How to Trade Natural Gas - A Full Guide for Traders

Trading natural gas offers one of the most exciting arenas in the global energy markets. Unlike crude oil, which often moves based on slow-shifting geopolitical tides, natural gas prices can explode higher or crash lower based on a single weather forecast.

But don't let the volatility scare you because this guide will walk you through exactly how to trade natural gas.

We will cover everything from the mechanics of natural gas futures contracts to the nuances of natural gas stocks and the critical data reports you must watch.

What is Natural Gas and Why Trade It?

Natural gas is a fossil fuel used primarily for electricity generation, heating, and industrial processes. It is often touted as a "bridge fuel" in the energy transition because it burns cleaner than coal or oil.

Why do traders flock to it?

- Volatility: Market volatility is a trader's lifeblood. Natural gas prices fluctuate significantly, providing ample opportunities for profit.

- Liquidity: The natural gas market is highly liquid, especially during US and European trading sessions, allowing traders to enter and exit positions with ease.

- Seasonality: Unlike some assets that walk a random walk, natural gas trading often follows distinct commodity seasonal patterns based on heating (winter) and cooling (summer) demand.

Natural gas is extremely popular among traders because it combines high liquidity with strong price volatility, driven by constantly changing supply-and-demand factors such as weather forecasts, seasonal heating and cooling needs, storage reports, and geopolitical developments. These frequent price swings create regular trading opportunities for both short-term speculators and longer-term trend traders, while tight spreads and active futures and CFD markets make it easy to enter and exit positions efficiently.

The Natural Gas Market

To understand the market price of natural gas, you must look at the benchmark: Henry Hub natural gas. This is also the natural gas future contract CFD offered by Switch Markets.

Henry Hub is a distribution hub on the natural gas pipeline system in Erath, Louisiana. It serves as the official delivery location for futures contracts on the New York Mercantile Exchange (NYMEX). When you see a quote for the price of natural gas in the news, they are almost always referring to the Henry Hub spot price or the front-month futures contract.

While Henry Hub natural gas is the US benchmark, the market is global. Prices in Europe (TTF) and Asia (JKM) also influence the global energy markets, especially now that Liquefied Natural Gas (LNG) connects these previously isolated markets.

What Drives Natural Gas Prices?

If you want to know how to trade natural gas successfully, you cannot just look at a chart. You need to understand the fundamental drivers that cause natural gas price changes.

1. Weather and Seasonality

Weather is the king of the natural gas market.

- Winter: Cold snaps drive demand for heating. A "Polar Vortex" forecast can send natural gas futures soaring.

- Summer: Heatwaves drive demand for air conditioning, which increases electricity generation from gas-fired power plants.

- Shoulder Seasons: Spring and Fall are typically periods of lower demand, where prices may drift or consolidate.

2. The 5 Key Reports

There are specific reports that every gas trader must have on their calendar:

- EIA Weekly Natural Gas Storage Report: Released every Thursday at 10:30 a.m. EST. This is the holy grail. It measures whether gas is being injected into storage (supply build) or withdrawn (demand draw). A surprise here triggers immediate volatility.

- Baker Hughes Drilling Report: Released Fridays. It tracks the number of active rigs. More rigs usually imply rising natural gas production in the future.

- Imports and Exports: The US is a major LNG exporter. Disruptions at export terminals (like Freeport LNG) can trap gas in the US, lowering domestic prices while spiking global prices.

3. Geopolitical Events

Geopolitical events play a massive role. Conflicts in Eastern Europe or the Middle East can disrupt supply lines. For instance, supply cuts from major producers like Russia have historically caused massive spikes in European and global gas prices.

4. Production Levels

Natural gas production in the US, particularly from shale basins like the Marcellus and Permian, sets the baseline supply. If production outpaces consumption, natural gas prices tend to fall.

Natural Gas Price Performance

Over the past six months, Henry Hub natural‑gas prices have swung from around $3/MMBtu to nearly $5/MMBtu. At the start of the period, June’s heat dome and record electricity demand pushed prompt‑month futures to nearly $4 per MMBtu; the average prompt‑month price for June was $3.64/MMBtu, about 30 % higher than June 2024, and Henry Hub spot prices averaged about $3.02/MMBtu.

However, as the summer progressed, prices eased: August prompt‑month contracts averaged $2.89/MMBtu - 12.5 % lower than July’s average - as cooler‑than‑normal temperatures curbed demand and storage levels rose. By mid‑September, the October contract settled around $3.03/MMBtu and had fallen 32.5 % from March’s $4.49 high.

A mild start to autumn kept November Henry Hub futures near $3.12/MMBtu on 13 October, but the market turned sharply higher as cold weather swept across the United States. In the week ending 3 December 2025, the Henry Hub spot price jumped from $4.59 to $4.87 per MMBtu, and near‑month futures prices reached their highest level since December 2022. Trading‑economics data show that U.S. natural‑gas futures hovered above $5/ 5/MMBtu on 8 December after a roughly 70 % rally from mid‑October lows.

Ways to Trade Natural Gas: Futures, CFDs, ETFs, and Stocks

There is no single "best" way to trade; it depends on your capital, risk tolerance, and goals. Here are the primary ways to gain exposure to the gas market.

1. Natural Gas CFDs

For retail traders, natural gas CFDs are often more accessible than futures. A CFD allows you to speculate on the price difference between the opening and closing of a trade without owning the underlying contract. You can also trade with leverage, meaning a smaller initial investment controls a larger position.

Brokers like Switch Markets are popular for this approach. They allow traders to start trading natural gas with a significantly lower barrier to entry (with an initial investment as low as $50) while offering competitive leverage. This eliminates the need for the massive capital requirements typical of professional futures accounts.

2. Natural Gas Futures

This is the most direct method. Natural gas futures are financial contracts obligating the buyer to purchase the asset at a specific price on a future date. They trade on exchanges like the CME Group (NYMEX). While this is the pro choice for trading natural gas, it also requires a large capital requirement, a long registration process, and top-notch internet connectivity.

3. Natural Gas ETFs

Exchange-Traded Funds (ETFs) track the price of natural gas futures. They are as easy to buy as any stock. For those interested, Switch Markets offers the United States Natural Gas Fund (UNG).

4. Natural Gas Stocks

You can buy shares in energy companies focused on exploration and production. Companies like EQT Corp, Chesapeake Energy, or Cheniere Energy offer indirect exposure as well.

How Natural Gas Futures Work

Regardless of the way you choose to trade natural gas, an understanding of the natural gas futures mechanics is essential.

The Contract

The standard natural gas futures contract (Symbol: NG) on the NYMEX represents 10,000 million British thermal units (mmBtu) of natural gas.

- Tick Size: The minimum price fluctuation is $0.001 per mmBtu.

- Tick Value: A one-tick move is worth $10 per contract.

This means if natural gas futures move from $2.500 to $2.600 (a 10-cent move), that is a $1,000 profit or loss per contract. This high leverage is why natural gas futures trading carries substantial risk.

Physical vs. Financial

Most traders never interact with physical natural gas. They are "speculators." If you hold a futures contract until expiration, you might theoretically be liable for physical delivery or acceptance of the gas at the Henry Hub. However, almost all retail and speculative traders close their positions before the "First Notice Day" to avoid this.

The Curve

The natural gas futures market has a "forward curve."

- Contango: Future prices are higher than spot prices (common when storage is full).

- Backwardation: Future prices are lower than spot prices (common during shortages).

Understanding the shape of the curve is vital for trading futures products.

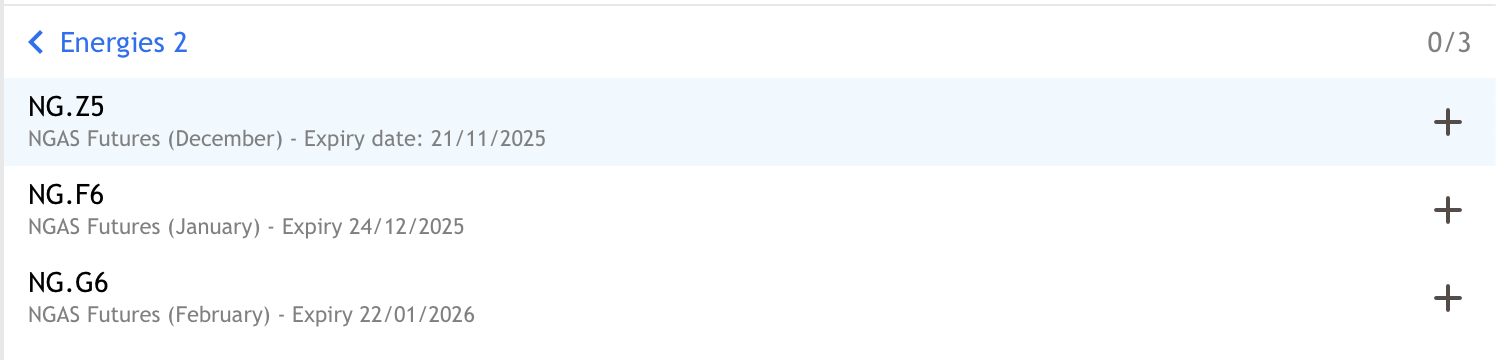

Note that Switch Markets is one of the few CFD brokers in the industry offering the first three nearest natural gas contracts. This enables traders to execute natural gas spread trading, meaning buying one contract and selling the other. It is a popular commodity spread trading strategy that follows seasonal patterns.

How to Start Trading Natural Gas

Ready to enter the arena? Here is how to start trading natural gas with Switch Markets.

Step 1: Choose Your Account Type - The first thing you need to do is to choose the type of account that suits your trading needs. For that matter, you can visit our account comparison page and choose your account. To learn more about our accounts, you can also visit our guide on ECN vs. Standard accounts and our informative guide on a cent account.

If you are a beginner who would like to explore our platform, you can start by opening a demo account. Bear in mind that Switch Markets is one of the few brokers offering a non-expiring demo account.

Step 2: Fund Your Account - Next, you'll get an email from Switch Markets to access your client terminal. In there, you'll be able to fund your account with one of our deposit methods.

Step 3: Analyze the Market - Before placing a trade:

- Check the trading hours. Natural gas futures trading happens nearly 24/6 on Globex (Sunday 6:00 p.m. to Friday 5:00 p.m. ET).

- Learn about lot size in trading, and decide on the position size that matches your account size.

- Review the weather forecast (NOAA maps).

- Check the economic calendar for the Thursday EIA report.

- Perform technical analysis on the charts.

Step 4: Develop a Trading Plan - Decide on your entry, stop-loss, and take-profit levels. Are you fading a spike? Buying a dip? Trading natural gas without a plan is gambling.

Step 5: Execute and Manage - Place your order. Once live, monitor the trade, and use our free trading journal template to record and track your trading performance. In natural gas trading, prices can move fast. Trailing stops are often used to protect profits during sharp moves.

Wrapping Up

Trading natural gas is not for the faint of heart, but for the prepared mind, it is one of the most rewarding markets in the world. From the depths of winter freezes to the heat of summer, natural gas prices tell the story of the global economy and Mother Nature combined.

Whether you choose natural gas futures trading, natural gas CFDs, or gas stocks, the principles remain the same: respect the volatility, watch the data, and manage your risk.

The natural gas market is waiting. Are you ready to trade?

FAQs

Here are some frequently asked questions and some answers about trading natural gas.

What is Henry Hub natural gas?

Henry Hub is a distribution hub on the U.S. Gulf Coast. It is the pricing point for natural‑gas futures traded on the NYMEX/CME and serves as a global benchmark. Prices quoted as “Henry Hub natural gas” refer to MMBtu delivered at this hub.

What time does natural gas start trading?

Natural gas futures (NYMEX Henry Hub) trade almost around the clock on CME Globex, starting at 6:00 p.m. Eastern Time (ET) on Sunday and running until 5:00 p.m. ET on Friday, with a daily one-hour break from 5:00–6:00 p.m. ET.

What are micro natural‑gas futures?

Micro natural‑gas futures (ticker MNG) are CME contracts representing 1,000 MMBtu, one‑tenth the size of the standard contract. They provide a lower‑cost way for retail traders to gain exposure.

Do natural‑gas ETFs pay dividends?

Most gas ETFs, such as UNG, reinvest earnings and do not pay regular dividends. They are designed to track the daily percentage change of gas futures. Some energy companies and midstream stocks do pay dividends; for example, Kinder Morgan’s dividend yield was roughly 4.2% in December 2025. Bear in mind that on Switch Markets, you can receive dividends on CFD positions.

Risk Disclosure: The information provided in this article is not intended to give financial advice, recommend investments, guarantee profits, or shield you from losses. Our content is only for informational purposes and to help you understand the risks and complexity of these markets by providing objective analysis. Before trading, carefully consider your experience, financial goals, and risk tolerance. Trading involves significant potential for financial loss and isn't suitable for everyone.