Fixed vs Floating Spreads: What’s the Difference and How to Choose

When you place a trade in the market, you’re immediately paying a cost before the market even moves in your favor. That cost is the spread, and understanding whether to use fixed and floating spreads can have a significant impact on your bottom line.

In this guide, you’ll learn exactly how each spread type works, the advantages and disadvantages of both, and a practical framework for deciding which one fits your trading strategy.

Quick Answer: Fixed vs Floating Spreads (Summary)

The difference between fixed and floating spreads comes down to predictability versus cost efficiency. Fixed spreads stay constant regardless of market conditions, while floating spreads change in real time based on market liquidity and volatility. Your choice depends on how often you trade, when you trade, and how comfortable you are with variable costs.

Here’s what you need to know in a nutshell:

- Fixed spreads stay the same most of the time and are set by the broker

- Floating (variable) spreads constantly change with market liquidity and volatility

Side-by-side comparison:

- Cost predictability: high for fixed, low for floating

- Typical cost level: usually higher for fixed, often lower for floating in calm markets

- Best for: fixed = beginners, news-avoidant swing traders; floating = active, cost-sensitive traders during liquid sessions

- Execution model: fixed = often market makers; floating = often ECN/STP/non-dealing-desk

How to decide quickly:

So, how to decide? Well, if you trade smaller position sizes, hate unexpected costs, and tend to stay out of major news events, fixed spreads are likely to feel more comfortable for you. On the other hand, if you scalp, day trade, or focus on the London and New York sessions when liquidity is high and spreads are tight, floating spreads usually make more sense. So, before deciding, think about how long you typically hold trades, how exposed you are to news, and the size of your account. And if you’re unsure, the safest move is to test both options on a demo account for a few weeks and see which one fits your trading style best.

What Is a Spread in Forex and CFD Trading?

Before we go into the details, let's understand what a spread in trading is. Simply put, the spread is the difference between the two prices your broker quotes for any financial instrument - whether that’s EUR/USD, XAUUSD, stock indices, or CFDs. It represents your primary transaction cost for entering and exiting positions.

Here’s how it works:

- Brokers quote two prices: the bid price (the price at which you can sell) and the ask price (the price at which you can buy)

- Spread = ask price − bid price, usually measured in pips for FX (e.g., 0.0001 for most pairs, 0.01 for JPY pairs)

- The spread is a core part of trading costs, similar to a built-in commission on every trade

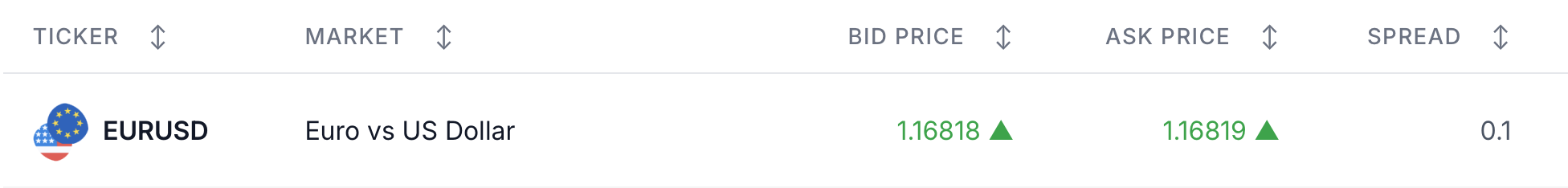

Let's take a look at the EUR/USD spread on Switch Markets:

As you can see above, the EUR/USD spread is 0.1, meaning the bid price is 1.16818, and the ask price is 1.16819. In that case, the cost for 1 standard lot (100,000 units): 1 pip × $10 per pip = $10.

However, you should note that ECN models, like Switch Markets, often combine tight spreads with a fixed commission per lot, so you’re always paying something. Understanding the bid-ask spread is fundamental to calculating your true trading costs. You can visit this page to learn more about Switch Markets' spreads.

Types of Spreads: Fixed vs Floating

Most retail brokers today offer two main types of spreads: fixed and floating (also called variable spreads). The naming varies between brokers, but the underlying logic remains the same.

With this foundation in place, let’s examine each spread type in detail.

What Are Fixed Spreads?

A fixed spread is quoted as a constant number of pips - for example, 2 or 3 pips on EUR/USD - and typically does not change tick-by-tick during normal conditions. The fixed spread level remains stable whether the market is quiet or moderately active.

How fixed spreads work:

- Typically offered by dealing-desk or market-maker brokers who internalize client flow

- The broker can control the displayed prices because it is the direct counterparty to many trades

- During extreme market volatility or off-market hours, some brokers may temporarily widen the “fixed” spread or block new orders

Brokers that offer fixed spreads are essentially absorbing the risk of market fluctuations on your behalf, and they price that risk into the spread.

Advantages and disadvantages of fixed spreads:

- Predictable transaction costs: you know the spread before you open a trade, useful for small retail accounts

- Easier planning: helps when building strategies that need stable costs (e.g., grid strategies, some EAs)

- Reduced stress around minor volatility: traders are shielded from small, frequent spread pulses

- No surprises during normal conditions: the cost stays the same whether you trade at 9 AM or 3 PM

- Typically higher than average floating spreads during normal, liquid sessions (e.g., fixed 2–3 pips vs. floating often 0.0–0.5 pips on EUR/USD at London open)

- Higher relative cost for scalpers and short-term traders, where every pip matters

- Increased risk of requotes and rejected orders during fast markets (e.g., U.S. CPI releases), because the broker cannot instantly widen the fixed spread and may offer a new price instead

- Possible slippage if the market jumps beyond the fixed one price level

Real-world scenario:

During calm London trading on EUR/USD, a fixed-spread broker might still charge 2 pips, while a floating ECN account could show 0.1–0.3 pips most of the time. Over dozens of trades, this difference compounds significantly.

Who benefits from fixed spreads:

Fixed spreads are suitable for novice traders, occasional traders, and those who usually trade outside of major news and are more concerned with predictable fees than achieving the absolute lowest pip cost.

What Are Floating (Variable) Spreads?

Floating spreads constantly adjust in real time according to the market’s current bid and ask prices. They reflect what’s actually happening in the interbank forex market at any given moment.

How floating spreads work:

- Common on Electronic Communication Network (ECN) brokers, STP, and “Raw” spread accounts, where prices are streamed from multiple liquidity providers (banks, prime brokers, institutional venues)

- Spreads tend to tighten when high liquidity exists (e.g., overlap of London and New York sessions) and widen significantly when liquidity is low or volatility spikes

- Typical range for EUR/USD: 0.0–0.5 pips during peak hours, 1–3+ pips during major currency pairs data releases or low-liquidity Asian late session

Advantages and disadvantages of floating spreads:

- Potentially very low costs under normal conditions, especially for major pairs and popular indices

- More transparent reflection of actual interbank market dynamics

- Generally fewer requotes because price movement is allowed to occur freely; orders are filled at current market prices, possibly with slippage instead of rejection

- Cost-effective for high-volume traders who time their entries during liquid periods

- Costs can spike without warning around news (e.g., Non-Farm Payrolls, FOMC statements, unexpected geopolitical events), sometimes widening to 8–10 pips or more on major pairs

- Harder to forecast exact entry/exit costs for tight stop strategies; may hit stop losses earlier when spreads briefly widen during spread widening events

- Requires more advanced risk management (e.g., avoiding trading during high-impact news, using wider stops, or lowering position size around known events)

Timeline example:

On a typical weekday, the EUR/USD floating spread might average 0.1–0.3 pips from 08:00–16:00 London time, rise to around 1–2 pips during illiquid rollover around 23:00 server time, and spike even higher during major news (like U.S. CPI at 12:30 UTC). During highly volatile periods like March 2020’s COVID market turbulence, EUR/USD spreads on floating accounts temporarily widened from 1 pip to over 10 pips.

Who benefits from floating spreads:

- Scalpers and high-frequency day traders executing during liquid sessions

- Professional traders and experienced traders who prioritize raw pricing

- Larger accounts comfortable paying a fixed commission per lot in exchange for tight spreads

- Short-term trading strategies that depend on capturing small price movements

Fixed vs Floating Spreads: Which Should You Choose?

Clearly, there is no universal “best” option. The right choice depends on your trading style, the time of day you trade, your strategy’s sensitivity to cost, and your psychological comfort with variable expenses. Here are the key factors you need to consider before choosing the right type of spreads.

Decision guide by trading frequency:

If you trade infrequently and only place a few positions per week, the cost difference per pip is usually less critical, which makes fixed spreads a reasonable choice for their simplicity and predictability. On the other hand, if you trade actively with multiple intraday positions, floating spreads tend to deliver lower overall costs—especially on major pairs during the highly liquid London and New York session overlap.

By trading strategy:

A trading strategy is another key factor to consider.

Scalpers (aiming for 3–10 pips per trade):

- Prefer floating spreads + low commission, trade mostly during high liquidity periods

- Must monitor spread changes around economic calendars and avoid minutes around major releases

Intraday swing traders (holding for hours):

- Can use either, but floating spreads often lead to lower cumulative cost if they avoid news spikes

Position traders (holding days/weeks):

- Spread cost is a smaller fraction of the total profit/loss

- Psychological comfort and trading platform stability may matter more than 0.1–0.2 pip differences

By account size and risk tolerance:

- Small accounts (under $1,000): fixed spreads can help with predictable costs, but traders still need to compare actual spread values versus ECN options

- Larger accounts (above $5,000): more benefit from floating/ECN accounts with lower spreads and professional-grade execution

- Low risk tolerance: fixed spreads are less emotionally stressful during mild market turbulence

- Higher risk tolerance / more experience: floating spreads are fine if you understand spread behavior and use proper risk management controls

Fixed vs Floating Spreads - Numeric Comparison Example

Let's take a look at how the difference between fixed and floating can impact a trader's trading costs.

So, a trader placing 100 round-turn EUR/USD trades per month:

- Fixed spread: 2 pips × $10 per pip × 100 = $2,000 total cost

- Floating spread: average 0.4 pips + $7 commission per lot (≈1.1 pips total cost), total ≈ $1,100 for the same volume

Result: saving approximately $900/month with floating spreads during normal trading conditions.

Practical selection tips:

Here are some important factors to consider when choosing between fixed and floating spreads:

- Check the average spread by currency pair and by session (London, New York, Asian) for each account type your broker offers

- Look at how spreads behaved historically around key events (NFP, Fed, ECB), and analyze if your strategy cannot tolerate wide spikes

- Test both account types - ECN vs Standard - on a demo account or with a very small live size for at least 2–4 weeks each

- Consider non-spread factors: execution speed, slippage statistics, regulation, and overall fee structure

Other Factors That Influence Spreads

Regardless of whether you choose fixed or floating spreads, several external factors affect how wide or narrow spreads are at any moment.

Market liquidity:

- Highest during overlaps (e.g., London–New York overlap roughly 13:00–17:00 UTC) → spreads generally narrow

- Lowest during late U.S. session and pre-Asian hours → spreads naturally widen, especially on cross and exotic pairs

- Low liquidity periods mean even tight spreads accounts will see wider quotes

Market volatility:

- Spreads widen when price moves quickly (e.g., after surprise central bank decisions, flash crashes, geopolitical shocks)

- Even floating ECN spreads can jump from 0.3 to 5+ pips temporarily on major pairs when markets are disorderly during high volatility periods

- Volatile market conditions create unpredictable trading conditions for all spread types

Economic calendar:

- High-impact news like U.S. Non-Farm Payrolls (usually the first Friday of each month at 12:30 UTC), CPI releases, FOMC rate decisions, and ECB press conferences frequently cause short-term extreme spread widening

- News traders and news trading strategies must account for these spread spikes in their risk calculations

- Traders who cannot tolerate spikes should avoid opening or closing trades in the few minutes around these events

Instrument type:

- Major pairs (EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CHF, USD/CAD, NZD/USD) usually have tight spreads due to deep global liquidity

- Minors and exotics (e.g., EUR/TRY, USD/ZAR) carry naturally wider spreads, often several pips, even in quiet conditions

- Metals (XAUUSD, XAGUSD), indices (e.g., US30, DAX40), and crypto CFDs can show large spread swings around market opens and news, sometimes approaching zero spreads during peak liquidity

Broker model and infrastructure:

- ECN/STP brokers aggregating multiple liquidity providers typically offer tighter floating spreads during normal conditions and provide direct access to interbank pricing

- Market makers can keep spreads fixed, but may use requotes or wider stable spreads to manage their business model risk

Price slippage and VPS solutions:

Price slippage occurs when your order executes at a different sell price or buy price than your desired price - common during fast markets and volatile periods. This can happen with both spread types, but is more pronounced with floating spreads during news.

Using a Virtual Private Server (VPS) can help reduce slippage by:

- Minimizing latency between your trading platform and broker servers

- Ensuring a stable connection during high volatility

- Executing orders faster than a standard home internet connection

Generally speaking, short-term traders and those using automated strategies benefit most from VPS hosting.

Account type considerations:

Different trading accounts come with different spread structures:

- Standard accounts: often fixed or wider floating spreads, no commission

- ECN/Raw accounts: typically very tight floating spreads plus commission per lot

- Pro/VIP accounts: may offer the tightest spreads but require higher minimum deposits

Your account type directly affects your higher trading costs or lower trading costs - choose based on your volume and strategy needs.

Final Word

Understanding fixed versus floating spreads is key to controlling your trading costs. Fixed spreads offer predictability and simplicity, but usually come with slightly higher costs and the risk of requotes during fast markets. Floating spreads are often cheaper and reflect real market conditions more accurately, but they can widen sharply during low liquidity or major news events.

If you value stable, clearly defined costs, trade less frequently, and avoid high-impact news, fixed spreads may suit you better. If you’re an active, cost-sensitive trader operating during liquid sessions and using solid risk controls, floating spreads are usually the better choice. The smart move is to test both on Switch Markets' non-expiring demo account using your real instruments and timeframes, track average and worst-case spreads, requotes, and true cost per trade, then commit after a month or two of data. Mastering how spreads behave is a core trading skill because over time, the bid-ask difference is what turns small edges into profits or quietly eats them away.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.