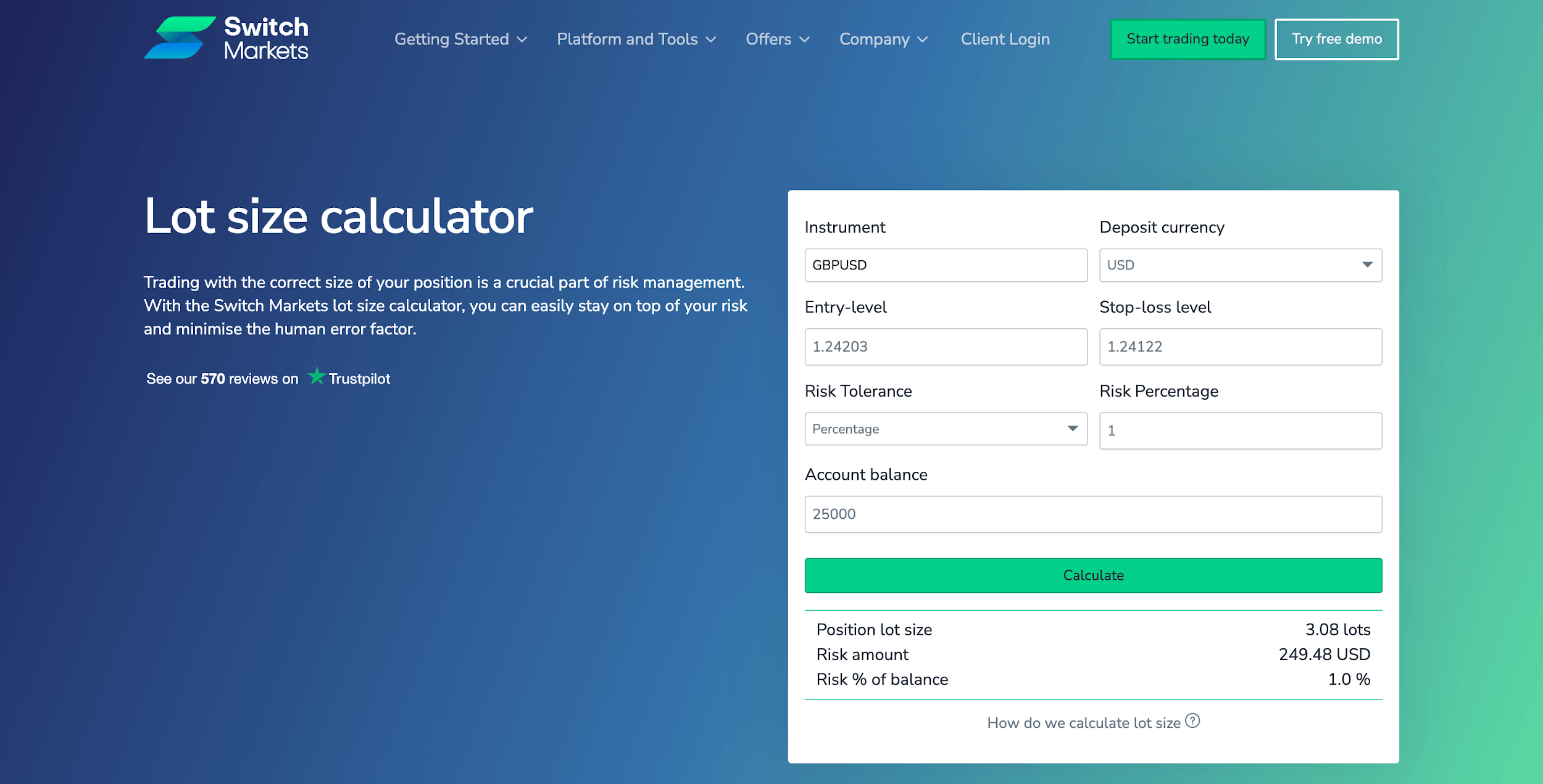

4. Lastly, fill in the information, insert your account balance, and determine your risk (either by percentage or a fixed amount). Once this is done, hit the “calculate” button, and you should get the lot size value instantly, just as shown below:

There you go. This example shows a long setup on GBPUSD with a stop loss value of about 81 pips, a risk of 1% on a $25,000 account. Once all the necessary information was provided, the calculator quickly returned a lot size of 3.08.

How to Calculate Lot Size in Stock CFDs

In traditional stock trading, a lot typically refers to a standardized number of shares. In the U.S. market, a standard lot is usually 100 shares, often referred to as a "round lot." Purchasing in these increments can sometimes offer better pricing and execution.

On the other hand, when trading stock CFDs, the concept of lot sizes is more flexible. This flexibility means that brokers can define lot sizes differently.

For instance, some brokers equate 1 CFD contract to 1 share of the underlying stock, while others might offer custom lot sizes. It is, therefore, advisable to check on the broker's site the contract specifications, and if necessary, open a demo account to figure out the exact lot size set by your broker.

Example Calculation Using Lot Size Calculator

Let’s say you have a high probability setup on Tesla (TSLA), and you are looking to calculate the appropriate lot size before entering a trade on your trading account.

Here’s how to go about it.

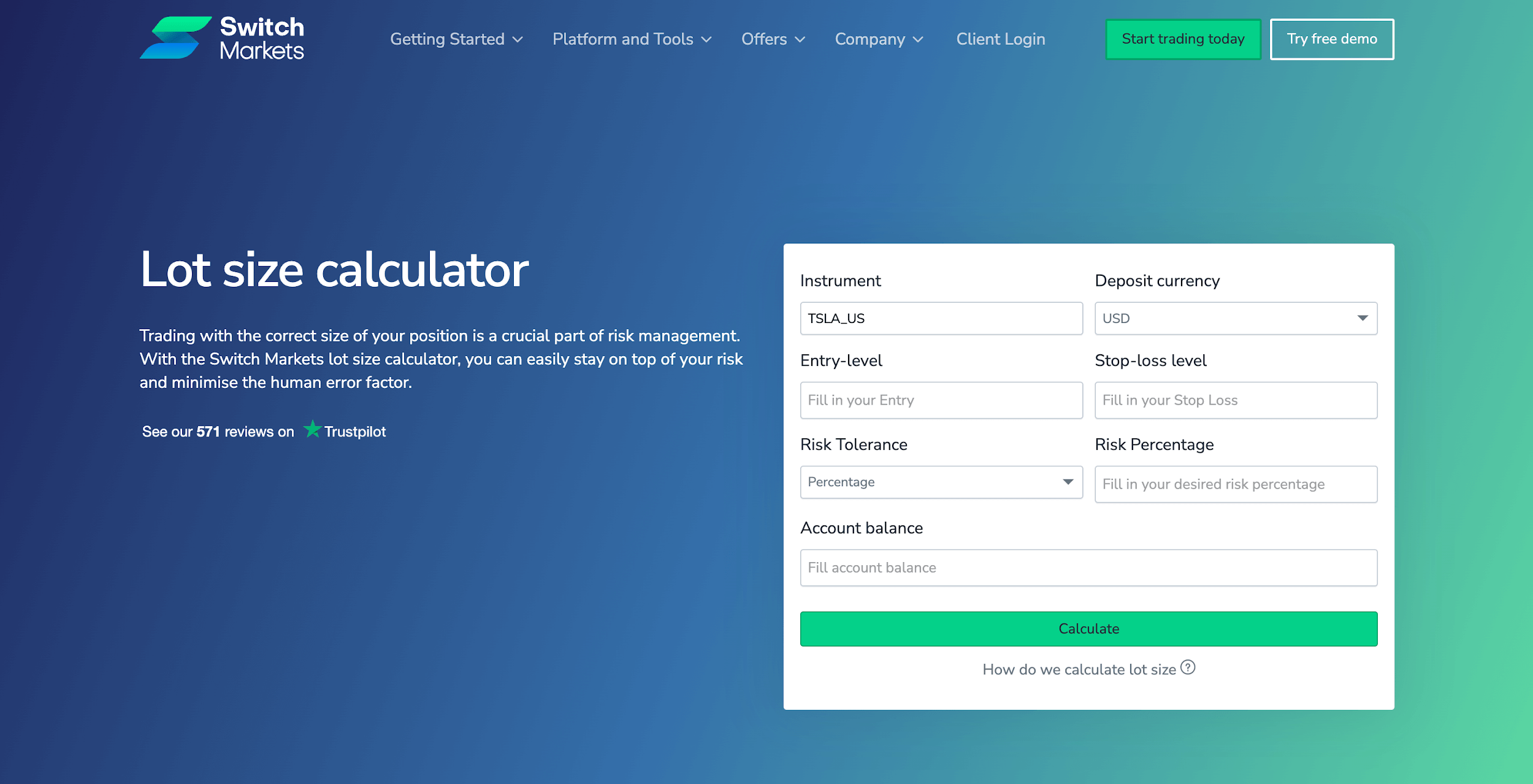

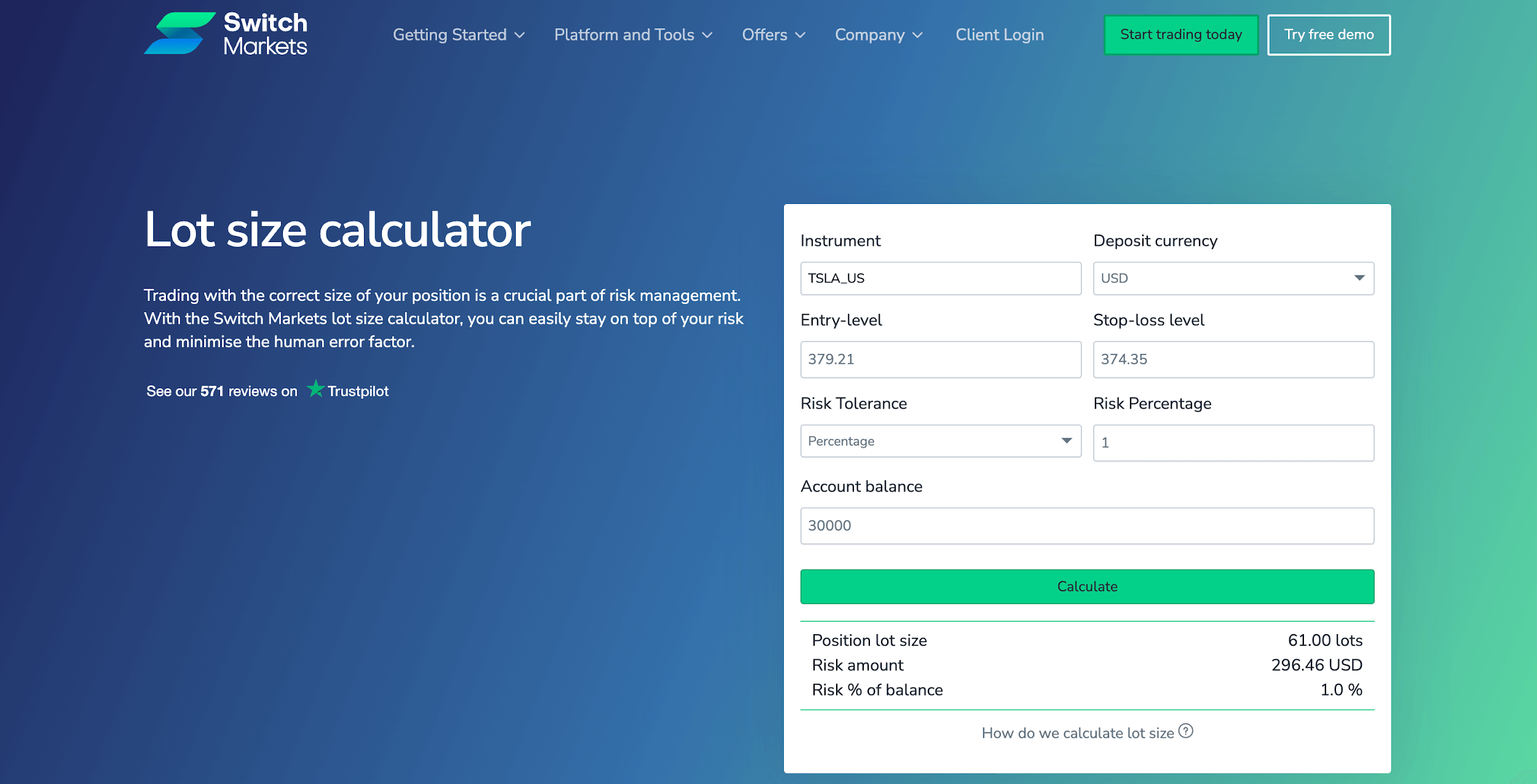

1. Similar to the Forex example, go ahead and open the Switch Markets Lot Size Calculator and select TSLA. If done correctly, everything should look like this:

2. Once that is done, go back to your chart and copy your entry price and stop loss price to the text field provided inside the lot size calculator. You should have something like this:

3. Finally, fill out your account balance and how much you are willing to risk. When that is done, just go ahead and click the “Calculate” button, and the corresponding lot size will be shown to you immediately, as shown below:

As you can see from the example above, the calculator gives us a lot size of 61 lots based on the provided details (a $30K account balance and 1% risk tolerance).

Lot Size in Commodity Trading (Crude Oil, Gold, etc.)

In commodity trading, a lot refers to a standardized unit that specifies the quantity of a commodity in a single contract. In other words, every commodity has a different lot size standard.

Lot Size & Contract Specifications in Commodity Trading

The specified lot size of a commodity contract directly influences margin requirements and the sensitivity of your position to price movements.

- Margin Requirements: To open a position, traders must deposit an initial margin, which is a fraction of the contract's total value. The larger the lot size, the higher the margin requirement.

- Price Movements: The impact of price fluctuations is magnified by the lot size. For instance, in a crude oil contract, a $1 change in price equates to a $1,000 gain or loss (since 1,000 barrels x $1 = $1,000).

Using a Lot Size Calculator for Commodity Trades

Determining the appropriate lot size is crucial for effective risk management. Here's a step-by-step guide to using a lot size calculator:

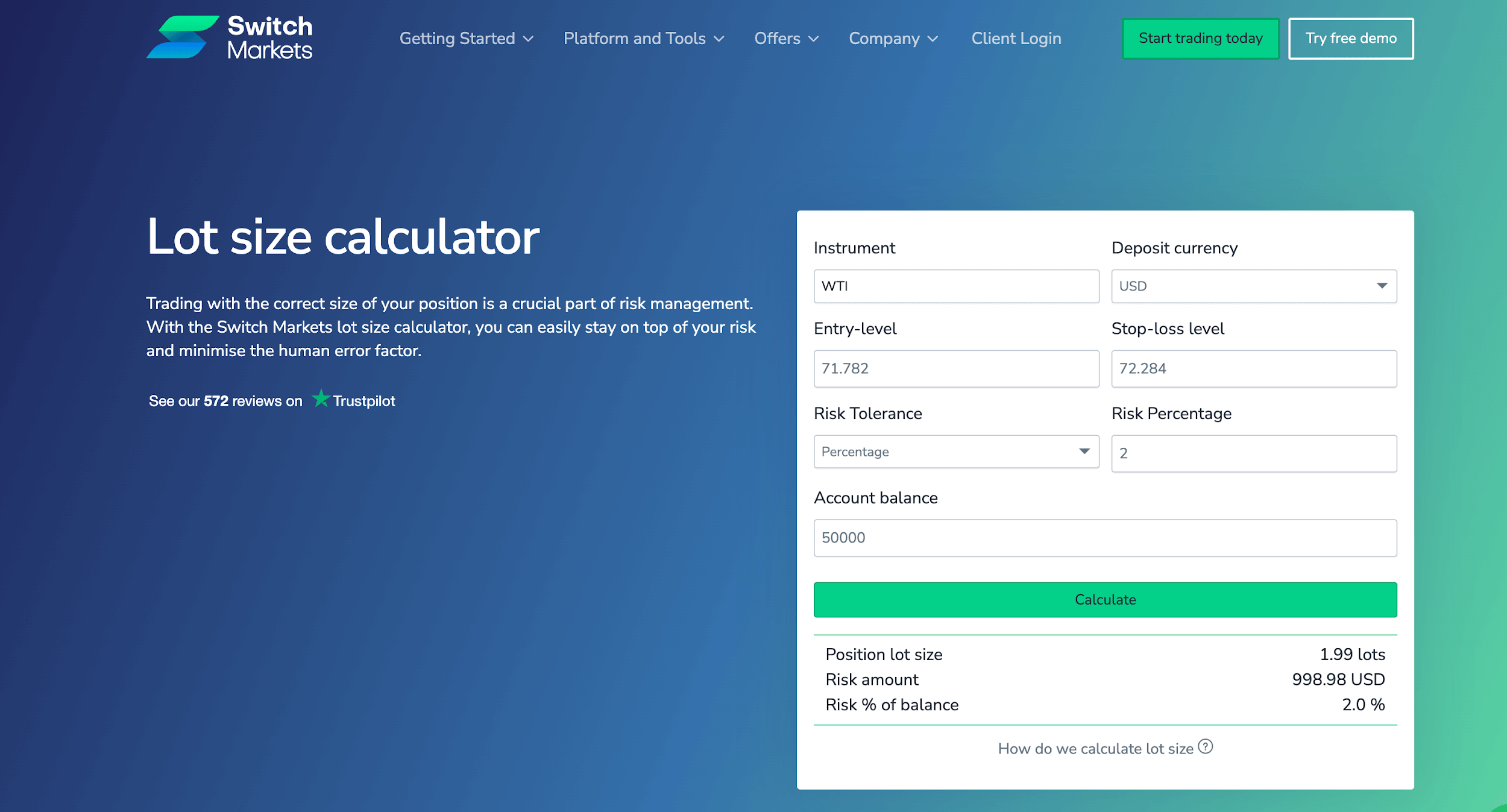

Let's say you have a balance of $50,000 and you wish to risk 2% of your account trading a Crude oil setup that you've just analyzed; here’s how to go about it using our lot size calculator:

Once you fill out all the important information, including your entry and exit price, go ahead and click the "calculate" button and you'll automatically get your appropriate lot size, as shown in the image above.

Common Mistakes Traders Make with Lot Sizes

Lot size selection is one of the most crucial aspects of risk management in trading, yet many traders, especially beginners, often get it wrong. Mistakes in lot sizing can lead to unnecessary losses, margin calls, or even account blowouts.

Here are some of the most common pitfalls traders encounter when dealing with lot sizes:

Overleveraging with Large Lot Sizes

One of the most frequent errors traders make is choosing a lot size that is too large relative to their account size.

Overleveraging often leads to devastating drawdowns when the market moves against a position. Traders who use oversized lot sizes may quickly deplete their accounts, especially during volatile market swings or news releases.

The temptation to make fast profits often clouds the reality that high leverage can also result in rapid liquidation.

Ignoring Account Size When Selecting Lot Size

This may sound like the first one, but it’s different. A trader’s lot size should always align with their account balance and risk tolerance. Here, the size matters.

Many beginners fall into the trap of trading a standard lot (100,000 units in forex) without considering whether their account can support such exposure.

A simple rule of thumb is to risk no more than 1-2% of the total account balance on any single trade. Failure to do so often results in excessive drawdowns, making it difficult to recover from losing trades.

Misunderstanding Broker-Specific Lot Size Rules

Each broker has its own lot size configurations, margin requirements, and leverage options. Traders who fail to understand these details may encounter issues such as "trading invalid lot size" errors.

Some brokers enforce minimum lot size restrictions or specific margin requirements that can impact trade execution. It is crucial to familiarize oneself with broker-specific rules to avoid unnecessary trading errors and frustrations. And if you cannot understand the broker’s lot size specifications, contact the support team and make sure you know the lot size and the value of a pip before you make any trade.

Just by avoiding these mistakes, you can turn your trading results around and outperform thousands of traders. Selecting the right lot size keeps you in the game for the long haul.

Final Thoughts

To sum up, many traders underestimate the importance of choosing the correct lot size. Choose a lot size bigger than necessary, and you can easily blow your account. What about a smaller lot size? You may miss out on fully taking advantage of a home run.

The goal is to use the perfect lot sizes consistently and, within time, learn how to increase your position size. By selecting the right lot size based on account balance, risk percentage, and stop-loss levels, you can ensure sustainable growth and long-term success.

And instead of manually calculating your position sizing, you can use a lot size calculator to get precise results tailored to your strategy. For that, you can try the Switch Markets lot size calculator to take control of your trading risk like a pro.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.