How to Short-Sell Cryptocurrencies - A Quick Guide

Over the past few years, cryptocurrencies have been mostly used as an instrument for growth, and rightfully so. It’s nearly impossible to ignore the meteoric rise of Bitcoin and its friends. However, let’s not forget that the price of Bitcoin dropped from $70K in 2021 to $15K in 2022, Ethereum fell from nearly $5000 to $860, and Solana lost nearly all of its value, falling from $257 to… $4. Yes, $4. A pretty good transaction for those who want to trade in both directions.

Even recently, since early October 2025 to early November 2025, BTC dropped from its all-time high of 126,210 to around 102,000. So, shorting crypto can be an excellent way to make profits.

But how can you short-sell cryptocurrencies? What are the options? And what are the key factors you must take into consideration? This article explains how to short crypto, the different ways you can use to short-sell cryptos, and the key reasons to short Bitcoin and other cryptocurrencies.

Key Points

What is Crypto Shorting?

Crypto shorting, or crypto short-selling, is a way of trading that involves borrowing cryptocurrencies from another market participant (broker or another investor), selling them at a higher price, and repurchasing them later at a lower price to profit from their expected decline in value.

In other words, short-selling a cryptocurrency means you predict that the asset is expected to lose value and you wish to make a profit from the decrease in the price. For example, let’s say you would like to short Bitcoin. In that case, you basically borrow Bitcoins from another investor or your brokerage firm; then you sell your borrowed Bitcoins in the open market, and once you are ready to close your position, you purchase your coins.

A Crypto Short-Selling Example

If, for example, Dogecoin is trading at $0.50 per coin and you assume that DOGE is expected to fall soon. So, let’s say you open a short position of 10,000 DOGE at $0.5, meaning a position size of $5000. A few days later, DOGE’s price drops to $0.3, and you decide to close your position. In that scenario, you’ve made a profit of $2000 (0.5-0.3x10000). In other words, you purchased DOGE at $0.3 and sold your Dogecoin at $0.5. But you just made it in the opposite direction, meaning first selling and then buying. That's the idea of short-selling cryptocurrencies.

Is It Possible to Short-Sell Cryptocurrencies?

Yes, it is possible to short cryptos. Like stocks, commodities, and other financial instruments, shorting digital assets can be done in various ways.

However, you must consider the complexities of shorting cryptos. Remember, shorting is a risky business since it has unlimited loss potential. Therefore, the process of shorting cryptos on major exchanges means you’ll have to open a margin trading account, which often requires an additional layer of complexity relative to just buying and owning cryptocurrencies. If opting for other options like CFDs, which is far more convenient than any other method, you'll have to take into consideration additional costs like swap rates.

Why Would You Want to Short Cryptocurrencies?

Investors have several reasons why they prefer short-selling cryptocurrencies, including:

Flexibility

The option of shorting cryptos allows you to trade in both directions rather than just one direction, hence buying and making a profit when the price rises. This is typically suited for traders who utilize short-term trading strategies or those who wish to speculate that a certain crypto is about to fall. It essentially allows traders to take advantage of rising and falling market trends and price movements.

High Valuations

Many investors are pessimistic about the future of crypto, and as such, they are constantly looking for a sharp decrease in cryptocurrency prices. These short-sellers often believe that the valuation of Bitcoin and other cryptocurrencies is a ‘bubble’ that can be burst at any moment. Indeed, when we analyze the crypto market performance over the years, many cryptos have lost a great chunk of their value. So, with the ability to short-sell cryptos, investors can make profits by betting against the coin.

Hedging

Some experienced traders also use shorting as a method to hedge their long positions or their crypto balance. For example, let’s say you have a substantial amount of Bitcoins in your account, but you are concerned that Bitcoin is likely to fall in the near future. In order to protect the valuation of your portfolio, you can open a short-sell position or, even better, buy a PUT option on BTC. If Bitcoin falls, then you protect your account by holding a short position.

Ways of Short-Selling Cryptocurrencies

There are different ways to short-sell cryptocurrencies, each with its pros and cons.

Shorting Cryptocurrencies with CFDs

Perhaps the easiest and simplest way to short cryptos is through Contract for Differences, also known as CFDs. For those unaware, CFDs are a form of trading that enables traders to speculate on the asset’s price without owning the underlying asset.

There are many benefits of trading cryptos via CFDs. Those include the simplicity of opening a crypto account, especially when compared to opening an account on leading crypto and futures exchanges. Furthermore, CFDs are leveraged products, which means that you only need to place a small deposit to access the full trade value. For instance, with Switch Markets, you get a leverage ratio of 1:3 for digital assets, making it an attractive form of trading. Lastly, the account creation process and the initial deposit requirement are more flexible than conventional trading accounts, which helps traders to be able to start trading CFDs easily.

However, it is worth noting that leverage amplifies both gains and losses, and given the volatile nature of cryptocurrencies, CFDs are a high-risk/high-reward type of trading.

Shorting Cryptocurrencies on Crypto Exchanges

Shorting cryptocurrencies is also possible on various crypto exchanges. Popular crypto exchanges like Binance, Kraken, and Gemini support crypto shorting, although opening a margin account typically comes with a set of complex requirements compared to buying Bitcoin and other altcoins solely.

Shorting Cryptos via Futures Contracts

Futures contracts are another trading method that enables traders to short-sell cryptos. Futures trading can be done on different crypto exchanges such as Binance, Coinbase, Kraken, and the Chicago Mercantile Exchange (CME), although the selection of cryptos on CME is limited and includes only Bitcoin and Ethereum.

How To Short-Sell Cryptos with Switch Markets (Step-by-Step Example)

Now that we’ve covered everything you need to know about short-selling cryptocurrencies, here is the step-by-step process for short-selling a crypto CFD using your Switch Markets account:

1. Open and fund your account

This is your foundation. Before trading, you must have a live trading account with Switch Markets and ensure it is sufficiently funded.

So, start by completing the account registration and verification process if you don’t have an account with the broker. Once approved, deposit funds (minimum $50). The platform supports various payment methods and offers leverage up to 1:3 for cryptocurrencies.

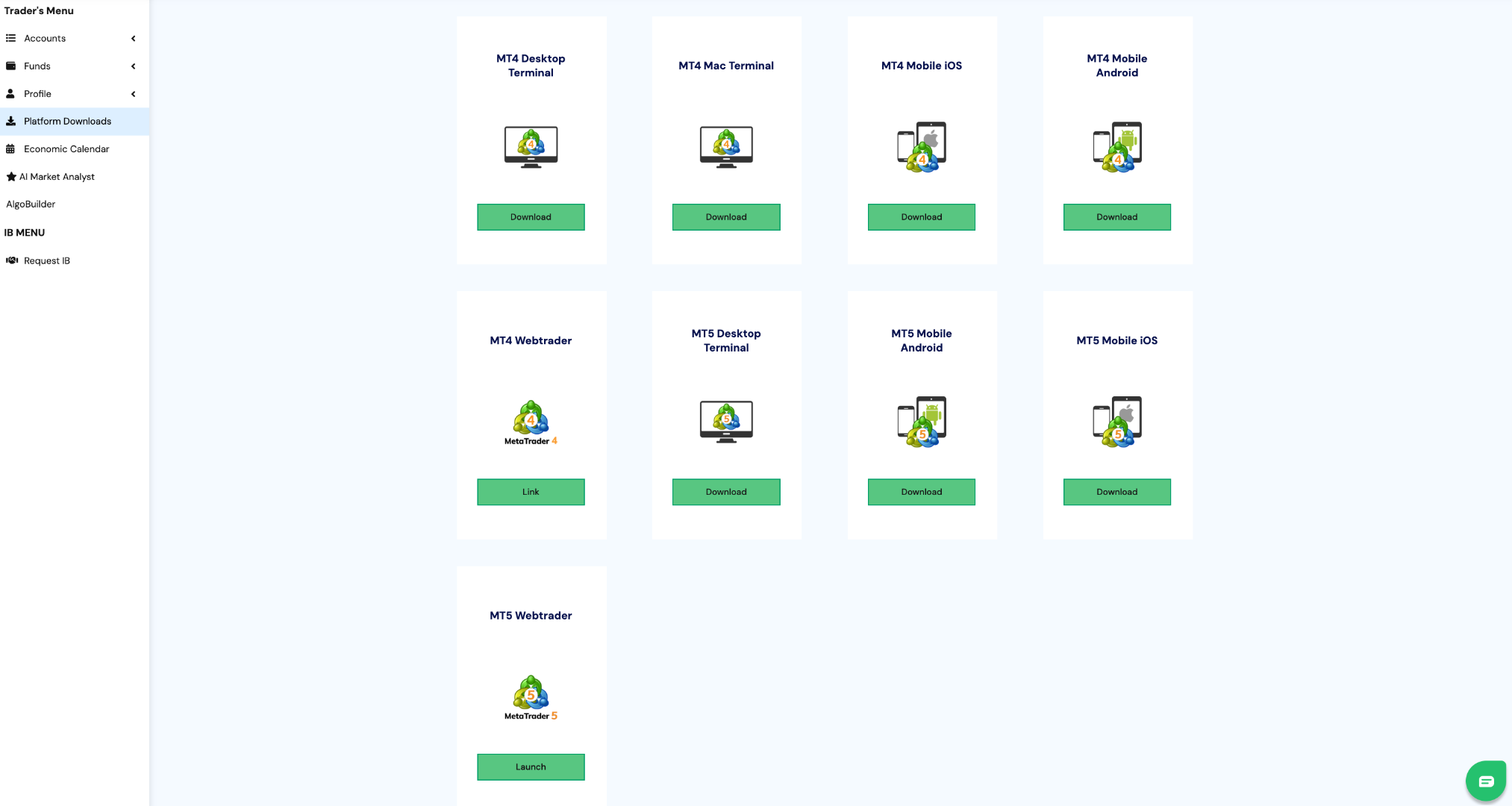

2. Install a trading platform (MT4/MT5)

Now that you have a trading account, it’s time to install any of the MetaTrader platforms. The MetaTrader platform is where you will execute your trades, perform technical analysis, and monitor the market.

So, go ahead and download MetaTrader 4 or MetaTrader 5 from the Switch Markets client terminal and log in with your account credentials. Alternatively, you can use MT5 webtrader directly from inside the “Platform downloads” page. This way, you can trade directly from your browser and won’t have to install any software.

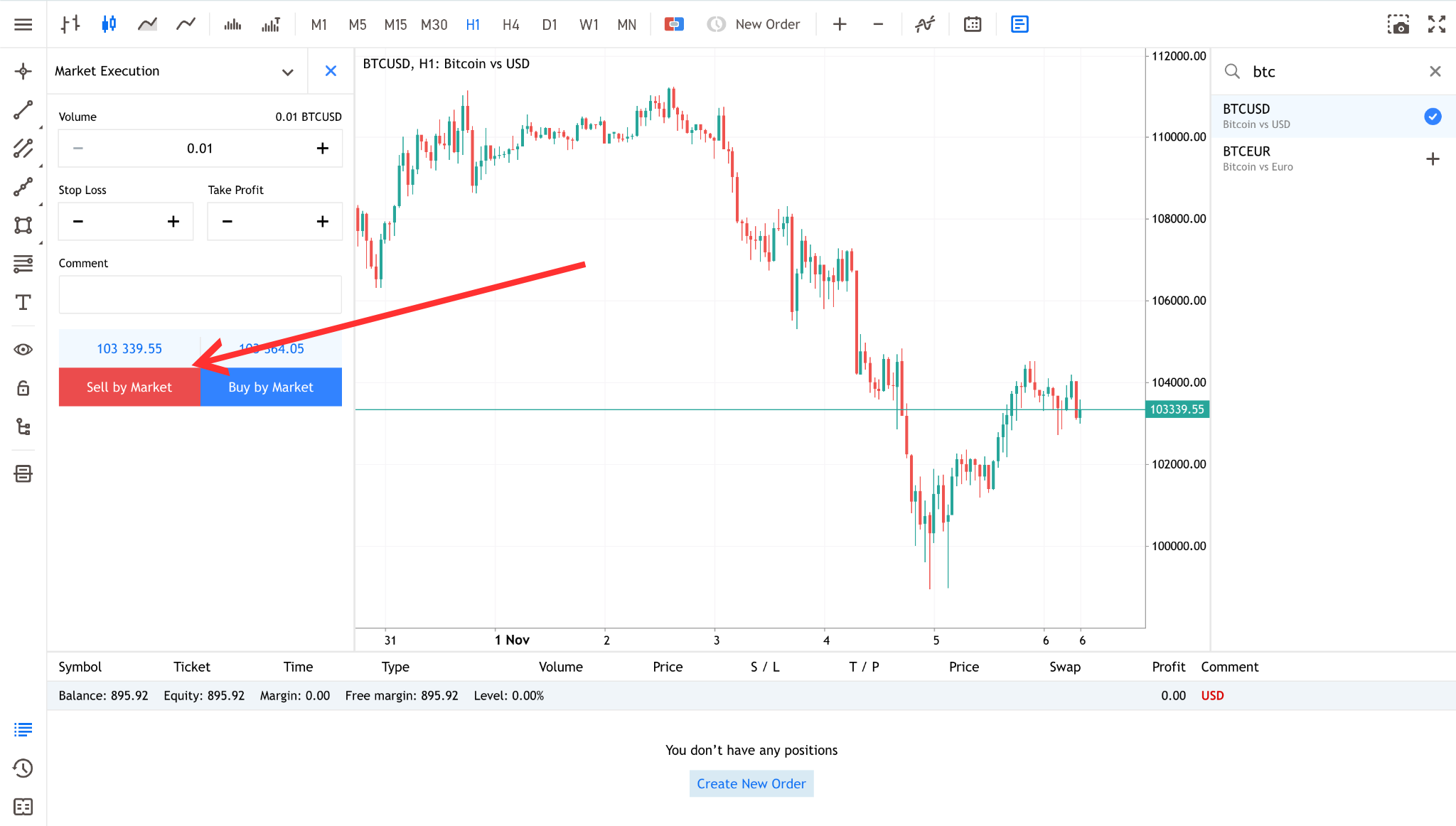

3. Select the cryptocurrency CFD

Next, choose the cryptocurrency you wish to short. In the Market Watch or Instruments list, you’ll see a variety of symbols – forex pairs, indices, and crypto pairs.

Navigate through the list until you find BTC/USD (or another crypto you want to short) and click on it to highlight it.

On the MT5 WebTrader platform, this step would look similar to the diagram below.

4. Open a new ‘Sell’ trade

With the instrument selected, open a new order. On MetaTrader, you can do this by pressing F9, clicking New Order on the toolbar, or right‑clicking the symbol and choosing New Order. In the order dialog:

- Symbol should automatically display the selected crypto (e.g. BTC/USD).

- Set your Volume (lot size): this determines how many contracts you are selling.

- Optionally set a Stop Loss above your entry price and a Take Profit below it to manage risk and lock in gains.

- Finally, click the Sell button to execute the short position.

The image below shows where to short at the market order; the arrow shows exactly where to click the Sell button.

However, if you want to short at specific prices, you may have to use either a SELL LIMIT order or a SELL STOP order. You can access these options after clicking the dropdown menu and changing the order type from “Market execution” to your preferred order type. You should see something like this:

Simply fill in your entry price, stop loss, take profit, and lot size, then hit the “Place order” button.

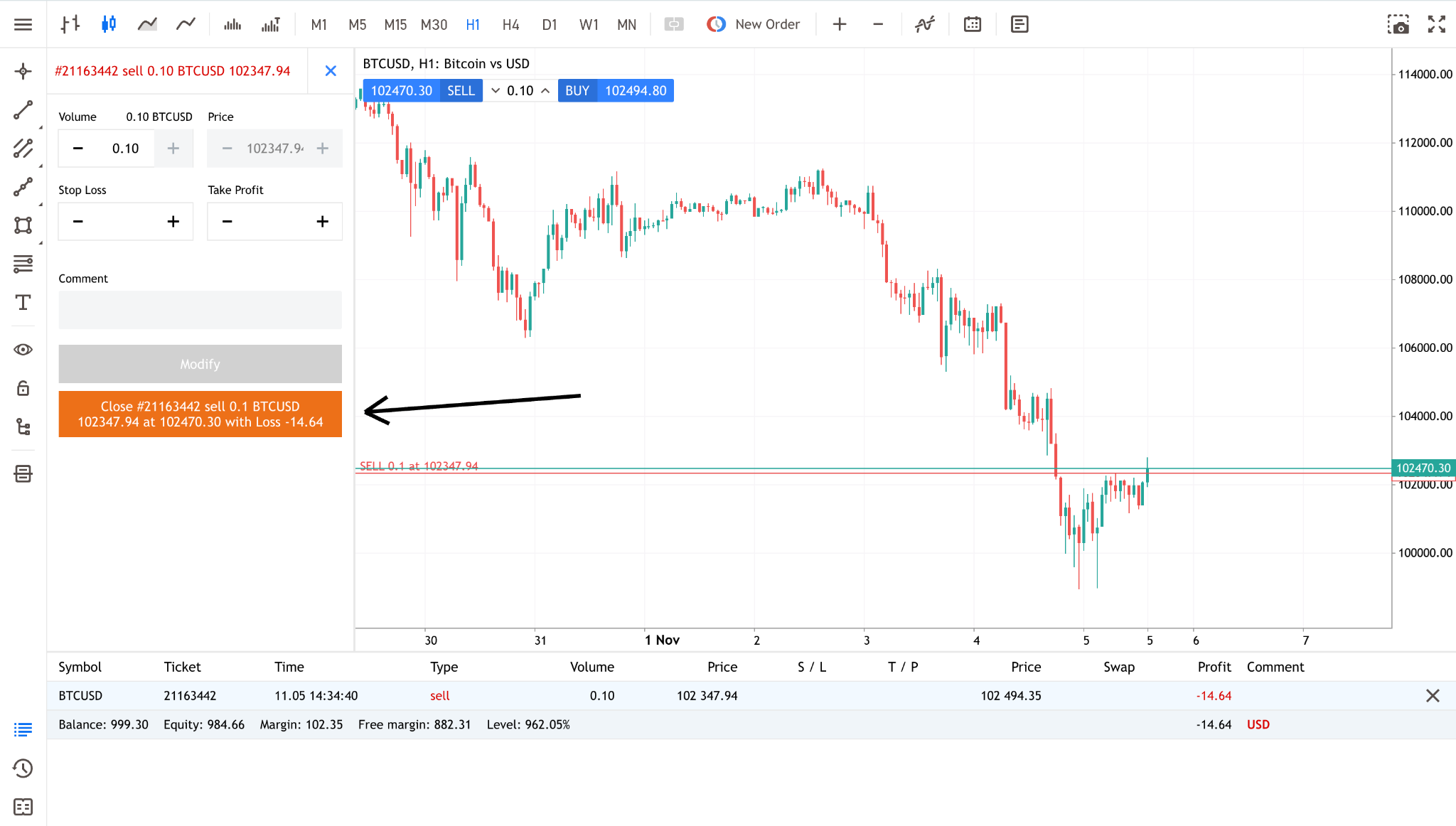

5. Monitor and close the trade

After the trade is open, monitor price movements via the chart and your account’s margin level. Adjust stop‑loss and take‑profit levels as needed. When the market moves in your favour and you’re ready to realise profits, you must close the short position. In MetaTrader, this is done by:

- Opening the Trade tab (or Positions tab) to see your open positions.

- Right‑clicking the short BTC/USD position and selecting Modify Position, or double‑clicking the position to open the close dialog.

- In the close dialog, clicking Buy (or Close) to buy back the CFD and close the short trade.

After clicking the “modify position”. You can just go ahead and close the trade by clicking the “Close” button, as shown in the image below.

Trading Cryptocurrencies with Switch Markets

In sum, despite the growing popularity of cryptocurrencies as a form of payment, trading them remains challenging and complex for many investors. And this is where Switch Markets can be an excellent solution for traders looking to trade digital assets.

With Switch Markets, you can buy and short-sell a wide selection of cryptocurrencies, including some of the most popular digital assets like Bitcoin, Ethereum, Ripple, and more exotic cryptos like the Binance Coin, Ethereum Name Service (ENS), Solana, Trump Coin, and Shiba Inu. Moreover, Switch Markets enables you to trade digital assets with a leverage of up to a 1:3 ratio and get some of the most competitive crypto spreads in the market. What's more, you can get a free VPS, an AI trading bot, and free access to PineConnector.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.