The Gold-Silver Ratio: A Trader’s Guide

As the name suggests, the gold-to-silver ratio is a ratio that measures how many ounces of silver are needed to purchase one ounce of gold. Due to the historic role of these two commodities and the fact that both gold and silver are extracted from the earth, many investors believe that this ratio is a reliable indicator to predict gold and silver's future price performance.

But how can you use this ratio in your trading? How does the gold-silver ratio really work? And what is the magic ratio number of the gold to silver ratio?

What is the Gold to Silver Ratio?

From a basic point of view, gold and silver are among the different precious metal commodities with intrinsic value and uses in various products. Each of these two precious metals has its own unique features and real uses that remain irreplaceable to date, and both are expected to become even more precious in the future.

Historically, these two metals became a legal form of money around 700 BC when the first Roman coins were issued to the public. Since then, physical gold and silver coins have had a strong financial connection known as the gold-to-silver ratio. In fact, the gold-to-silver ratio is likely to be one of the most historically significant ratios ever established, and it remains a significant ratio in the financial system to this day. In Roman times, the gold-silver ratio was fixed at 12:1, and by the 18th century, the ratio was set to 15:1 in the United States and to 15.5:1 in France.

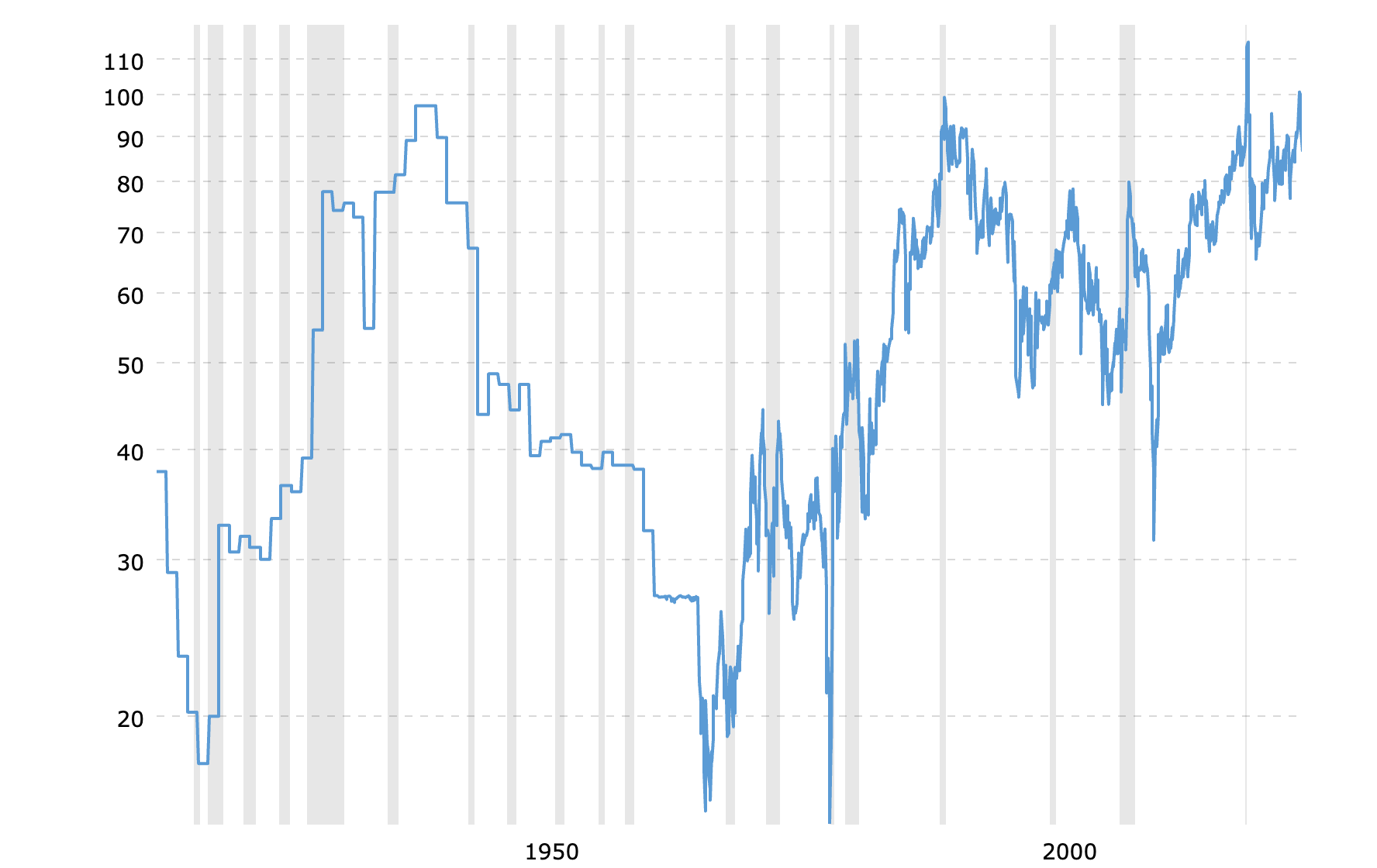

During the 20th century - when the free market economy has developed - the average gold-silver ratio was 47:1. However, it experienced lots of extreme highs and lows over the century due to the great depression, the gold standard act in 1900 and the decision of the US government in 1971 to no longer convert US dollars to gold at a fixed rate.

Since the beginning of the current century, the gold-silver ratio history has mostly traded in a range between 40 and 80 until the ratio peaked at an all-time high of above 126 due to the impact of the Covid-19 pandemic in early 2020. But since the economic recovery started in May 2020 and the end of lockdowns has resulted in a massive rebound in global economic activity, the spread has dropped to be trading around 60-90. In 2025, it rose to a 5-year high above 105 during the 2025 stock market crash before falling again to trade around 87, as of writing.

So, What Does the Gold-Silver Ratio Measure?

Simply put, the ratio measures the number of silver ounces required to purchase one troy ounce of gold. It is a fairly simple ratio that calculates the relationship between the gold spot price and the silver spot price. Meaning, anyone can make this calculation by dividing the price of gold by the relative value of the price of silver.

So, what’s the big story with this ratio? Well, for many reasons and in many ways, the gold-silver ratio has been an extremely reliable indicator for making investment decisions by gold and silver traders and investors. This can be attributed to the high correlation between the two assets, and perhaps even the myth of the gold-to-silver ratio. Moreover, the gold-silver ratio is often used to determine the overall sentiment in financial markets. In that sense, it works similarly to the VIX index. In times of uncertainty and economic slowdowns, the ratio is likely to rise and fall in tandem, as evidenced by the start of 2025.

The gold/silver ratio compares the price of gold to that of silver and serves as a tool for investors to assess the relative value between the two metals, helping guide buying and selling decisions.

Why Does the Gold-Silver Ratio Matter?

Throughout modern history, gold and silver have been humans’ most pure and widely used forms of money. That made the gold and silver ratio such a vital piece of information, and even nowadays, the ratio is being used by metals merchants and traders worldwide.

In trading, investors who trade gold, silver, and other precious metals use the gold-to-silver ratio as an indicator for determining the optimal time to make a purchase or sell one of the metals. Also, according to geologists and ‘rational’ traders, the ratio should be closely correlated to the ratio of silver to gold in the earth's crust. If this is the case, then there’s no doubt that the gold-silver ratio should drop at some point. Theoretically, some people believe that the ratio should be set at 16:1 in favor of gold, which is the same ratio it has been trading for centuries. Others even take it further, stating that in the current market conditions, in which silver is widely used in industrial applications and electronics, the ratio should be in favor of silver.

Either way, for the average Joe trader, there’s no question about the importance of the gold-silver ratio. It has been in existence for thousands of years and is closely monitored by professional day traders and long-term investors.

Trading the Gold-Silver Ratio - How Does It Work?

Trading the gold-silver ratio works on a very simple principle. As mentioned previously, the ratio simply measures the number of silver ounces an investor needs to trade in order to receive one ounce of gold. For instance, if gold (XAU/USD) is trading at $3300 per ounce and silver bullion (XAG/USD) is trading at $38 per ounce, then the ratio is set at $86.8.

Yet, there’s one thing you need to remember about trading the gold-silver ratio. There’s no future contract or any derivative contract that enables you to trade the ratio directly. To trade the ratio, you can basically trade gold and silver futures contracts or commodity CFDs. This can be done by buying one contract (i.e., gold) and selling the other (silver). For instance, if you predict that gold is likely to rise at a higher rate than silver, then you can buy gold and sell silver. This is the only way to trade the gold-silver ratio directly.

In terms of gold-silver ratio analysis, things could get quite complicated. Normally, the ratio is primarily affected by fundamental analysis since both gold and silver are highly affected by macroeconomic factors and global economic growth. Some investors believe the ratio should be in line with the availability of the two metals extracted from the earth. According to this theory, the ratio should also be traded somewhere between the average levels since the early 20th century, which fall somewhere between 50-60. However, financial markets are often not predictable, and as such, the ratio could be higher or lower than the historical average.

Crucially, the ratio is primarily used as a technical indicator to buy and sell one of the metals, assuming that assets should be trading close to their average ratios. Obviously, the ratio fluctuates to extreme prices from time to time, which is an indication for investors to buy or sell one of the precious metals with the hope that the ratio will be trading again at ‘normal’ levels.

For example, when the COVID-19 pandemic broke out, the demand for gold was higher than the demand for silver, which caused a very high spread between the two precious metals. How high? Some experts and historians say it has been the highest level in 5000 years. But then, as things calmed down following the pandemic crisis, the gold and silver ratio dropped from 126 to its slightly above-average levels of around 70.

What was the catalyst behind the huge drop? Simply because the demand for silver was higher than the demand for gold in the industrial world, especially during times of trade shutdowns. So, the conclusion - when economic activity went back to normal, silver prices rose more than gold, and the spread tightened.

As evident from the above, while gold is mainly a safe haven asset, silver is one of the most highly traded commodities and widely used metals in the world - it is used in a variety of products, including LED lighting, solar panels, touch screens, TV screens, mobile phones, water purification, and other electronic equipment.

Since 2020, the gold-silver rratio has been trading at fairly high levels of around 60-90, largely due to concerns of inflation and economic fears of a recession.

How to Trade the Gold-Silver Ratio

So, the big question is, how can you trade the gold-silver ratio? Well, the first method is to directly trade the ratio by buying one asset versus the other. On brokers like Switch Markets, you can trade a variety of commodities, including gold and silver. If your prediction tells you that the ratio is likely to increase, then you buy gold and sell silver, and vice versa.

Another interesting approach to using the gold-silver ratio is through correction trading. Historically, there is a strong correlation between gold and silver, especially since these two metals are often regarded as safe-haven assets and are used for a variety of similar purposes. Using this strategy simply means that when you notice one asset before another, you receive a signal to buy the asset that is lagging behind.

Here’s the idea on how to trade the gold-silver ratio:

You're betting that the ratio will revert to its historical average (usually around 50–60). So:

- If the ratio is high (e.g., 85–100):

Silver is cheap relative to gold → Buy silver / Short gold - If the ratio is low (e.g., 40–45):

Gold is cheap relative to silver → Buy gold / Short silver

In practice, you need to do the following in order to trade the gold-silver ratio

- Find a platform like Switch Markets that offers both the gold market and the silver market.

- Identify the correct lot size for both assets. For that purpose, you can use our lot size calculator.

- Track the ratio and find abnormal values.

- Execute your gold-silver trade.

Final Word

In sum, the gold-to-silver ratio could be a handy tool to determine when to enter a gold or a silver position. I can personally attest that, based on my experience in the commodity trading space, I’ve heard many gold and silver traders frequently discuss the gold-silver ratio and its significant impact on market speculation.

The good news is that using the gold-silver ratio is fairly simple. You should always place silver below gold on your watchlist and closely follow the gold-silver ratio. Then, you’ll be surprised by how many trading opportunities you’ll be able to find when using this ancient ratio. After all, even the Romans and the Greeks used this ratio at some point in time, so maybe you should do the same...

FAQs

Here are some of the most frequently asked questions around the web regarding the gold-silver ratio:

Why is the gold-silver ratio so high?

At the time of writing, the gold-silver ratio trades at around 88 after falling from its highest levels in 5 years of nearly 108. Factors such as rising demand for gold as a safe-haven asset, softer industrial demand for the current silver price, and changes in central bank reserve strategies contribute to the imbalance. This divergence is further driven by economic uncertainty, changes in interest rates, and fluctuations in the strength of the U.S. dollar.

What is the average gold-to-silver ratio?

The historical average gold-to-silver ratio typically falls between 50 and 60, with a long-term average of around 55–60 over the past century. In recent decades, the ratio has fluctuated between 40 and 80, influenced by changing market dynamics. During periods of economic uncertainty, it often spikes above 80–100, as investors tend to favor gold over silver for its safe-haven appeal.

What affects the gold-to-silver ratio?

The gold-to-silver ratio simply measures the price of gold in relation to the price of silver. So, it would be better to ask what affects gold and silver prices. Both precious metals are known as safe-haven assets, although gold is the most logical choice as a protection against inflation, uncertainty, and in times when governments seeking monetary stability. On the other hand, gold does not have many industrial uses like Silver.

This means that in periods of economic downturn and stock market crash, the ratio tends to rise due to high demand for gold, while in periods when the global economy functions well, the ratio is expected to fall due to the increasing demand for silver. In addition, it is worth noting that other factors that might affect gold and silver prices include the US dollar’s trend (or that of another nation's fiat currency), interest rates, and the global supply of gold, silver, and other precious metals, such as Uranium, Platinum, and aluminum.

What is the ratio of gold to silver in the Earth’s crust?

Presently, geologists believe that the abundance of silver is much greater than gold, or in other words, there is approximately 19 times more silver than gold in the earth’s crust.

What is the gold-silver ratio right now?

As of August 2025, the gold-silver ratio stands at 88.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.