How to Start Trading Forex: The Full Beginners Guide

- What is Forex Trading?

- How Does Forex Trading Work?

- What is Leverage in Forex Trading?

- What Are Swap Rates in FX Trading?

- What Drives the Value of FX Currency Pairs?

- Ways to Analyze FX Currency Pairs

- How to Read Forex Trading Charts?

- Who Trades Forex?

- Forex Market Structure

- What Are CFDs in Forex?

- The Forex Jargon - Forex Trading Terms That Every Trader Should Know

- Currencies and Currency Pairs Nicknames

- Trading Sessions in the Forex Market

- Basic Forex Trading Strategies for Beginners

- The Psychology of Trading in the Forex Market

- How Is Forex Trading Taxed?

- How to Get Into Forex Trading

- Forex Trading Tips for Beginners - Key Things You Need to Know

- Final Word

- FAQs

- Is forex trading profitable?

- How to open a real trading account on MetaTrader4/5?

- Is forex trading good for beginners?

- Do you need a forex broker to trade currency pairs?

- What is copy trading in Forex?

- How’s the forex market regulated?

- How to trade news in forex?

- Can you make a living from trading forex?

- What is the minimum capital required to start trading forex?

- What’s the best way to trade FX currencies?

- Is Forex trading halal?

- What is a margin call in forex trading?

In its most basic sense, the forex market has been in existence in various forms since money was created and exchanged. Throughout history, humans have always exchanged commodities, coins, and paper money to buy and sell goods, and so they created a financial system where currencies are traded and used to exchange goods.

However, the modern forex market, as we know it today, is quite a new market, particularly the online forex market. Over the last three decades, with the technological revolution and especially since the internet has emerged, forex trading has also become a global network for currency trading where banks, hedge funds, central banks, governments, corporations, and retail investors all exchange forex currency pairs at any given moment. And with that advancement, it is also possible for retail traders to make a living (or at least an additional income) from forex trading.

So, in this article, we’ll cover everything you need to know about forex trading. We'll help you understand the basics of online foreign exchange trading, explain what forex trading is, how it works, provide valuable forex trading strategies, and show you how you can start trading FX currency pairs.

What is Forex Trading?

The Forex market, also known as the Foreign Exchange market, involves the buying and selling of one currency for another. In essence, Forex trading can be done for various purposes, including exchanging foreign currencies for a local currency, buying goods and services in other countries, investing in other regions of the world, etc. Every transaction that includes the exchange of currencies is considered forex trading.

Yet, when referring to online forex trading, the idea is slightly different. With the rise of the internet and technology, a big portion of online forex trading is made for speculative purposes and the goal of making profits. In other words, it is a form of speculative trading in which traders exchange one currency for another in order to potentially make revenue. As a matter of fact, it is estimated that nearly 90% of the volume in the currency market is executed by speculators.

How Does Forex Trading Work?

Unlike shares and futures markets, FX currency trading does not take place on any regulated exchange. Instead, forex exchange trading takes place between banks in what is called ‘over- the-counter (OTC) market or interbank market. This global network of banks creates a 24-hour, 5-day-a-week market with no central location and no centralized exchange.

In forex trading, there are three types of FX currency pairs - majors, minors, and exotic. Major currency pairs account for around 80% of the total volume in the forex market and include the EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, AUD/USD, and NZD/USD.

Minor currency pairs are a combination of any currency pairs from the major currencies that do not include the US dollar (EUR/GBP, GBP/JPY, AUD/GBP, etc). Exotic currency pairs are combinations of a major currency with the currency of an emerging country or a currency of a less developed or strong economy. For example, EUR/TRY, USD/SEK, GBP/HKD, etc.

All FX currencies are always traded in pairs, meaning you buy one currency and sell another. Each currency has its own symbol or code. For instance, the code for the Japanese Yen is JPY, and for the Australian dollar is AUD.

A forex pair is made up of a base currency, which is the first currency, and the quoted currency, which is the second currency. For example, if we take the British Pound versus the US Dollar (GBP/USD), the base currency is the British pound, while the quoted currency is the US dollar.

The smallest price movement in a currency pair is known as a pip, short for "percentage in point.” A pip in forex normally refers to the fourth decimal point of a price change, although in some other currency pairs, it may represent the second or third and sometimes the fifth decimal point of a price change (i.e., USD/JPY).

For example, let’s say the EUR/USD moves from 1.1200 to 1.1201; it basically means the currency price changed by 1 pip.

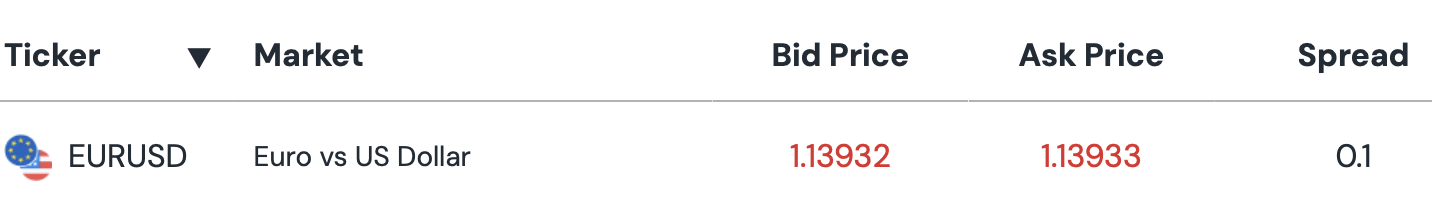

Each currency pair also has a spread, which is simply the difference between the buying and selling prices or bid and ask. The spread differs between forex brokers and is based on the type of market execution the forex broker offers (ECN/STP, market maker, etc).

For instance, a Forex currency pair quote can look like this:

You can see a live FX quote for EUR/JPY above. As you can see, there’s a spread between the buy and sell prices. The price at which you purchase the base currency is called the "bid," while the price at which you sell it is the "ask." Together, these prices form the bid-ask spread.

Every currency is influenced by factors like interest rates, economic data, geopolitical events, and market sentiment. Traders use this data with the help of various tools and analysis methods to buy and sell currency against another one. For example, a trader can speculate that the USD is likely to weaken over the near future, buying the EUR against the US dollar. That is, how forex trading works.

To better understand how the forex market works, you can view all major currency pairs in the screener below:

What is Leverage in Forex Trading?

One of the main attractions of online forex trading is the high leverage provided by retail forex brokers. For those unaware, leveraged trading (also known as margin trading) is a trading mechanism in which a trader borrows funds from the brokerage firm in order to be able to trade with a larger amount of capital than initially deposited.

For example, suppose you want to trade $10,000 worth of EUR/USD, but you only have $1,000 in your account. With 10:1 leverage, your broker allows you to control a position 10 times larger than your capital.

Your investment: $1,000

Leverage: 10:1

Total position size: $10,000

With leverage, traders can basically generate high returns with a relatively small investment. That is one of the main reasons why many are so attracted to forex trading. Forex trading is the ideal market for beginners since traders can start trading with a fairly low initial deposit, and still learn the markets and engage in short-term trading.

Since brokers often partner with liquidity providers or banks, they can pass on leveraged trades to the market or internalize them depending on their model (STP/ECN vs. market maker). This is because forex and CFD trading are being treated as derivative markets.

Top online forex brokers offer forex trading with a leverage ratio of 50:1 to 1000:1 to allow traders to increase the size of their positions. Here, at SwitchMarkets, we offer a leverage ratio of up to 500:1 on major and minor currency pairs, which requires a trader to use only 0.2% of the account balance to be able to open a position. Take note, however, that at Switch Markets, leverage is provided in accordance with client classification. Retail clients can trade with leverage of up to 1:30, in line with regulatory guidelines, while professional clients, upon approval, can access higher leverage of up to 1:500. We also offer a dynamic leverage feature that automatically adjusts your leverage based on the size of your open positions, helping you manage risk more efficiently as your exposure increases.

The Risk of Leverage in Forex Trading

Although leverage is a huge benefit in forex trading, it is important to note that the higher the leverage you use, the higher the risk. When you are using a high leverage ratio, it essentially means you increase the chances of making high profits, but at the same time, you also increase the risk involved in trading the forex markets. In short, leverage is a double-edged sword.

For example, a leverage ratio of 100:1 requires a margin of only 1%. So, with a position size of $1,000, you would be able to control $100,000. This means that a value of one pip is equal to $10, and if the market goes against you by 100 pips, then you’ll automatically exit the trade (unless you deposit more funds). So, the best solution is to use a leverage ratio that you can deal with and feel comfortable when trading. In addition, in order to know your exit level and where to set your stop-loss, you can use tools like Forex Profit Calculator and Lot Size Calculator.

What Are Swap Rates in FX Trading?

Swap rates play a crucial role in forex trading. This cost, which is essentially the fee a trader must pay or receive in order to hold an open position overnight, is a key factor every trader must know about, learn how to calculate, and know its impact on a P&L.

At the basic level, the swap rate, also known as a rollover swap fee, rollover swap, or swap rate, is the interest payment that a trader may receive or pay when holding a position overnight.

Over time, swap rates can add up to bring significant profit or loss, especially for long-term investors. Therefore, it is important for traders to find out if their broker provides any details regarding the swap (overnight) fees. For example, at Switch Markets, we have a detailed page of all the swap rates for taking a long or short position. Furthermore, to help our traders understand ahead of time their costs for holding a position overnight, we also provide a Forex Swap calculator.

To learn more, you can visit our guide on CFD rollovers.

What Drives the Value of FX Currency Pairs?

Clearly, the most intriguing part of forex trading is what makes one currency strengthen versus the other. What drives the market, and how can you, as a retail trader, identify these price movements?

Currencies are traded in pairs, which means the value of a currency pair is determined by the strength or weakness of one country versus the other. As such, you need to evaluate the economic performance of one versus the other and, according to this data, make a decision to buy or sell a certain currency versus the other.

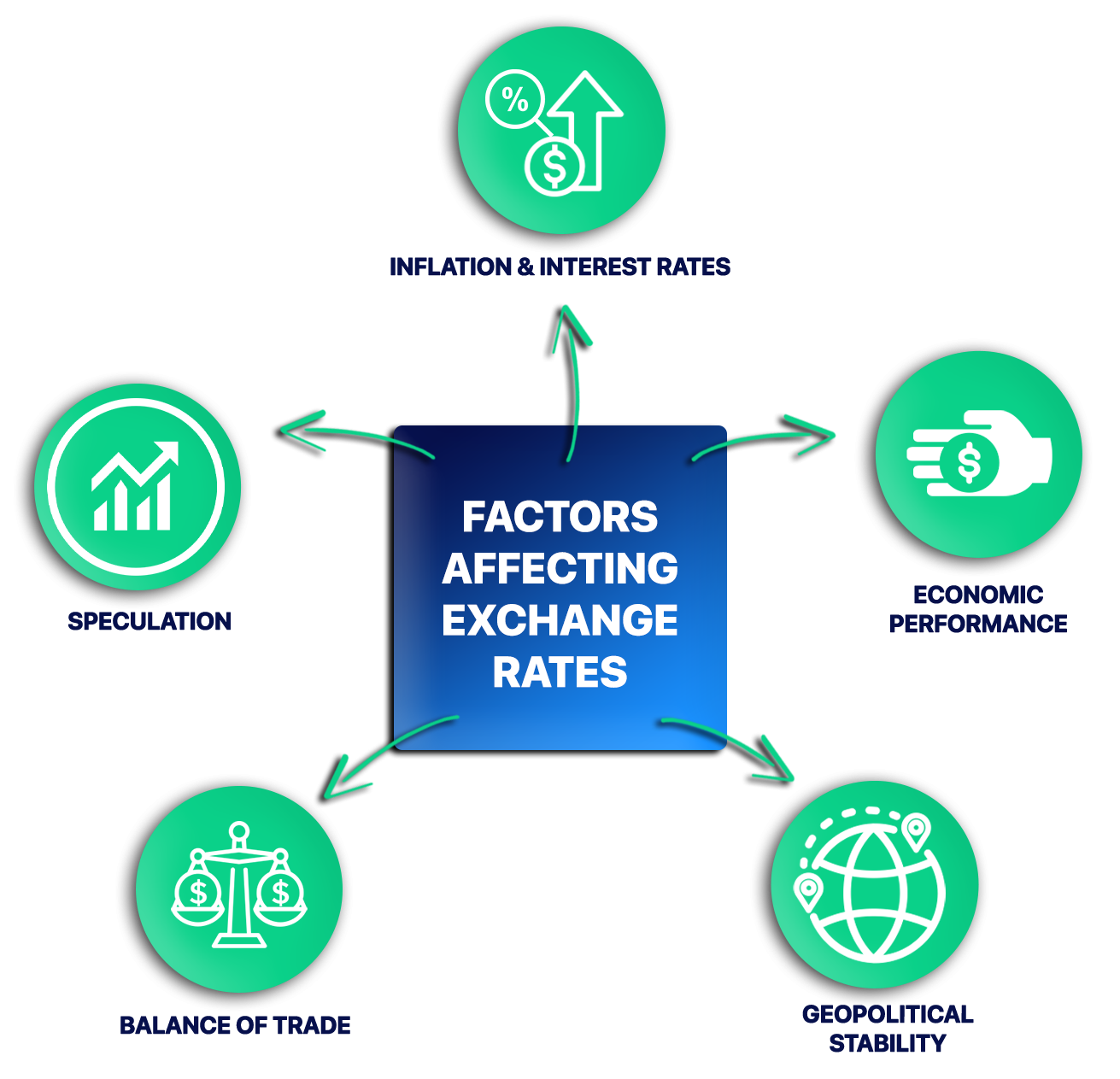

Here are the main factors that affect the value of FX currency pairs:

- Inflation and interest rates - The number one factor that has a direct impact on the value of currencies is interest rates maintained by the country’s central bank. Simply put, when there’s an interest rate differential (IRD) between two currencies in a pair, investors will prefer to invest in the currency with higher interest rates and sell the one with the lower interest rate - a trading strategy known as carry trade.

- Economic Performance - A country's economic performance is an early indicator of an interest rate hike and, thus, an increase in the value of its currency. Therefore, economic Data such as GDP, CPI, exports, and imports, etc, are all crucial and ultimately affect the currency’s value.

- Geopolitical Stability - The political state of a country is a major factor in a country’s economic growth and can affect the value of its currency. So, situations like war conflict, Brexit, elections, political instability, protests, etc, have a direct impact on a currency.

- Balance of Trade - Balance of trade, also known as net exports, is the difference between the value of a country’s exports and imports. The meaning of a positive trade balance is that a country's total exports exceed imports, and thus, the demand for its local currency rises.

- Speculation - At last, the forex market is extremely speculative. It is estimated that speculators fuel 90% of the total volume in the forex market. So, very often, the main reason for a movement of a certain currency pair is simply a market trend and the growing demand from investors to make profits.

Ways to Analyze FX Currency Pairs

As a beginner in forex trading, you must recognize the different methods used by traders to analyze the currency market. For that, there are two common and widely used techniques to analyze currency pairs' price movements - those are technical and fundamental analysis. These techniques enable traders to get some clues about a certain market, either by using a chart showing prices or by reading the news and analyzing economic data. Remember that trading is a lot about predicting the future.

You should note that while some traders use only one method of analysis, others prefer to combine fundamental and technical analysis to determine entry and exit levels. No matter what, you need to at least have a basic understanding of both methods. In the best scenario, you can become an expert at one of the techniques or find the ideal way to combine the two.

Let’s quickly understand how each method works:

Fundamental Analysis

In forex trading, fundamental analysis examines economic conditions influencing a country's currency value. Key indicators such as Gross Domestic Product (GDP) and the Consumer Price Index (CPI) offer valuable insights into the nation's economic health. This method aims to evaluate a country's economic situation and, as such, determine whether its currency is likely to strengthen or weaken.

Unlike technical analysis, a fundamental analysis attempts to measure the intrinsic value of a currency pair based on economic factors and financial outputs. Consequently, a trader who analyzes a currency pair based on this approach will look at economic data published on the economic calendar, political events, market news, central bank announcements, and changes in interest rates.

Technical Analysis

Technical analysis is a trading technique that attempts to help a trader predict the price movement of an asset by using historical data and technical indicators displayed on charts.

The theory of technical analysis is that past trading activity can help a trader predict future price movement since markets tend to move in a repetitive pattern. Also, according to technical analysis traders, all the data is displayed in the chart, and if a trader knows how to effectively read a trading chart, it is enough to be able to analyze the market and determine entry and exit levels.

How to Read Forex Trading Charts?

If you’ve read this far, there’s a high chance you’re interested in technical analysis. If that’s the case, then you need to know how to read forex trading charts.

A forex chart visually represents the price movements of a currency pair over a specific period. This means that if you want to know how the British Pound performed versus the Japanese Yen for a given period, you can get this information on a trading chart. Here's what a trading chart of GBP/JPY looks like on TradingView, one of the most popular trading platforms:

Learning to read these charts can help you analyze market trends and identify potential trading opportunities.

The forex chart looks like a graph, and it consists of two primary axes:

- The X-Axis (Horizontal Axis): This represents time. Depending on the timeframe you select, it can display minutes, hours, days, or even weeks. The X-axis helps you analyze how price movements evolve over time and identify historical trends.

- The Y-Axis (Vertical Axis): This represents the price of the currency pair. As prices fluctuate, the Y-axis records these changes, allowing traders to gauge how much a currency pair has moved within a given timeframe.

Understanding these axes is fundamental, as they provide the framework for analyzing price movement over different time intervals.

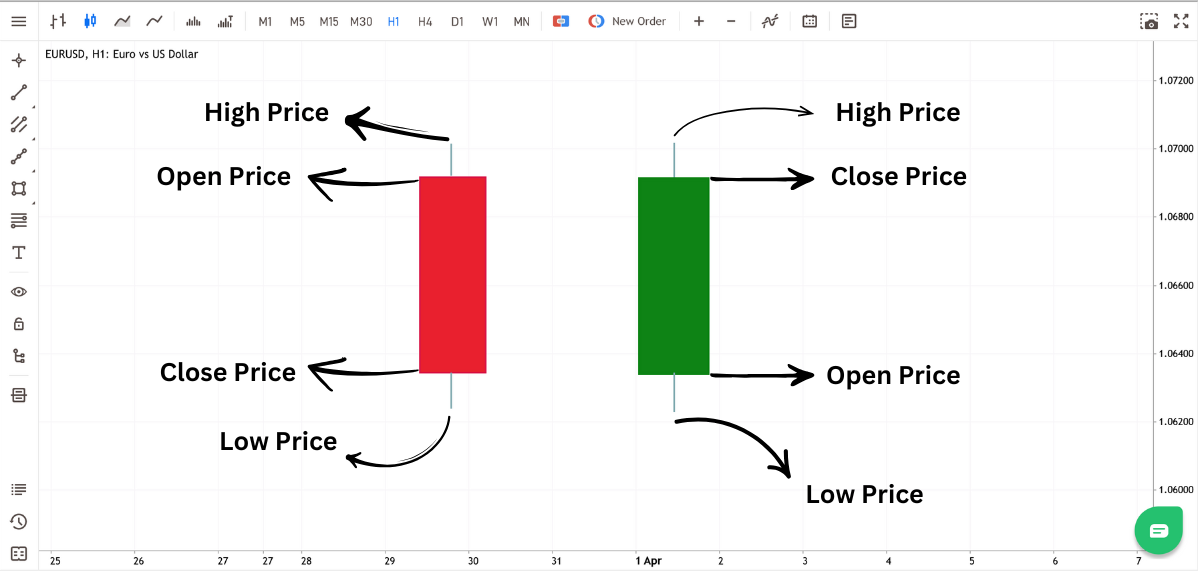

Candlestick Formation and Its Importance

When it comes to how price itself is displayed on a chart, there are different types of visualizations, from line chart to bar chart, Renko chart to mountain chart, and so on.

However, most forex traders primarily use candlestick charts to analyze market movements. These charts provide a clearer and more detailed representation of price action compared to line or bar charts.

As seen above, each candlestick represents a specific time period. For instance, if you are on the 5-minute timeframe, one candlestick contains price information for 5 minutes. The same goes for any other timeframe you choose.

A candlestick usually consists of four key components:

- Opening Price: The price at which the currency pair started trading during the selected time period.

- Closing Price: The price at which the currency pair finished trading during the same period.

- High Price: The highest price reached during the time period.

- Low Price: The lowest price reached during the time period.

Each candlestick also has a body and wicks (shadows):

- The body of the candlestick is the range between the opening and closing prices.

- The wicks (or shadows) extend from the body and indicate the high and low prices during the period.

- A bullish candlestick (typically green or white) signifies that the closing price was higher than the opening price, meaning the price increased.

- A bearish candlestick (typically red or black) indicates that the closing price was lower than the opening price, meaning the price decreased.

Candlestick patterns can also signal potential market reversals or continuations. Common patterns include doji, engulfing patterns, and hammer formations, all of which provide you with critical insights into future price movements.

Choosing the Right Timeframe for Trading

One other thing you should know about forex charts is that they can be viewed in different timeframes, depending on the trader’s strategy and goals. Each timeframe displays price movements over a specific period:

- Short-term traders (scalpers & day traders): Use 1-minute (M1), 5-minute (M5), and 15-minute (M15) charts to capture quick price movements and small profits within a single trading session.

- Swing traders: Prefer 1-hour (H1), 4-hour (H4), and daily charts to identify medium-term trends and execute trades that last a few days.

- Long-term traders (position traders & investors): Analyze daily (D1), weekly (W1), and monthly (M1) charts to identify significant trends and hold positions for weeks, months, or even years.

Selecting the right timeframe depends on the trader’s trading style, risk tolerance, and market conditions.

Technical Indicators and Tools for Forex Charts

Technical indicators help traders analyze market trends and predict price movements. Some of the most commonly used indicators include:

Moving Averages (MA)

Moving Averages are popular indicators that smooth out price fluctuations to help traders identify trends. There are two main types:

- Simple Moving Average (SMA): A basic average of past prices over a selected period.

- Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to current market conditions.

Here's what an exponential moving average (EMA) looks like on a price chart:

Traders use MAs to determine trend direction and identify potential buy or sell signals when prices cross these averages.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and helps traders identify overbought (above 70) or oversold (below 30) market conditions.

Traders using the RSI see the overbought region as an area where the buyers are exhausted and the sellers are stepping in, making it a signal for a bearish reversal. On the other hand, they view price in an oversold region as a bullish reversal signal.

Bollinger Bands

Bollinger Bands consist of three lines: the middle line (SMA), the upper band, and the lower band.

These bands expand during high volatility and contract during low volatility. Traders use them to spot potential breakouts and reversals.

Learning how to read a forex trading chart is crucial because it's the foundation of making informed trading decisions. Charts visually represent currency price movements over time, allowing traders to spot trends, identify key levels, and time their entries and exits effectively.

Who Trades Forex?

Forex (foreign exchange) markets are traded by a wide variety of participants:

- Banks and financial institutions - Major global banks form the core of the forex market, both trading for clients and for their own accounts.

- Central banks - Trading to implement monetary policy and manage currency reserves.

- Investment managers and hedge funds - Managing portfolios and speculating on currency movements.

- Corporations - Hedging currency risk in international business.

- Retail traders - Individual investors who trade through brokers or trading platforms.

- Proprietary trading firms - Companies that trade exclusively with their own capital.

- Money transfer companies - Converting currencies as part of their business model.

- Automated trading systems - Algorithm-based trading that executes based on programmed conditions.

The forex market is the largest financial market in the world, with daily trading volumes exceeding $7.5 trillion. It's particularly attractive because of its high liquidity, 24-hour trading (except weekends), and the ability to use leverage.

Forex Market Structure

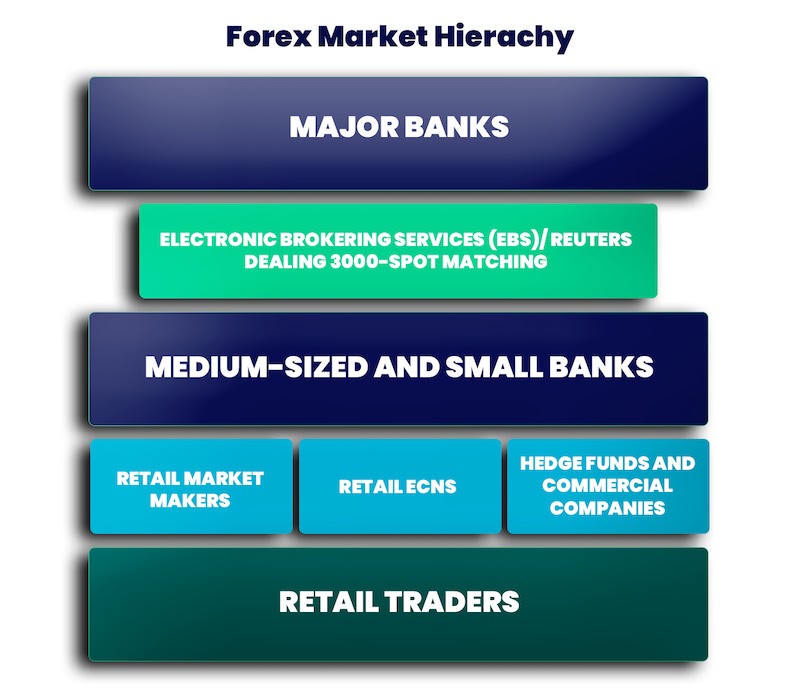

The forex market is different from any other market in the sense that it is decentralized and has no major exchange. Ironically, it works the same as the cryptocurrency market. The only difference is that FX currencies are not decentralized (as they are controlled by central banks and governments), while digital assets like Bitcoin, Ethereum, and other altcoins are, in fact, decentralized.

Regardless, the way the forex market structure works is quite impressive. There’s huge competition in this giant global marketplace, and quotes essentially vary from one dealer to another. At its most basic, this global decentralized over-the-counter (OTC) market enables any person on the planet to buy and sell currencies at any given moment.

In terms of market structure, major banks are at the top of the forex market hierarchy. They are responsible for creating the interbank market, which is basically a huge global network where banks trade currencies and provide exchange rates. Next, the exchange rates are transferred to electronic brokering services such as EBS or Reuters, dealing with 3000 spot-matching, and from there to medium- and small-sized commercial banks. Finally, retail market makers, ECN brokers, hedge funds, investment banks, and information data websites extract quotes and allow retail traders to view and trade currencies.

What Are CFDs in Forex?

Forex trading can be done in various forms, including through banks, dealers, and online brokers. Any individual, for example, can visit a money exchange store or contact the bank to buy a currency and sell the other. This form of forex trading is also known as no-leverage forex trading since you are trading FX pairs without any leverage.

However, CFDs, which are a popular form of trading derivative products, provide an ideal way to get access to forex trading.

So first, what exactly are CFDs? A Contract for Difference (CFD) is a financial derivative contract in which two parties agree to speculate on the price of an asset without having to exchange and hold it. For example, when you buy the British pound and sell the US dollar at your local bank, you are essentially transferring currencies, and you make a ‘physical’ exchange. The bank is responsible for transferring GBP to your bank account and transferring your USD to another account.

On the other hand, when trading CFDs, traders can easily speculate on the future price movements of an underlying asset without any hassle of exchanging and holding the currencies and paying high commissions. For more information, you can visit our guide on CFD trading tips.

Some of the pros and cons of Forex CFDs vs Forex include:

- With CFDs, traders can trade with leverage.

- CFDs allow you to trade on both rising and falling markets.

- It is arguably the ultimate way to speculate on FX currencies’ price movements.

- Unlike the conventional forex market, CFDs can be traded 24/5

- Low trading costs

- Access to advanced and user-friendly platforms

- High risk

- CFD Forex brokers charge an overnight fee, meaning it is less suited for long-term positions

- You do not actually own the currencies, meaning you cannot use the currency you bought if you need it.

The Forex Jargon - Forex Trading Terms That Every Trader Should Know

Like any other field or industry, the foreign exchange market has its own terms, words, and slang - or, in other words, jargon. Below, you will find some of the most common terms you need to know to make the first step to get into forex trading, as well as learn how to read the news and trade FX currency pairs.

Pip - A pip stands for ‘percentage in point’ and represents the smallest market price movement of a forex pair. For example, when the US dollar versus the Japanese yen (USD/JPY) moved from 114.00 to 114.01, the currency pair rose by 1 pip. If the USD/JPY jumped from 114.00 to 115.00, then the pair price would change by 100 pips.

Lot Size - In forex, a trading lot size is the size of a position measured in the number of currency units. The standard lot size is equivalent to 100,000 units of currency, and the pip value is calculated according to the size of the position.

Today, most forex brokers offer Standard lot sizes in addition to mini (10,000), micro (1000), and nano (1000). To calculate the right trade size for your forex trade, it is advisable to use a lot size calculator.

The Bid and Ask Spread - A spread in forex is the difference between the currency price at which investors are willing to buy or sell that one currency pair. Whenever you see a quote of a currency pair, you’ll notice a bid and ask price or buy and sell. For instance, the bid quote for the EUR/USD currently stands at 1.13932, and the ask at 1.13933 - a spread of 0.1.

Leverage/Margin - In essence, leverage in the forex markets is the ability to trade currency pairs by using only a fraction of the total funds you have in your account. For example, using a leverage ratio of 100:1, a trader can control a position size of $100,000 by using a margin of just 1%, or $100. However, while leveraged trading enables investors to control larger sizes of positions, it also significantly increases the risks involved in losing money.

Bullish and Bearish Market - The terms bullish and bearish describe the market condition or sentiment of a certain asset/market. A bullish market refers to a situation where the market is rising, while a bearish market refers to a situation where the market is falling. The terms come from the way in which a bull and a bear attack their opponent - a bull attacks in an upward direction while a bear attacks in a downward direction.

Long and Short - In currency trading, long and short are definitely terms you’ll hear frequently. In simple terms, going long means buying an asset, while going short means short-selling an asset. For example, taking a long position in the EUR/USD essentially means you are buying the Euro and selling the US dollar. Short selling the EUR/USD means you are doing the opposite, selling the Euro and buying the US dollar.

Used/Free Margin - On the vast majority of online forex trading platforms, you’ll see tabs for free and used margin. A free margin shows an investor’s money available to open new positions, while a used margin shows the money used for open positions.

Stop Loss and Take Profit - These are two of the most important and widely used market orders in trading. A stop loss is an order to close the position at a certain price in order to limit the potential loss. In that sense, it is also crucial to know how to use a trailing stop loss order, which is essentially a stop loss order that automatically moves in the direction of the market. A take-profit order allows you to set a price at which you wish to close the position at a profit. These are some of the most widely used trading order types that are essential for every trader to know before opening a live account.

Currencies and Currency Pairs Nicknames

If you want to learn how to trade in foreign exchange markets, it might also be helpful to know the nicknames of the most popular individual currencies and FX currency pairs. This way, you can easily read and understand market news and forecasts related to currencies.

Nicknames for Currencies

| US Dollar | Greenback |

| British Pound | Sterling, Quid |

| Euro | Fiber or Single |

| Canadian Dollar | Loonie |

| Australian Dollar | Aussie |

| New Zealand Dollar | Kiwi |

| Swiss Franc | Swissy |

| Norwegian Krone | Noki |

Nicknames for Currency Pairs

| EUR/USD | Fiber |

| GBP/USD | Cable |

| USD/JPY | Ninja |

| EUR/GBP | Chunnel |

| USD/CAD | Loonie |

| USD/RUB | Barnie |

| GBP/JPY | Gopher or Guppy |

| EUR/JPY | Yuppy |

| EUR/RUB | Betty |

Trading Sessions in the Forex Market

Unlike the stock market, the forex market is decentralized and runs 24 hours a day, five days a week, from Monday to Friday. This essentially means that currencies are traded worldwide in four major forex-decentralized exchanges across the globe, including Sydney, Tokyo, London, and New York.

Getting to know the exact times of trading sessions is crucial, as many traders are looking for certain hours with high liquidity, tighter spreads, etc. On the other hand, some traders prefer to trade at times when the markets are slow and less liquid and avoid times when economic data is released.

With that in mind, here are the four trading sessions each trading day:

- Sydney session: 21:00 GMT (5 pm EST) to 06:00 GMT (2 am EST)

- Tokyo Session: 23:00 GMT (7 pm EST) to 08:00 GMT (4 am EST)

- London Session: 07:00 GMT (3 am EST) to 16:00 GMT (12 pm EST)

- New York Session: 12:00 GMT (8 am EST) to 21:00 GMT (5 pm EST)

You should note that the forex market opens at 5 pm EST (21:00 GMT) on Sunday and closes at 4 pm EST on Friday (20:00 GMT).

Basic Forex Trading Strategies for Beginners

Only a few forex traders are able to find the right trading strategy and the right mindset straight from the first days of trading. In some ways, trading is a process of trial and error, which means you sometimes need to try, fail, and then try another strategy again.

But no matter what your vision and goals for trading currencies are, there are several basic trading strategies you need to be aware of. In some cases, even if you do not use a particular strategy, it is still crucial to know how the strategy or indicator works. Perhaps you’ll see a market forecast from an analyst with a certain strategy, so you want to know how to use it. You might also want to combine several trading strategies until you find the one that is right for you.

So, let’s take a closer look at some of the simple and highly effective beginner FX trading strategies:

1. Support and Resistance Levels

Using support and resistance levels can simplify your trading and significantly help you find entry and exit points. It is one of the most common and effective strategies out there and is very often used by all types of traders. The reason for its effectiveness lies in the fact that many traders look at the same levels. This makes some points in a certain market crucial and, therefore, these levels can be used as signals to enter and exit positions.

Here's what support and resistance might look like on a price chart:

As you can see, a support level is formed when the price fails to break below a certain level, while resistance is formed when the price cannot break above a certain level. Traders use these price levels to identify trade opportunities and manage their trades.

Bear in mind that there are many ways to use support and resistance levels in trading, with some of the most popular including round numbers, Fibonacci levels, range trading support and resistance levels, and swing highs and lows.

2. Fibonacci Retracement Levels

The Fibonacci trading strategy is certainly among the most favorable trading strategies, largely due to its simplicity and accuracy. This strategy involves the use of Fibonacci retracement levels, which are part of the Fibonacci sequence. Notably, there are many Fibonacci trading strategies that traders can implement, with each one having its own benefits.

So, how does this strategy work? In the chart below, we have drawn Fibonacci retracement levels. For that matter, an investor needs to define a time period and draw the lines from the lowest level to the highest level in the specified period of time.

Once Fibonacci retracement levels have been correctly added to the chart, a trader can use these levels to find entry and exit levels.

3. Moving Averages

Moving Average (MA) is a simple yet very powerful technical analysis indicator used by day traders and long-term investors. In simple terms, this market trend indicator shows the average price of a currency pair over a specified period of time and helps traders identify entry and exit points.

Once again, there are lots of types of moving averages, including the simple moving average, exponential moving average, weighted moving average, etc. Also, there are different ways in which a trader can use this indicator - crossover, different lengths, combining the moving average indicator with the Bollinger bands indicator, etc.

Generally, the MA is an excellent method to get an indication of the next price movement of a certain financial asset. According to this indicator, a trader buys the asset when the MA line crosses the price of the asset and vice versa.

4. Scalping Trading

There’s a rule in trading - The shorter the trades you make, the less exposure you have to market movements. Makes sense. The idea of a scalping trading strategy is that a trader essentially tries to obtain small price movements in very short periods of time. For that matter, a forex trade could be seconds or minutes, but not longer than that.

How to do that? That depends on the type of trader you are and whether you prefer to trade in times of high volatility or in times when the markets are calm. Many traders do scalp trading when there's not much volatility, just to collect small profits. Others, on the other hand, wait for economic events or times when the markets are moving sharply into one direction.

Regardless, it is an exciting way to trade FX currency pairs and is particularly used by forex traders due to the high leverage ratio provided by forex brokers (For example, SwitchMarkets offers a leverage ratio of up to 500:1 on FX currency pairs).

5. Range Trading

Range trading is perhaps one of the most effective strategies in trading. In essence, this strategy uses support and resistance levels to find entry and exit levels. The idea is simple: when the price reaches the support level, you buy; when the price reaches the resistance level, you sell. Since the price can stay in a range for a long period of time, traders use this technique to make profits in a ranging market condition.

Range trading is also the opposite of breakout trading (although you can certainly combine the two). Once the price gets out of the range, this is when you can apply the breakout stratgey.

Take note that this strategy usually works well in less volatile assets or when the markets are in a state of consolidation. For some, this trading strategy is more suited for their personality, as it requires a lot of patience and discipline.

6. Breakout Trading

If you love action, then this is the right trading strategy for you. Breakout trading is a trading technique in which a trader basically trades breakouts of support and resistance levels or highs and lows (of the day, weekly, monthly, and all-time). For example, if the EUR/USD is trading during the day near the high level, a trader simply waits for the breakout and buys the pair once it breaks above the highest level of the day. Another way to trade breakouts is by waiting for the price to break a support or resistance level after the price has consolidated in a range. A key rule to remember is that the longer the range, the stronger the breakout.

We can generally say that breakout trading is essentially ‘trading the momentum strategy’ as you basically trade with the trend. Still, it’s a relatively difficult strategy as, in many cases, a false breakout occurs, meaning prices break above or below the identified level and reverse back to the contrary direction.

The Psychology of Trading in the Forex Market

Let’s assume you have developed the perfect trading strategy and gained the necessary experience in the foreign exchange market. Unfortunately, that still does not guarantee your success as a trader. Trading is, more than anything else, a mind game. It is, therefore, essential to understand trading psychology and how to develop a mindset for success in trading.

Much like individual and team sports, in trading, there are good and bad days. It’s a challenging profession, and in most cases, those who have mental toughness are able to become profitable traders. But no one can really teach mental toughness, and you’ll probably have to get into the forex markets and find out if you have it. Still, what you can do is to get some basic tools and understanding by taking online courses about psychology in trading, reading books, and practicing on a demo account.

To start, we also suggest that you visit our comprehensive guide on Trading Psychology.

How Is Forex Trading Taxed?

Profits made from trading forex are considered income, and as such, you generally need to pay taxes on forex trading profits in most countries. How forex trading is taxed varies significantly depending on your country of residence, your trading status (casual vs. professional), and the specific tax laws in your jurisdiction.

It is advised that all traders keep detailed records of their trades, including profits, losses, and any related expenses, as accurate documentation is essential for tax reporting. Since tax laws vary widely by country and trading activity, it's also important to consult a qualified tax professional familiar with your local regulations. Additionally, if you're trading as a business rather than an individual, your tax obligations may change significantly, potentially affecting how your income is classified and taxed.

For more information, it’s a good idea to consult with your accountant to understand the taxation on forex trading in your country.

How to Get Into Forex Trading

Assuming you have completed all the steps above and you want to start forex trading, here’s what you need to do to get started:

- Open a demo account and learn the basics of forex trading (understand what lot size is, the value of a pip, how to read forex charts, follow the economic calendar, etc.).

- Practice on a demonstration account and develop a trading plan/strategy.

- Fund your trading account. It is recommended that you start with a small initial investment and grow it as you meet your earning goals.

- Select 1-3 currency pairs you wish to trade on and focus on these currency pairs in the first few weeks/months of trading.

- Use risk management techniques and tools - Set a stop loss and risk-reward ratio.

- Apply a trade tracking application to track and analyze your trading performance.

- Open an online trading account and start trading forex.

Forex Trading Tips for Beginners - Key Things You Need to Know

Make no mistake; forex trading is tough. You can essentially lose your money in a second, and even if your first trade is profitable, don’t get too excited about it. To be successful in forex trading, you need to form a long-term trading structure and understand how the forex market works. In my view, the best way to start is to invest money you can afford to lose and use this money to learn how the market works. This way, you’ll be able to find the strategy that works best for you.

Remember that forex trading is like any other profession. Much like lawyers, accountants, and every other profession, you need to set a period of time, sort of an internship of 3-6 months, and learn the fundamentals of trading and what makes currencies move in a certain direction.

A great approach to achieving true expertise in trading is the 10,000 rule, which says that it takes roughly 10,000 hours of practice to become an expert in a certain field. I mean, it worked for the Beatles and Bill Gates, so…

Regardless, there are a few steps you need to take before you start trading forex:

Final Word

To sum up, there are many reasons why the forex market has gained such popularity over the last two decades. Understanding the dynamics in the forex market is interesting not only as a way to make profits but also as a method to help you open your eyes to the world and get a better understanding of how the economy and financial markets work. Additionally, over the last few years, regulations have improved, and notable regulators in the industry have quickly removed scammy brokers. This makes the forex industry more competitive and free from fraud.

The bottom line - whether you are a beginner or an experienced trader, the forex market is a great way to get involved in trading. If you are ready to do that, visit our sign-up page and open an online trading account.

FAQs

Here are some of the most frequently asked questions regarding forex trading:

Is forex trading profitable?

Generally, trading is subjective, as there are many ways to analyze and trade forex. In online forex trading, most traders lose money, largely due to the high leverage and because they usually enter the market unprepared. That said, trading forex can definitely be profitable if you understand the dynamics in the market and are able to form the right trading strategy.

How to open a real trading account on MetaTrader4/5?

MetaTrader 4 and 5 are certainly the most popular online trading platforms among forex and CFD traders. To open a real trading account on MetaTrader4, you need to find a forex broker like SwitchMarkets that gives users access to this trading platform and then open an online trading account. If you are not familiar with the platform, it is advisable to start with a demo account to get a better grasp of the platform and add funds to your live account when you are ready to trade the live markets.

Is forex trading good for beginners?

That depends on many factors. Even though trading forex is considered a risky form of trading, it is a great place for beginners to start trading for several reasons.

First, it is accessible, and there’s no need to risk a large amount of capital, which you might have to do when investing in stocks and futures. Secondly, forex brokers provide a great trading experience that includes online trading platforms, tools, leverage, and investment recommendations from their analysts. Finally, the forex market is less complicated than other markets, especially for beginners. You need to follow the news, understand macroeconomics and the political impact on FX currency pairs, and find the best hours of the day to trade the markets.

Do you need a forex broker to trade currency pairs?

Technically, no. There’s no need for a forex broker to trade currency pairs. You can do that by exchanging currencies at a money exchange store or buying and selling foreign exchange currencies at your bank. However, this way, speculating on the prices of forex pairs is extremely difficult, and you need large amounts of money to make small profits. Forex brokers, on the other hand, provide leverage and access to advanced online trading platforms where you can actually trade currency pairs as an additional or main source of income.

What is copy trading in Forex?

As the name suggests, copy trading is a technology that enables users to automatically copy the forex trades of other traders. It is part of social trading and is mainly used by beginners or those who do not have the time and knowledge to research the forex market. Instead, they simply use the skills of other traders, who are compensated to share their trading activity.

How’s the forex market regulated?

Generally, there’s no one regulatory body responsible for the regulation of the forex market. However, the primary market participants in the forex market are banks and retail forex brokers, which are regulated by various regulatory agencies. Therefore, even though the forex market is not directly regulated by one regulator, all transactions and dealers must be approved and licensed by a regulatory authority in the area where they provide services.

How to trade news in forex?

The forex market is highly influenced by market news and economic data. As such, many traders monitor news and important information released on the market to assess currency pairs and, based on that, make trading decisions. For that purpose, it’s important for a forex news trader to find a news source provider and understand the key factors that impact a certain currency pair's price movements.

Can you make a living from trading forex?

Well, yes, you can. But that is very difficult, and only a few reach the point where they have the skills to generate consistent profits over the long term.

What is the minimum capital required to start trading forex?

If you want to trade forex, you can basically do so with just $50. However, it is recommended that you make an initial investment of at least $500-$1000 to get the most out of your trading forex account.

What’s the best way to trade FX currencies?

The key to successful trading in the forex market is to develop a trading strategy or trading style that works for the long term. There are lots of ways to do that, and each successful trader has different strategies. To start, you need to know how to read candlestick charts, use technical analysis indicators, and effectively interpret fundamental factors and central bank announcements that influence currency prices.

Is Forex trading halal?

Forex trading is considered halal, but only if it is conducted within certain guidelines in accordance with Sharia Law. For that reason, some brokerage firms, like Switch Markets, provide an Islamic trading account to Muslim traders.

What is a margin call in forex trading?

A margin call occurs when a trader’s account balance falls below the required margin level set by the broker. This typically happens when a trader has highly leveraged positions and the market moves against them, reducing available equity. To avoid a margin call, you can use a dynamic leverage, which is a tool offered by a few brokers that adjusts your leverage to your position size.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.