MT4 vs. MT5 – Which Trading Platform Is Right for You?

Selecting the right trading platform is one of the most important decisions a trader can make. Platforms affect how quickly you can act on market information, what tools you have at your disposal, and even which instruments you can trade.

Two platforms dominate retail trading: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both are developed by MetaQuotes Software Corp. and both offer rich charting and automation capabilities, yet they serve slightly different audiences. And both are provided by Switch Markets.

This article digs deep into the differences between MT4 and MT5. It also explains when each platform might be a better fit and highlights the strengths of both so you can choose based on your trading goals. Got it? Now, let's show you around.

What Is MetaTrader 4 (MT4)?

MetaTrader 4 debuted in 2005 and quickly became the gold standard for CFD and Forex trading. The platform was built to serve currency traders, and its popularity is due largely to its user‑friendly interface, reliable execution, and support for automated strategies. Key features of MT4 include:

What Is MetaTrader 5 (MT5)?

MetaTrader 5 arrived in 2010 as a more versatile successor. Instead of serving only Forex traders, MT5 was built to support multi‑asset trading, including futures trading, stocks, and options. Important features include:

MT4 vs. MT5 Feature Comparison

Below is a concise table summarizing the key differences between MT4 and MT5:

Similarities Between MT4 and MT5

Although the two platforms differ, they share many core characteristics. Both provide comprehensive charting, technical indicators, and the ability to run automated strategies. They support demo trading accounts, enabling traders to practise with virtual funds.

MT4 and MT5 are among the most popular platforms for online trading, letting users access the markets from desktop, web, or mobile devices. The user experience across both platforms is fairly consistent; menus may look slightly different, but the primary functions like placing orders, viewing charts, and managing accounts are similar. Both platforms allow hedging and offer deep customization of the user interface.

Why MT5 Might Be Better Than MT4?

While MT4 has been the go-to platform for years, MT5 brings some powerful upgrades to the table. If you’re looking for more advanced tools and flexibility, here’s why MT5 might be the better choice for your trading journey.

- Broader Market Access. If you intend to trade more than just currency pairs, MT5 is the better choice. It was designed for multi‑asset trading. MT5 was built to support multiple financial markets, including Forex, stocks, commodities, cryptocurrencies, ETFs, and indices. MT4’s focus on Forex makes it less suitable for diversified portfolios.

- Additional Order Types and Market Depth. MT5 includes six pending order types and supports partial order fills, giving traders more flexibility in execution. The platform also offers a depth of market (DOM) window, showing the full order book. For traders who require advanced order management or level‑II data, MT5 is clearly superior.

- More Timeframes and Indicators. Scalpers and algorithmic traders often need granular timeframes beyond M1 or H1. With 21 timeframes and DOM features, MT5 gives traders everything they need for detailed market analysis. Additional graphical objects and the ability to integrate thousands of custom indicators mean you can build sophisticated, multi‑timeframe strategies without leaving the platform.

- Integrated Economic Calendar. Keeping track of economic events can be the difference between a profitable and a losing trade. MT5’s built‑in economic calendar presents upcoming data releases directly on the chart. MT4 users must use external websites for this information.

- Superior Back‑testing and Programming. For traders who build their own Expert Advisors (EAs) or trading robots, MT5’s multi-threaded back-tester makes it a powerful choice for algorithmic trading strategies that span multiple assets. MQL5 is object‑oriented and enables more complex strategies. You can test multiple instruments simultaneously and see results faster than with MT4’s single‑threaded tester. For more information, you can visit our guide on how to connect your MQL5 account to MT4/5.

- Convenience Features. MT5 allows fund transfers between accounts, attaches files to internal emails, and includes an MQL5 community chat. These features may seem minor, but they make the trading experience smoother.

- Netting for Exchange‑Traded Products. MT5 supports both hedging and netting, so it can aggregate positions in markets like futures or stocks. For traders who hold a single direction across multiple orders, netting simplifies position management.

Add it all up: For those looking for a wide range of markets, advanced tools, more timeframes, and indicators, then MetaTrader 5 is the ideal platform.

Why MT4 Might Be Better Than MT5?

Even with MT5’s advanced features, MT4 still has a loyal following, and for good reason. Here’s why many traders continue to choose MT4 over its successor.

- Simplicity and Familiarity. MT4 remains the more widely used platform for retail Forex trading. Its interface is simple and intuitive, which reduces the learning curve for beginners. Traders who value a straightforward workflow may find MT4 easier to navigate than MT5.

- Wider Broker Support. Because MT4 has been available since 2005, nearly every Forex broker offers it. Some smaller brokers do not yet support MT5. If you plan to change brokers frequently or use lesser‑known brokers, MT4 ensures compatibility.

- Hedging Focus. Many Forex traders use hedging strategies to manage risk. MT4 supports hedging by allowing opposite positions on the same pair. While MT5 also permits hedging, its netting default can make hedging setups less straightforward if the broker enforces netting.

- Lighter Resource Requirements. MT4’s codebase and single‑threaded tester are more lightweight. Although this means slower back‑testing, the platform typically consumes fewer resources than MT5 and runs smoothly on older computers.

- MQL4 Ecosystem. The MT4 marketplace offers thousands of ready‑made indicators and EAs written in MQL4. Many developers have not yet ported their tools to MQL5, so if you rely on specific EAs, you may find better support in MT4.

- Focused Toolset for Currency Trading. Because MT4 was purpose‑built for Forex, its default setup contains everything a currency trader needs. If you do not require additional instruments or advanced order types, MT4’s simplicity can be an advantage.

Add it all up: If you are a beginner looking to focus on forex trading with a simple user interface, the MetaTrader might be the best choice for you.

How to Decide Which Platform Is Best for You

When choosing between MT4 and MT5, consider the following questions:

What markets do you trade?

If your primary focus is Forex, MT4 will give you all the tools you need without unnecessary complexity. MT5 is better if you want to trade a diversified portfolio (stocks, ETFs, indices, commodities, or cryptocurrencies).

Do you use advanced order types or require market depth?

MT5 offers additional pending order types, partial fills, and depth of market. If your strategy depends on sophisticated order placement or level‑II data, MT5 is the way to go.

Are you coding or back‑testing complex strategies?

Algorithmic traders who need multi‑currency back‑testing or object‑oriented code will benefit from MT5’s MQL5 language and multi‑threaded tester. For simpler EAs or single‑asset bots, MQL4 is easier to learn.

How important is broker compatibility?

MT4 is more widely supported. If you anticipate working with smaller brokers or require maximum compatibility, MT4 may be safer.

Do you prefer a leaner interface?

If simplicity is key, MT4’s interface has fewer menus and options, which can help you focus. MT5’s extra features, while powerful, may be distracting or overwhelming for beginners.

If you are still unsure about the right trading platform, you might want to try both platforms on a demo account. This will allow you to get familiar with each platform and decide which is better for you. Remember that here, at Switch Markets, we provide a non-expiring demo account, which is an account that lets you trade with virtual money without a time limit.

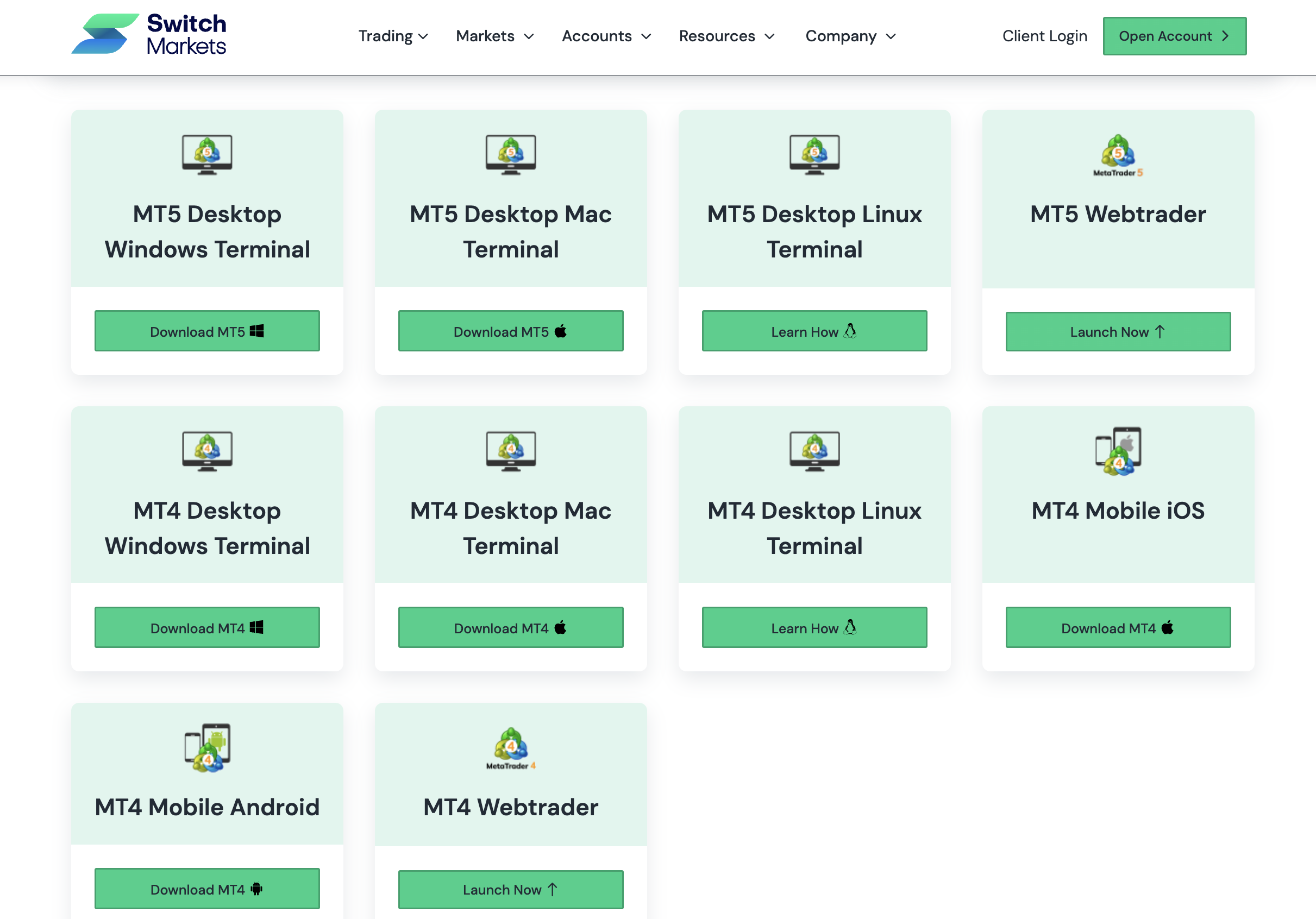

To get started, visit our Trading Platforms page and download MT4 and MT5 on your operating system.

Case‑By‑Case Recommendations

Choosing between MT4 and MT5 isn’t always black and white. So, here are a few case-by-case breakdowns to help you decide.

- Beginner Forex traders: Choose MT4. Its intuitive interface and abundant educational resources reduce the barrier to entry. The hedging capability helps novices experiment with risk management strategies.

- Experienced Forex traders using EAs: MT4 remains an excellent choice if your automated strategies rely on MQL4. However, if you’re ready to build more complex multi‑asset robots, consider MT5 for its advanced programming environment.

- Data‑driven strategists and quant developers: MT5’s multi‑currency back‑tester, partial fills, and comprehensive order book make it better suited for data‑intensive trading.

- Traders using smaller brokers: Choose MT4 to ensure your platform is supported; not all brokers offer MT5.

- Multi‑asset traders: Opt for MT5. It supports a wider range of markets and offers tools like DOM, extra timeframes, and integrated news, enabling more informed decisions across diverse instruments. For instance, here's the difference in asset selection between MT4 and MT5 on Switch Markets.

Bear in mind that, in addition to getting MT4/MT5, Switch Markets' clients can also get free access to PineConnector, a tool that bridges TradingView and MetaTrader 4/5. For more information, you can visit our guide on how to use PineConnector, and claim your free access to PineConnector by clicking on the link below.

Final Thoughts

In sum, MT4 and MT5 are both powerful trading platforms, and neither is inherently “better” in every situation. MT4’s longevity and simplicity make it ideal for Forex traders and beginners, while MT5’s advanced features cater to traders who demand more instruments, more order types, and deeper analytical capabilities.

Choosing the right platform depends on how you plan to use these trading tools to execute your strategy. By understanding the key differences summarised above and assessing your own needs, you can choose the platform that best supports your trading journey.

If you are still unsure, it's advisable to test both platforms on a demonstration account. This will help you get familiar with each platform and make the best decision for your trading career.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.