How a Cent Account Can Level Up Your Trading Skills

- What is a Cent Account?

- Why Cent Accounts Are the Ultimate Training Ground for Skill Development

- What Makes Cent Accounts Different from Standard Trading Accounts

- Why a Cent Account is Better than a Demo Account

- How to Open a Cent Account on Switch Markets - Step-by-Step Guide

- Common Mistakes to Avoid When Using Cent Accounts for Learning

- When and How to Transition from Cent to Standard Accounts

- Final Word

- FAQs

- What’s the minimum amount needed to start trading with a cent account?

- How long should I stay in a cent account before transitioning to a standard account?

- Are spreads higher on cent accounts compared to standard accounts?

- Do Cent accounts have the same trading tools, asset selection, and platforms as standard accounts?

- Is it possible to lose more than my initial deposit in a cent account?

Learning trading presents a classic catch-22: you need real market experience to develop skills, but gaining that experience traditionally means risking significant capital that beginners can’t afford to lose. This dilemma has kept countless aspiring traders stuck in demo accounts that fail to replicate real market psychology, or worse, jumping straight into standard accounts where a few bad trades can wipe out months of savings.

The solution? The cent account - a specialized trading account that bridges the gap between risk-free demo trading and high-stakes live trading. By denominating your balance in cents rather than dollars, cent accounts provide the authentic trading experience you need to develop genuine skills without the fear of losing significant capital.

In this comprehensive guide, you’ll discover how Cent accounts offer the ideal training environment for skill development, what makes them different from standard trading accounts, and exactly how to leverage them to accelerate your journey from novice to profitable trader.

What is a Cent Account?

A cent account is a specialized CFD and forex trading account where your account balance and all transactions are displayed in cents instead of dollars. The mechanics are straightforward: when you deposit $50 into a cent account, your trading platform shows a balance of 5,000 cents rather than $50.

This isn’t just a cosmetic change; it fundamentally alters how you approach position sizing and risk management. Your trades are executed using the same trading platforms, charts, and market access as standard accounts, but with dramatically scaled-down position sizes that make learning affordable and less stressful.

The key advantage lies in accessibility. While forex cent accounts typically require minimum deposits of just $1 to $10, standard accounts often demand $100 to $1,000 or more to get started. This low barrier to entry allows aspiring traders to begin their trading journey with minimal financial exposure while gaining experience in real market conditions.

Reputable brokers like Switch Markets offer cent accounts through popular trading platforms like MetaTrader 4 and MetaTrader 5. The account uses the same infrastructure and technology as standard accounts, ensuring you’re learning on professional-grade trading tools that you’ll use throughout your trading career.

Why Cent Accounts Are the Ultimate Training Ground for Skill Development

Cent accounts transform how you learn forex trading by creating a realistic yet low-risk environment that eliminates the psychological barriers preventing skill development. Unlike demo accounts that use fake money, cent accounts force you to confront real emotions and market dynamics while keeping financial exposure minimal.

The psychological impact cannot be overstated. When you’re trading with real money, even small amounts, your brain processes wins and losses differently than demo trading. This authentic emotional response helps you develop the psychological resilience and decision-making discipline essential for profitable trading.

Micro lot trading precision represents another crucial advantage. In standard accounts, the smallest position size is typically 0.01 lots, representing $1,000 worth of currency. Cent accounts allow you to trade with 0.01 lots, representing just $10 worth of currency, enabling precise risk management skill development without requiring large capital.

The reduced financial risk environment serves as a safety net specifically designed for novice traders. Rather than learning forex trading while simultaneously managing anxiety about potential losses, you can focus entirely on building skills, understanding market dynamics, and developing emotional control. This focused learning approach accelerates skill acquisition by removing the paralyzing fear of significant financial loss.

Cent accounts also enable strategy testing with real market conditions. You can test new trading strategies and expert advisors without the artificial constraints of demo accounts or the high stakes of standard accounts. This real-world validation helps you identify which trading techniques align with your personality and market understanding before committing substantial capital.

What Makes Cent Accounts Different from Standard Trading Accounts

There are several differences between a Cent account and a Standard trading account:

Denomination and Scale

The fundamental difference between cent accounts and standard accounts lies in denomination and scale. While a standard account displays your $100 deposit as $100, a cent account shows the same deposit as 10,000 cents. This scaling affects every aspect of your trading experience, from position sizes to profit calculations.

Position Sizing

Position sizing differences create the most significant practical impact. For example, in standard accounts, a 0.01 lot trade in EUR/USD represents $1,000 worth of currency with a pip value of approximately $0.10. In cent accounts, that same 0.01 lot represents $10 worth of currency with a pip value of $0.001. This 100-fold reduction makes it possible to learn proper position sizing techniques without risking substantial amounts.

Entry Barrier

The entry barriers differ dramatically between account types. Cent accounts offer minimum deposits as low as $1, making forex trading accessible to virtually anyone interested in learning. Standard accounts typically require minimum deposits of $100 to $1,000, creating a significant financial hurdle for many aspiring traders.

Leverage

Leverage options remain similar between account types, but the practical impact differs significantly. While both account types may offer 1:1000 leverage, the smaller position sizes in cent accounts mean you’re less likely to over-leverage your account accidentally. A 0.01 lot trade with $10 position value is much easier to manage psychologically than a $1,000 position.

Spread, Commission, and Execution Speed

Spread costs and execution speed represent areas where cent accounts may have slight disadvantages. Brokers sometimes offer wider spreads on cent accounts to compensate for lower trading volumes and account sizes. However, these differences are generally minimal and acceptable given the educational benefits Cent accounts provide.

Why a Cent Account is Better than a Demo Account

Demo accounts create a false sense of security by removing the emotional element that drives real trading decisions. Without genuine financial risk, demo trading fails to replicate the fear, greed, and pressure that influence actual trading performance. It is not uncommon to hear new traders making substantial gains in a demo account just to lose funds quickly on a live account. Cent accounts solve this problem by introducing real financial consequences while keeping risk exposure minimal.

Real market execution provides authentic trading conditions that demo accounts cannot match. Demo platforms often show perfect order execution with no price slippage or requotes, creating unrealistic expectations about trading performance. Cent accounts expose you to actual spread variations, execution delays, and market volatility that you’ll encounter in all live trading environments.

What's more, the emotional authenticity of cent account trading proves invaluable for psychological development. When you experience a losing streak with real money, even small amounts, you develop genuine coping mechanisms and emotional control techniques. You learn how to face situations like trading on tilt, when emotions take over discipline and decision-making. Demo account losses feel inconsequential, preventing the development of crucial psychological skills needed for consistent profitability.

Building authentic trading confidence requires real profit and loss outcomes. A trader who consistently profits on demo accounts may still fail spectacularly when transitioning to live trading because they haven’t developed real market psychology. Cent accounts bridge this gap by providing genuine market experience with manageable financial exposure.

Also, broker reliability testing becomes possible with cent accounts in ways that demo accounts cannot provide. You can evaluate order execution quality, platform stability during volatile market conditions, and customer service responsiveness without risking significant capital. This real-world broker evaluation helps you make informed decisions about which trading platforms to use as your account size grows.

Ultimately, the transition from cent to standard accounts becomes seamless because you’ve already mastered real market trading. Rather than making a psychological leap from demo to live trading, you’re simply scaling up your proven profitable approach.

How to Open a Cent Account on Switch Markets - Step-by-Step Guide

Opening a cent account on Switch Markets follows a straightforward process designed to get you trading quickly while maintaining proper regulatory compliance. Switch Markets offers competitive cent account conditions with low minimum deposits and access to professional trading platforms.

Here’s what you need to do to get started:

Step 1: Sign Up for an Account

First, navigate to the Switch Markets Sign Up page and enter your personal details. This includes details such as your full name, date of birth, contact information, and residential address. On this step, you are also required to submit identification documents to verify your identity.

Once this is done, you’ll get an email to be transferred to the Switch Markets’ Client Cabinet.

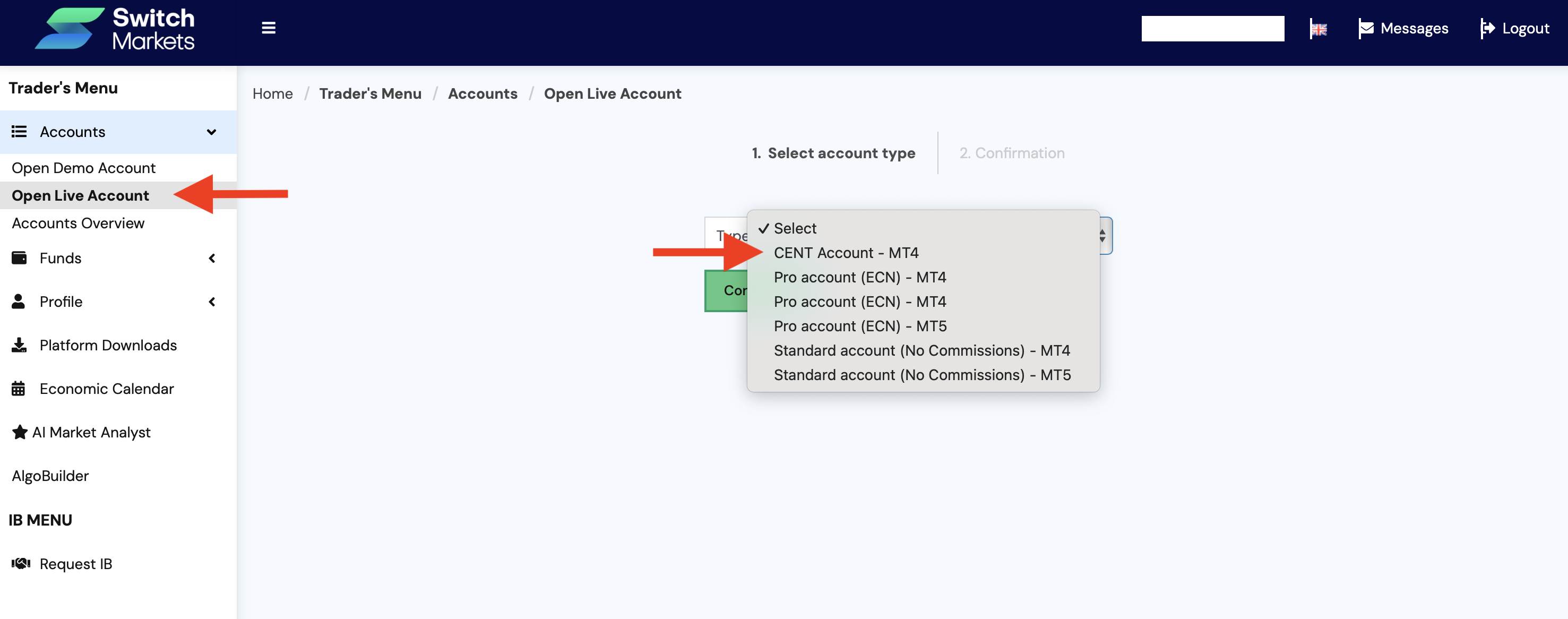

Step 2: Choose Account Type

In the client terminal, navigate to the Open Live Account and select “Cent Account” from the available account options. Take note that the Switch Markets Cent account is only available on MetaTrader4.

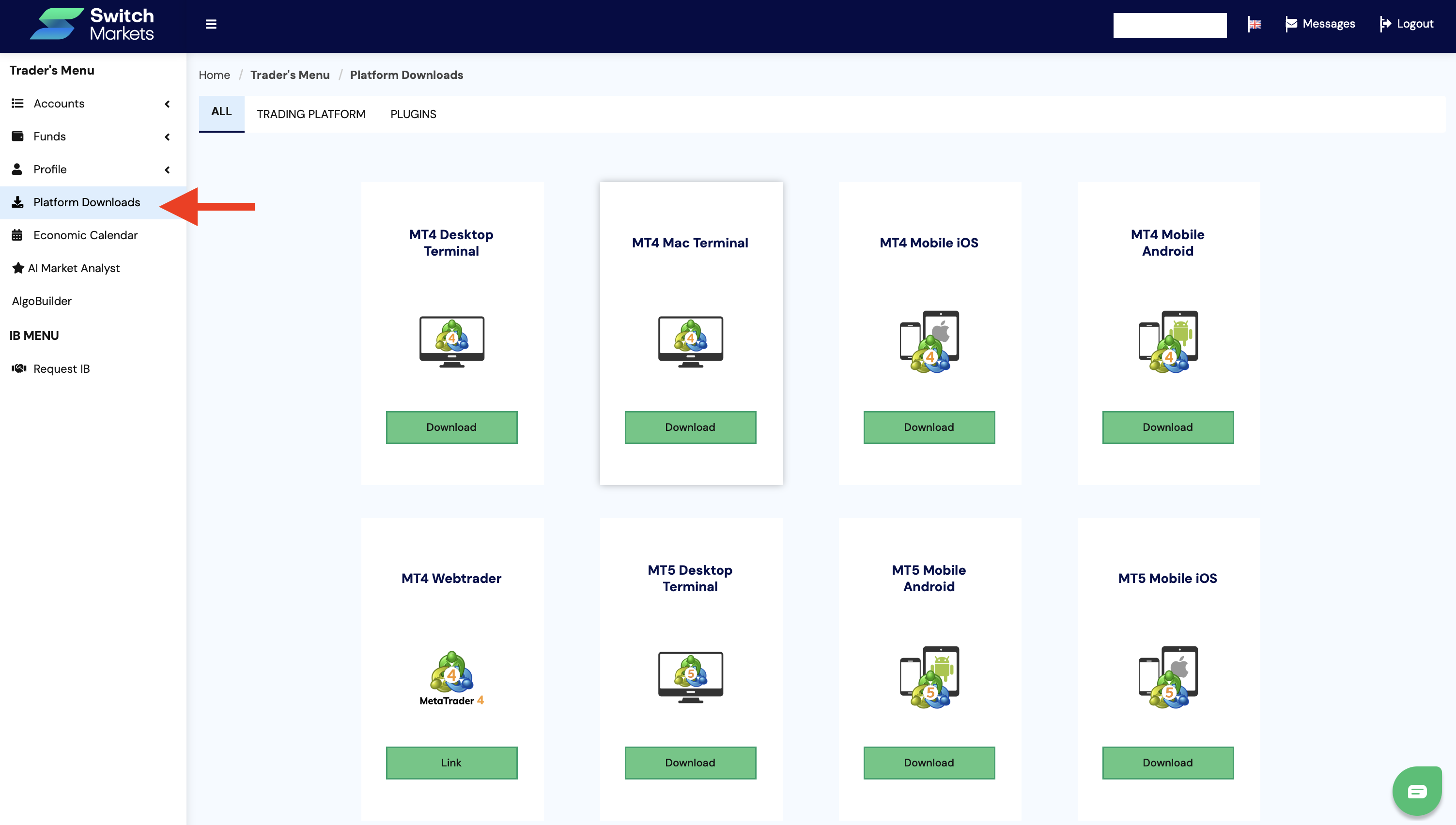

Step 3: Download MT4 Trading Platform

Next, navigate to the Platform Downloads tab on the left-side menu, and download the platform that works on your desktop/mobile operating system.

Step 4: Make Initial Deposit

Fund your Cent account using available payment methods. Switch Markets offers a huge variety of payment options, including the ability to fund your account using Bitcoin and other cryptocurrencies.

Step 5: Configure Account Settings and Start Trading

Now, set up your trading environment, including chart preferences, risk management tools, and any expert advisors you plan to use. Familiarize yourself with the platform’s cent account-specific features, and place your first order in the market.

Common Mistakes to Avoid When Using Cent Accounts for Learning

The most dangerous mistake traders make with cent accounts is treating them carelessly because the monetary amounts seem insignificant. This casual approach defeats the primary purpose of cent accounts, which is to develop proper trading discipline and risk management techniques that translate to larger accounts.

Over-leveraging beyond reasonable limits represents another critical error that undermines skill development. While cent accounts may offer leverage up to 1:1000, experienced traders recommend never exceeding a 1:10 leverage ratio regardless of what’s available. High leverage creates unrealistic profit expectations and poor risk management habits that become difficult to unlearn later.

Many traders fall into the trap of staying in cent accounts too long, developing what’s known as a “small money mindset.” This psychological barrier makes it difficult to transition to standard accounts because traders become comfortable with small position sizes and minimal financial pressure. The goal should be graduating to larger accounts once consistent profitability is demonstrated, not permanent cent account trading.

Another common mistake involves using Cent accounts to gamble rather than learn. The low monetary stakes can encourage reckless trading behavior, experimental strategies, and poor decision-making that would never be acceptable on larger accounts. Maintaining professional trading standards regardless of account size ensures that skills developed translate effectively to larger capital management.

Lastly, failing to maintain detailed trading records represents a missed learning opportunity. Because cent account trades involve small amounts, traders sometimes skip journaling and performance analysis. However, developing systematic record-keeping habits on cent accounts establishes crucial practices needed for professional trading success. For that reason, we suggest using our free-to-use trading journal template, where you can record and monitor your trading performance.

Download Our Free Trading Journal Template

When and How to Transition from Cent to Standard Accounts

A common question many novice traders ask is when to move to a standard account. So, the transition from cent accounts to standard accounts should be based on demonstrated competence rather than arbitrary time periods or account balance milestones. The key indicator for readiness is consistent profitability maintained over at least 3 months with positive expectancy in your trading approach.

Performance metrics that indicate readiness include:

Crucially, the transition process should be gradual rather than immediate. This progressive scaling allows you to adjust to larger position sizes and increased financial pressure without overwhelming psychological stress.

For instance, risk management principles must remain constant during the transition. The same 2% risk per trade rule that worked on your cent account should continue unchanged, whether you decide to trade on a standard account or an ECN account. Many traders make the mistake of increasing risk percentages when moving to larger accounts, believing bigger accounts require more aggressive approaches.

You should also maintain the same trading strategies and techniques that generated consistent profits on your cent account. The only change should be position sizing. If you profitably traded 0.01 lots on a cent account, you can confidently trade 0.01 lots on a standard account. The market dynamics remain identical; only the monetary consequences per pip movement increase.

It is also advisable to consider keeping a small cent account active even after transitioning to standard accounts. This provides a low-risk environment for testing new strategies or trading during high-volatility events without impacting your primary trading capital. Many experienced traders maintain multiple account types for different purposes throughout their trading careers. This can also be done on a demo account, as long as the broker (like Switch Markets) offers a non-expiring demo account.

Eventually, the psychological adjustment period may take several weeks as you adapt to larger potential profits and losses. This is normal and expected. The key is maintaining the same disciplined approach that generated success on your cent account while allowing time for emotional adaptation to larger monetary stakes.

Final Word

In sum, Cent accounts represent the ideal bridge between theoretical knowledge and practical trading success, offering the authentic market experience needed for skill development without the financial risk that destroys most beginner accounts. By transforming your deposit into cents and enabling micro lot trading, these specialized accounts create a realistic training environment where you can develop genuine trading competence.

The path from novice to profitable trader doesn’t require risking substantial capital or enduring devastating losses. Cent accounts provide everything needed to master risk management, develop emotional control, and validate day trading strategies in real market conditions. The minimal financial barriers make professional-grade forex education accessible to anyone committed to learning proper trading techniques.

Your trading journey begins with a single step. Opening a cent account and committing to disciplined skill development. Start with a modest capital and treat every trade as seriously as you would with a larger account. The habits and skills you develop in this low-risk environment will serve as the foundation for a lifetime of profitable trading.

FAQs

Here are some common questions regarding a Cent trading account:

What’s the minimum amount needed to start trading with a cent account?

On Switch Markets, a minimum deposit of $50 is required to open a cent trading account.

How long should I stay in a cent account before transitioning to a standard account?

There’s no fixed timeframe, but most traders benefit from 3-6 months of consistent profitability before transitioning. Focus on demonstrating sustained positive performance rather than arbitrary time periods.

Are spreads higher on cent accounts compared to standard accounts?

Some brokers may offer slightly wider spreads on cent accounts to compensate for lower trading volumes. However, the difference is typically minimal and acceptable given the educational benefits and risk reduction.

Do Cent accounts have the same trading tools, asset selection, and platforms as standard accounts?

Yes, normally, there are some limitations on a cent account compared to standard accounts. For instance, the Switch Markets cent account is only available on MT4, and allows traders to trade 38 popular assets. However, all of the other free tools provided by Switch Markets are available on a Cent account. These include the free VPS, PineConnector, Algo Builder, free EAs, and many more.

Is it possible to lose more than my initial deposit in a cent account?

No, reputable brokers like Switch Markets offer negative balance protection, preventing your account from falling below zero. This safety feature ensures you cannot lose more than your initial investment, making cent accounts ideal for learning risk management.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.